The blogger writing for Social Democracy For The 21st Century: A Post Keynesian Perspective has an interesting post about Keynes’ view on wages.

I have a few points to add, which may not be contradictory to that post. It’s possible Keynes’ understanding changed from his discussions with Kalecki. In fact, Jan Toporowski, biographer of Michael Kalecki sees Kalecki’s position as far superior compared to that of Keynes. In an article titled Kalecki And Keynes On Wages, he says:

Both Kalecki and Keynes realised that their macroeconomic analysis depended critically on the inability of the labour market to be brought into equilibrium by changes in wages, as postulated by neoclassical theory. In 1939 therefore they wrote their explanation for this inability of free markets in capitalism to attain the equilibrium imagined by Robbins, in which all resources, including labour, are fully utilised. Keynes however got stuck on the effects of wages on the short-period equilibrium in an abstract Marshallian model. Kalecki was able to demonstrate more clearly the complex real income effects of wage changes.

…

Kalecki’s approach to the subject was much clearer, and free of Marshallian dilemmas applied to historical data.

Jan Toporowski, Levy Institute, May 2011

In the article, Toporowski points out the debate between Keynes and John T. Dunlop, Lorie Tarshis and Michal Kalecki. He also quotes Keynes from the GT:

in the short period, falling money wages and rising real wages are each, for independent reasons, likely to accompany decreasing employment; labour being readier to accept wage-cuts when employment is falling off, yet real wages inevitably rising in the same circumstances on account of the increasing marginal return to a given capital equipment when output is diminished.

Keynes was not fully correct on this but it is interesting to note that he was almost there. Perhaps his own quote explains: he himself couldn’t escape from old ideas which ramify into every corner of our minds.

In his book Post-Keynesian Economics: New Foundations, pp 277-278, Marc Lavoie says:

Indeed, in several versions of post-Keynesian short-run model of employment, higher real wages are conducive to higher levels of employment.

In their biography, Michal Kalecki (Great Thinkers In Economics), Julio López G and Michaël Assous point out that it was Michal Kalecki who first figured this out before Dunlop-Tarshis-Kalecki (1939) in his 1938 paper The determinants of distribution of the national income, also published in Collected works of Michal Kalecki, Vol. I, edited by J. Osiatynsky, Oxford University Press, 1990.

So here’s Kalecki. It’s great and humble of him to call it the “Keynesian theory”, although he found something contrary to Keynes’ own point. But that’s the thing about Keynes – he said a lot of things which is contrary to his own revolutionary thoughts. Heterodox economists see it in a nicer way. Joan Robinson would have said, “Keynes should not have said that”. Keynes’ opponents would pounce on his several vulnerabilities. And then there’s the bastardization of Keynes’ work. Most of economics before the crisis simply states: “Keynes is wrong”. Over to Kalecki:

Final remarks

1. There are certain ‘workers’ friends’ who try to persuade the working class to abandon the fight for wages in its own interest, of course. The usual argument used for this purpose is that the increase of wages causes unemployment, and is thus detrimental to the working class as a whole.

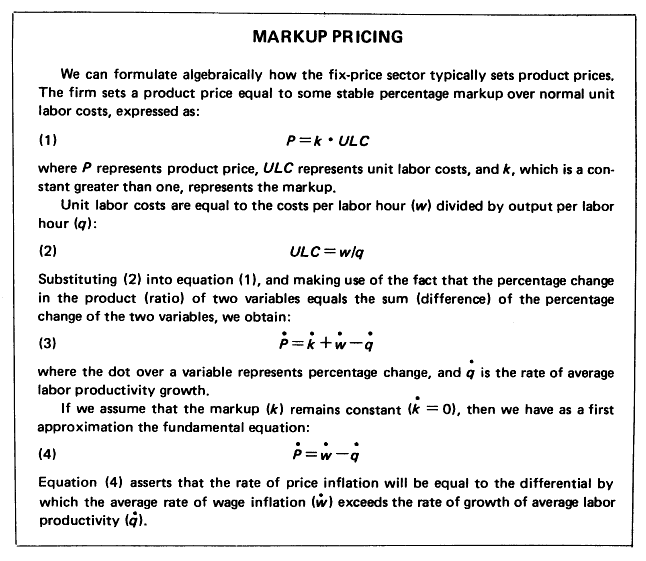

The Keynesian theory undermines the foundation of this argument. Our investigation above has shown that a wage increase may change employment in either direction, but that this change is unlikely to be important. A wage increase, however, affects to a certain extent the distribution of income: it tends to reduce the degree of monopoly and thus to raise real wages. On the other hand, ‘real’ capitalist incomes tend to fall off because of the relative shift of income from rentiers to corporations, which lowers capitalist propensity to consume.

If viewed from this standpoint, strikes must have the full sympathy of ‘workers’ friends’. For a rise in wages tends to reduce the degree of monopoly, and thus to bring our imperfect system nearer to the ideal or free competition. On the other hand, it tends to increase the thriftiness of capitalists by causing a relative shift of income from rentiers to corporations. And ‘workers’ friends’ are usually admirers both of free competition and or thrift as a virtue of the capitalist class.

2. Another question may arise in connection with the Keynesian theory of wages. Is not the struggle of workers for higher wages idle if they lose whatever gain they may make in the form of a higher cost of living? We have shown that wage reduction causes a change in the distribution of the national income to the disadvantage of workers, and that in the event of an increase in wages the reverse occurs. This is not to deny, however, that changes in real wages are much smaller than those in money wages; but never the less they may be quite material, especially as we are dealing with averages which reflect only slightly great fluctuations in real wages in particular industries.

We noticed above the great stability of the relative share of manual labour in the national income. This is not in contradiction with the influence of money wages upon the distribution of the national income. On the contrary, the resistance to wage cuts prevents the degree of monopoly from rising in the slump to the extent it would if ‘free competition’ prevailed on the labour market. Although, in fact, the relative share of manual labour is more or less stable, this would not obtain if wages were very elastic.

It is quite true that the fight for wages is not likely to bring about fundamental changes in the distribution of the national income. Income and capital taxation are much more potent weapons to achieve this aim, for these taxes (as opposed to commodity taxes) do not affect prime costs, and thus do not tend to raise prices. But in order to redistribute income in this way, the government must have both the will and the power to carry it out, and this is unlikely in a capitalist system.