FT Letter To The Editor On Current Account Imbalances And War

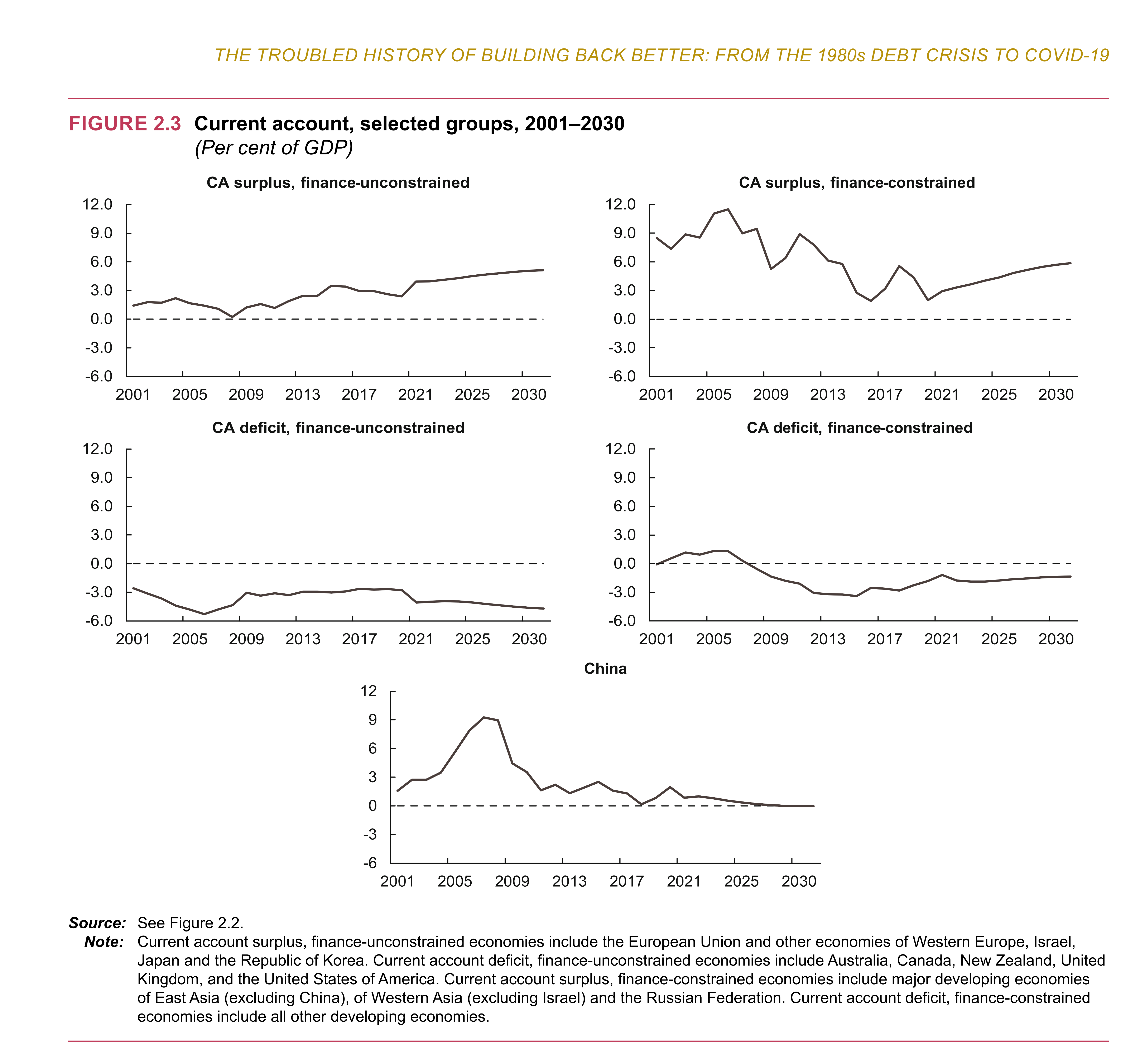

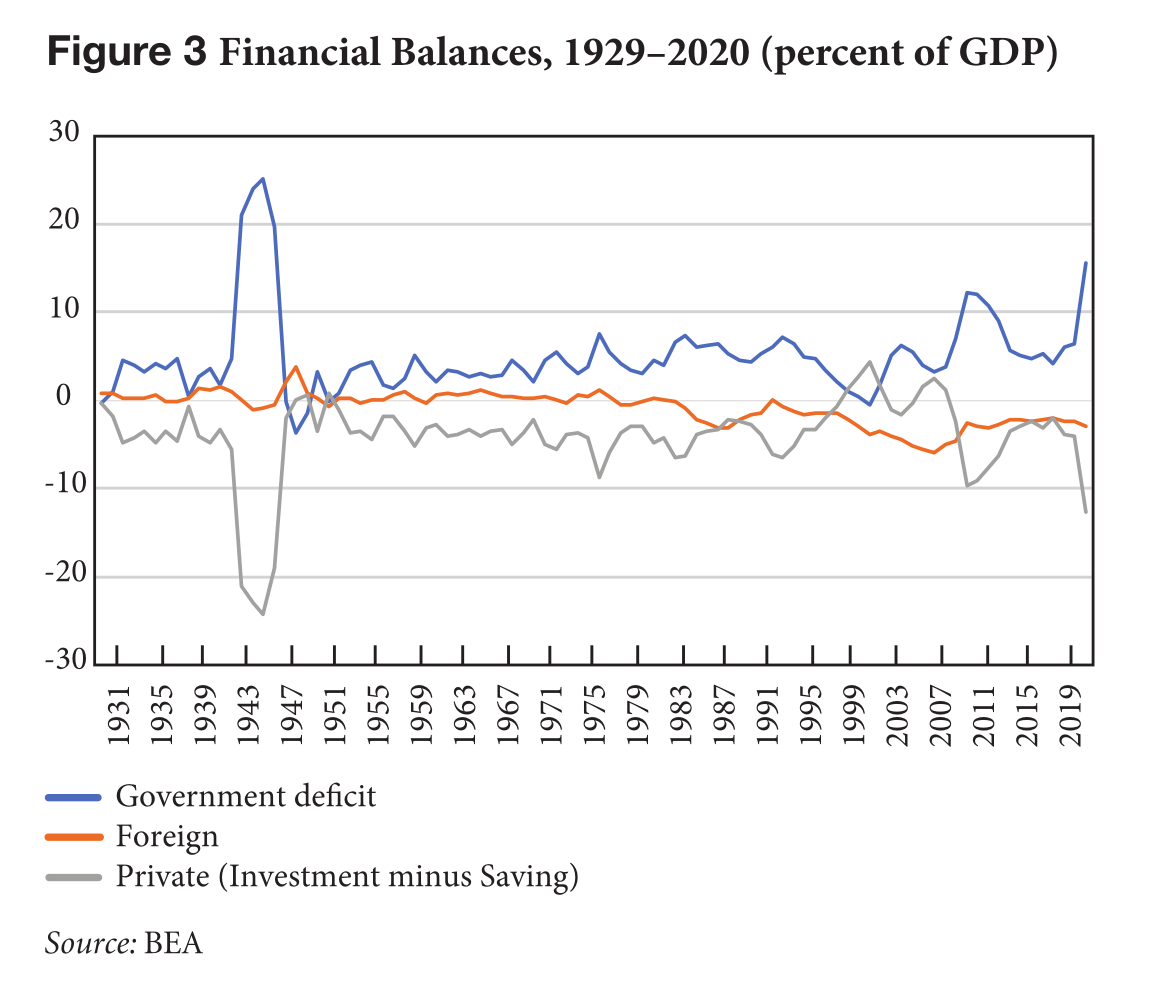

FT has published a letter to the editor from some post-Keynesian economists arguing for regulating imbalances in the current account balance of payments, and that such imbalances make wars more likely.

One of the signatory of the letter is Dimitri Papadimitriou, who along with Wynne Godley had been warning about imbalances since the turn of the millennium.

From the letter:

…

A new international economic policy initiative is therefore required to head off the threat of further wars.

A plan is needed to regulate current account imbalances, which draws on John Maynard Keynes’s project for an international clearing union.

…

The current system of free trade has created a deflationary bias in the world economy. A further bias is introduced because the United States is now a large debtor of the world and till the crisis which started in 2007 it was acting as the driver of the world, a role which it still plays but is not as big as before. With such a deflationary bias, countries try to use beggar-thy-neighbour policies, as world output is limited. That creates tensions between countries and the desperation to raise output exacerbates the tensions. So a new international order: a system of regulated/planned trade.