There are two new books in honour of Wynne Godley and they are out now

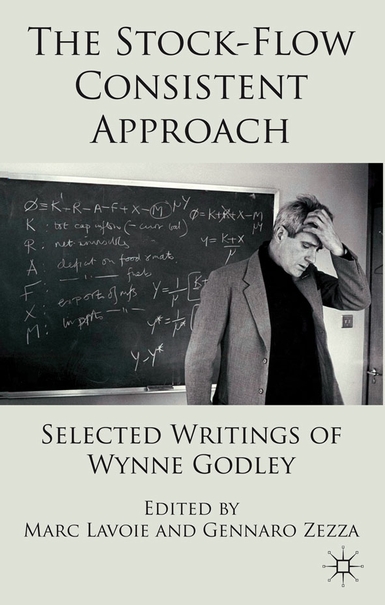

The first one – edited by Marc Lavoie and Gennaro Zezza – has selected articles and papers by Wynne Godley, and carefully chosen.

It’s available at amazon.co.uk, but not yet on amazon.com

Here’s the book’s website on Palgrave Macmillan. The book also contains the full bibliography of Godley’s papers, books, working papers, memoranda (such as to the UK expenditure committee), magazine/newspaper articles, letters to the editor etc.

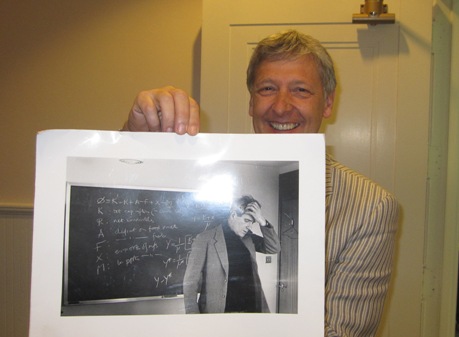

Here’s a picture I took of Marc at Levy Institute in May when he was deciding on the cover.

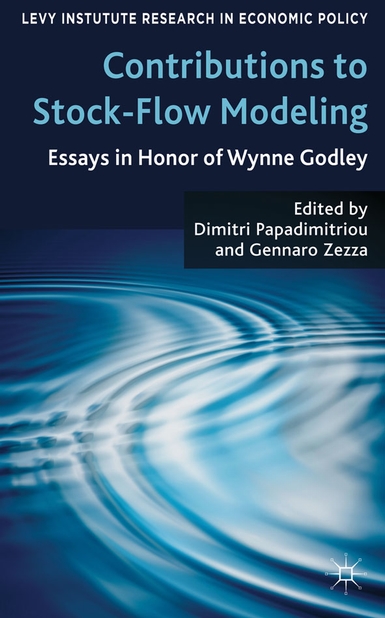

The is second book written in honour of Wynne Godley contains proceeding of the conference held in May at the Levy Institute (the same place the above photograph was taken)

The publisher’s website for the book is here.

Dimitri says:

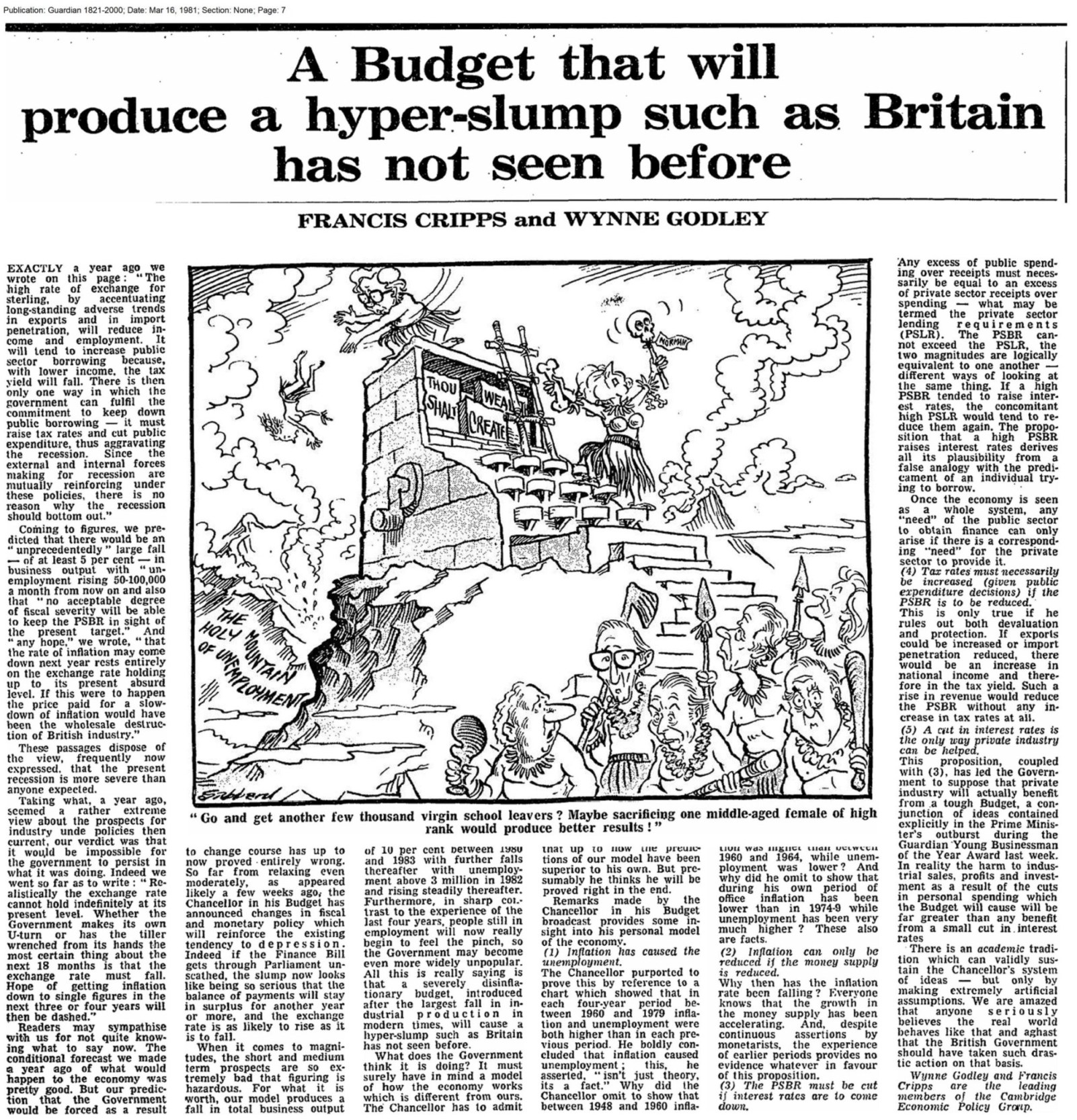

The death of Wynne Godley silences a forceful and very often critical voice in macroeconomics. Wynne’s own strong view, that although his work was representative of the non-mainstream Keynesian approach to economics and especially economic policy was important nevertheless, has been confirmed time and time again as evidenced in the fortunes of the UK, US and Eurozone economies. His writings, reflecting the sharpness of his mind and intellectual integrity, have had a considerable impact on macroeconomics and have aroused the interest of scholars, economic journalists and policymakers in both mainstream and alternative thought. In a review of Wynne’s last book with Marc Lavoie (2007), Lance Taylor had this to say: ‘Wynne’s important contributions are foxy – brilliant innovations… that feed into the architecture of his models’

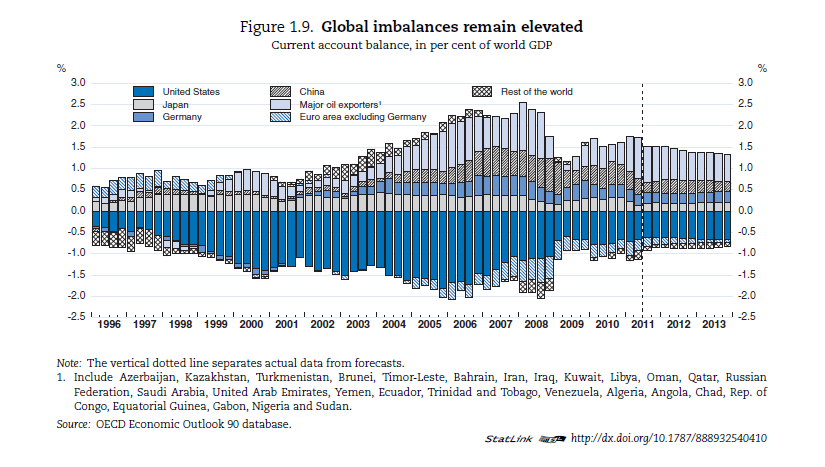

I also like Wynne’s stand on the current account imbalance of the United States:

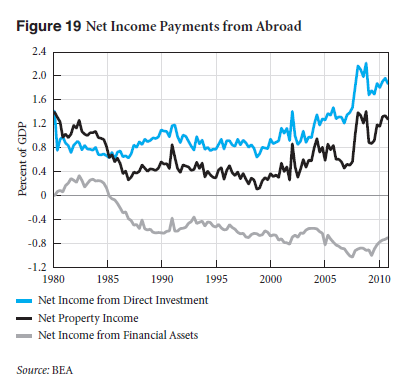

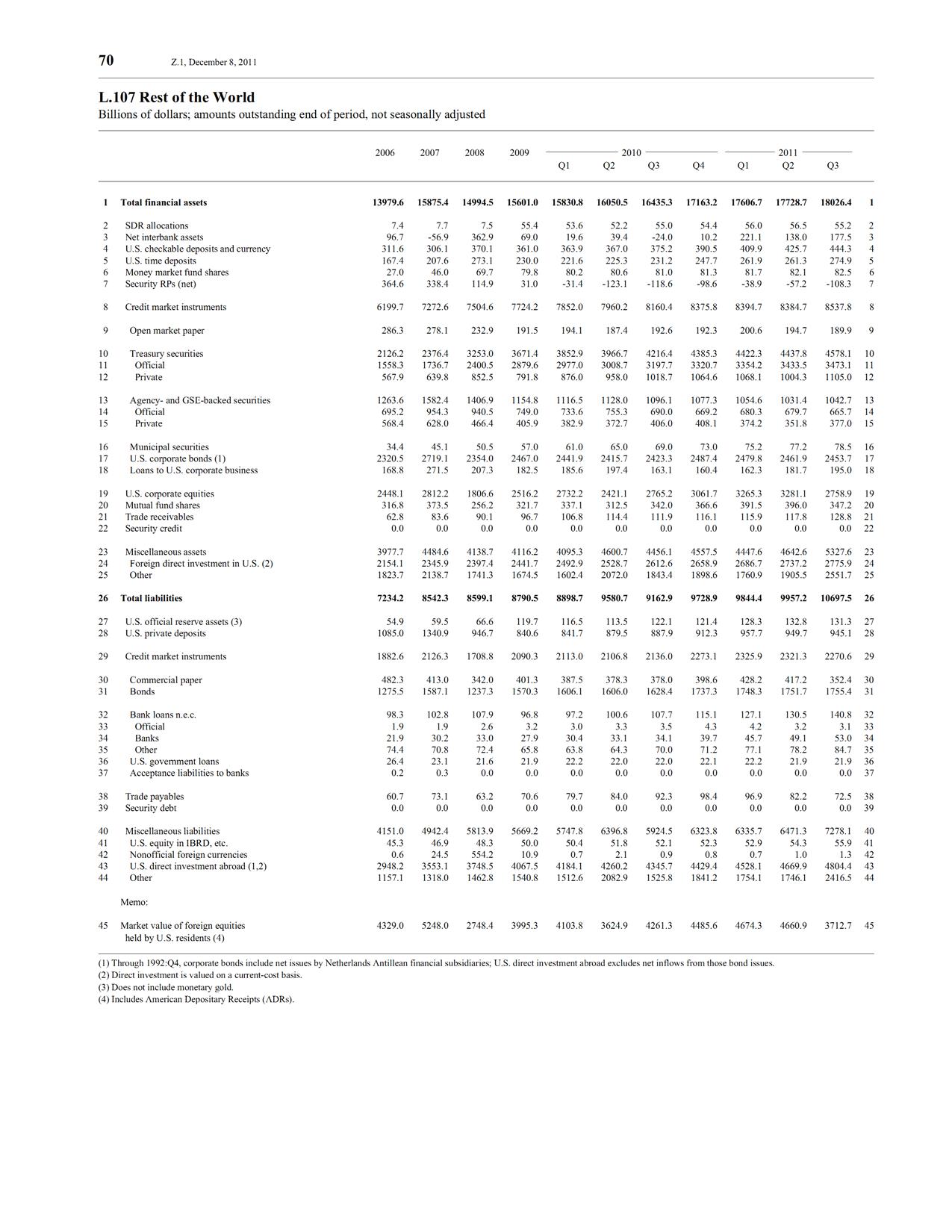

Bibow finds that Godley’s diagnosis of the looming economic and financial difficulties ahead of their occurrence was prescient with regard to US domestic developments – a theme that came up in the chapters by Wray and Galbraith. But Bibow takes issue with Wynne’s assessment of the US external balance being unsustainable. He notes that the US investment position and income flows are more or less in balance and he attributes this phenomenon to the safety of the US Treasury securities and the dollar functioning as the reserve currency.

Dimitri then says

Even if this is so, it cannot continue indefinitely, Wynne would have replied.

The conference page is here