II

Class war was not the only element of inherent vice in the free-market system to disturb the age of growth. There were also the problems generated by the unevenness of development amongst various capitalist nations and the economic and political relationships between industrial countries and primary producers, particularly those in the third world.

The pre-Keynesian theory of international trade required the balance of imports and exports for each country to be maintained by movements in relative price levels. After experiencing the attempt to return to the gold standard in 1925 (see Keynes, 1972), Keynes adopted the view that depreciating the exchange rate was much to be preferred to attempting to depress the price level. At the end of his life, feeling obliged to defend the Bretton Woods agreement against his better judgement (Kahn, 1976), he lapsed into arguing that, in the long run, market forces would tend to establish equilibrium in international trade (Keynes, 1946). He had forgotten his old crack, that in the long run we are all dead.

As it turned out, market forces generated disequilibrium. Differences in competitive power, whatever their origin, set up a spiral of divergence. A country such as West Germany, with growing exports, could maintain a high rate of investment and therefore of growing productivity, which enhanced its competitive power, and allowed real wages to rise so that workers were less demanding. In the United Kingdom, any increase in employment caused an increase in the deficit in the balance of payments so that every hopeful go had to be brought to an end with a despairing stop. Thus strong competitors grow stronger and the weak, weaker.

Because of the size and strength of the United States and its overseas economy, trade plays a small part in national income, but not a small part in the world market. The USA can move from deficit to surplus without much disturbance at home, but with a great deal of disturbance to the other trading nations. Moreover, it was able to take advantage of the dollar being the world currency to run an ever greater outflow on capital account with an ever growing deficit on income account, until President Nixon, with the dollar devaluation of 1971, suddenly tried to reverse the position with a stroke of the pen. All this laid great strains on the international monetary system.

Keynes worked out the structure of the General Theory mainly in terms of a closed economy. When it is extended to take in the operation of international economic relations, a missing link appears in the argument. The rate of interest was to be used to regulate home investment, and Keynes believed that a secular fall in interest rates was both necessary for this purpose and desirable in itself. Exchange rates were to offset differences in relative labour costs. Then nothing would be left to regulate short-term capital movements. Traditionally this was the function of relative interest rates. Britain, and other countries with chronically weak payments balances, could not indulge in cheap money however much home conditions required it, and had to follow the interest rates of other countries up whenever they happened to rise. This was one more turn in the spiral of weakness weakening itself.

Over and above the strains set up by the uneasy relationships amongst the industrial nations themselves, there were the strains involved in the relations of the industrial countries as a whole and the third world. The formation of prices in the free-market system is in two parts—cost-plus in manufacturing industry and supply and demand for primary products.† A rise in the level of production and consumption in industrial countries normally increases demand for all kinds of primary products. When prices of materials rise, while money wage rates are constant, real wages fall and so generate a demand for rising money wages, which adds to the original rise in costs. Thus favourable terms of trade reduce class conflict in the industrial countries and unfavourable terms exacerbate it.

Commodity prices responded sharply to the pressure of demand during the Korean war boom, but this was soon over and during the 1950s the terms of trade moved in favour of industrial countries. However, the long boom, swollen by the Vietnam war, financed by the USA on the principle of guns and butter, caused an acceleration in the rate of increase in commodity prices and finally sparked off the great inflation of 1973.

In an economic model, it is possible to analyse the consequences of any one change by keeping other things constant. In real life a lot of things happen at once. During the long boom, an excess of demand over growth of capacity led to shortages of one commodity after another. The demonetisation of the dollar in 1971 drove speculative funds into commodity markets. The Moslem oil producers, temporarily bound together by hostility to Israel, suddenly realised the extent of their monopoly power. Inflation at what now seems a mild and acceptable rate had been going on for years all over the capitalist world, setting up expectations that inflation would continue and undermining the conventional belief that a dollar is a dollar. Injected into this situation, the sudden rise in the costs of materials, especially oil, blew the inflation sky high.

This concatenation of circumstances has been described as a historical accident. But it is the inherent vice in the free-market system of international trade which creates the setting for such ‘accidents’, from which it has no means to defend itself except by destroying prosperity and depriving the primary product sellers of their favourable terms of trade.

III

The hopes which accompanied the Keynesian revolution, of reforming capitalism so as to ensure continuous prosperity with full employment, are now all but extinguished. The slide into crisis in the capitalist world has re-established the pre-Keynesian orthodoxy as the conventional wisdom in economic policy-making at both national and international levels. The inevitable consequence of this is a much higher general level of unemployment and recurrent crises, involving a massive waste of resources and considerable human misery.

Important changes in the world economy have taken place over the last two decades, which have ended the era of near-full employment and exposed the inadequacies of the conventional Keynesian analysis. One of the most important of these developments has been the relaxation of tariffs and exchange controls and the resulting large increase in international trade‡ and capital movements; this has increasingly exposed national economies to the ravages of uncontrolled capitalist competition, in the way that they were exposed before the 1930s.

While the USA remained the predominant world economic and political power, and effectively acted as the world central bank, some semblance of order in international economic relations was retained. The use of the dollar as a reserve currency and the eagerness of the USA to lend abroad allowed international liquidity to expand to meet the needs of the growing volume of trade and facilitated post-war reconstruction and structural adaptation in the capitalist world. But with the emergence of Japan and western European countries as strong competitors to the USA, and the deterioration of the USA’s balance of payments, unhindered capital movements became a major destabilising force. The IMF proved totally inadequate to its appointed task of protecting national economies from external shocks and assisting the correction of more permanent imbalances in payments. In fact, by establishing rules which threw the burden of adjustment mainly onto deficit countries, the IMF institutionalised an important element in the process of unequal development among capitalist countries.

Faced with growing international pressures, the governments of debtor countries have been obliged to adopt the deflationary policies acceptable to their creditors (including the IMF); policies which conflicted with the avowed aim of maintaining full employment and with the real-wage demands of the working class. Thus democratically elected governments of debtor countries, where the working class is well organised, have walked a knife edge between the international and internal disapproval of their economic policies. But the frequently imposed deflationary policies progressively weakened the competitive position of such economies, increasing their indebtedness and reducing the opportunities for advances in real wages. Unable to meet either internal or external demands, economic policy vacillated wildly; consequently growing economic crisis has been accompanied by increasing political instability and further destabilisation of the international economy.

The world market system has run into a second, and much more general, impasse, caught between two interlocking conflicts—the demands of workers in the industrial countries for higher real wages and the demands of the third world for improved terms of trade.

So long as unemployment and slow growth continue, the relative prices of raw materials are kept down and this somewhat mitigates inflation in industrial countries. As soon as a revival begins, prices of raw materials and foodstuffs begin to go up and real wage demands become harder to resist; the authorities nervously pull back and the revival is checked. The orthodox economists, still repeating incantations about equilibrium, encourage the authorities to pursue these deflationary policies—the very same that Keynes in the thirties used to describe as sadistic.

It is ironic that after the great technical achievements brought by the age of growth, all we are offered is a return to large-scale unemployment and poverty in the midst of plenty, in an age of frustration. Kalecki was right to be sceptical; the modern economies have failed to develop the political and social institutions, at either domestic or international level, that are needed to make permanent full employment compatible with capitalism.

…

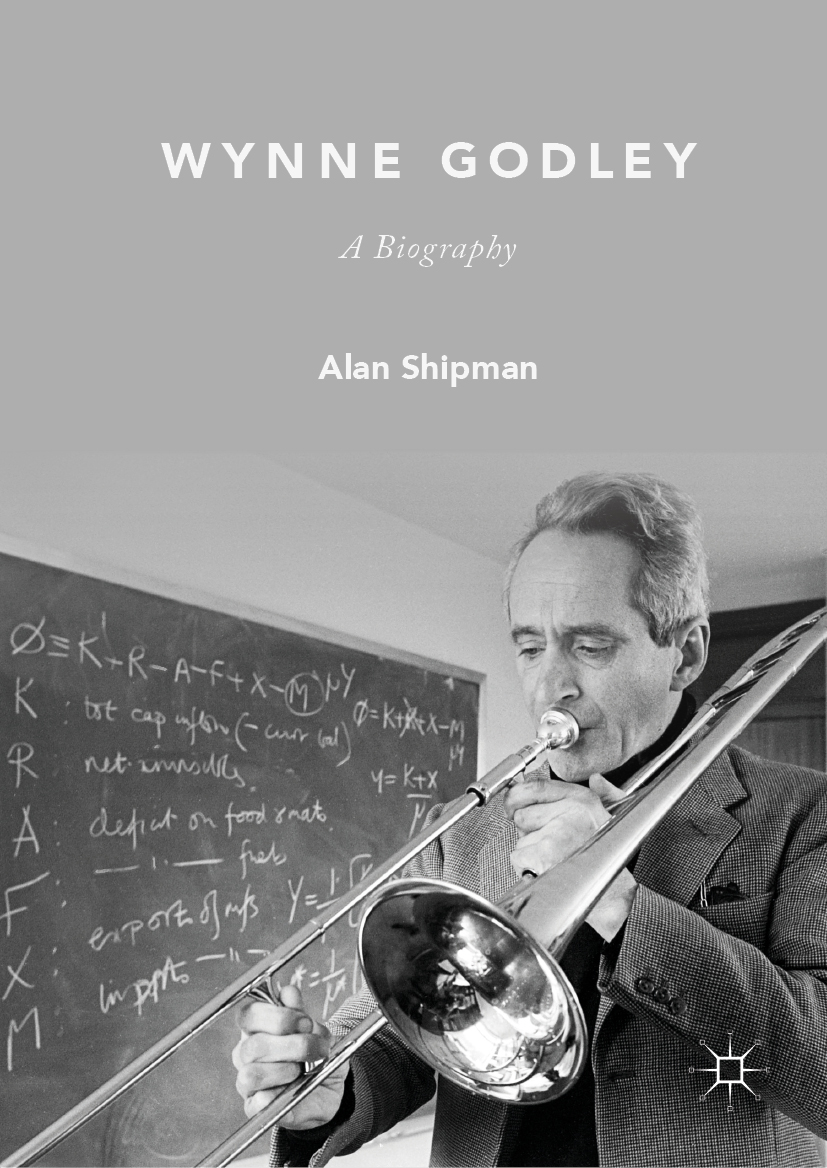

† See Robinson (1962); K. J. Coutts, W. A. H. Godley and W. D. Nordhaus, Industrial Pricing in the United Kingdom, Cambridge, CUP, forthcoming.

‡ Exports of OECD countries as a whole increased from 11% of GDP in 1954 to almost 17% of GDP in 1973.

References

…

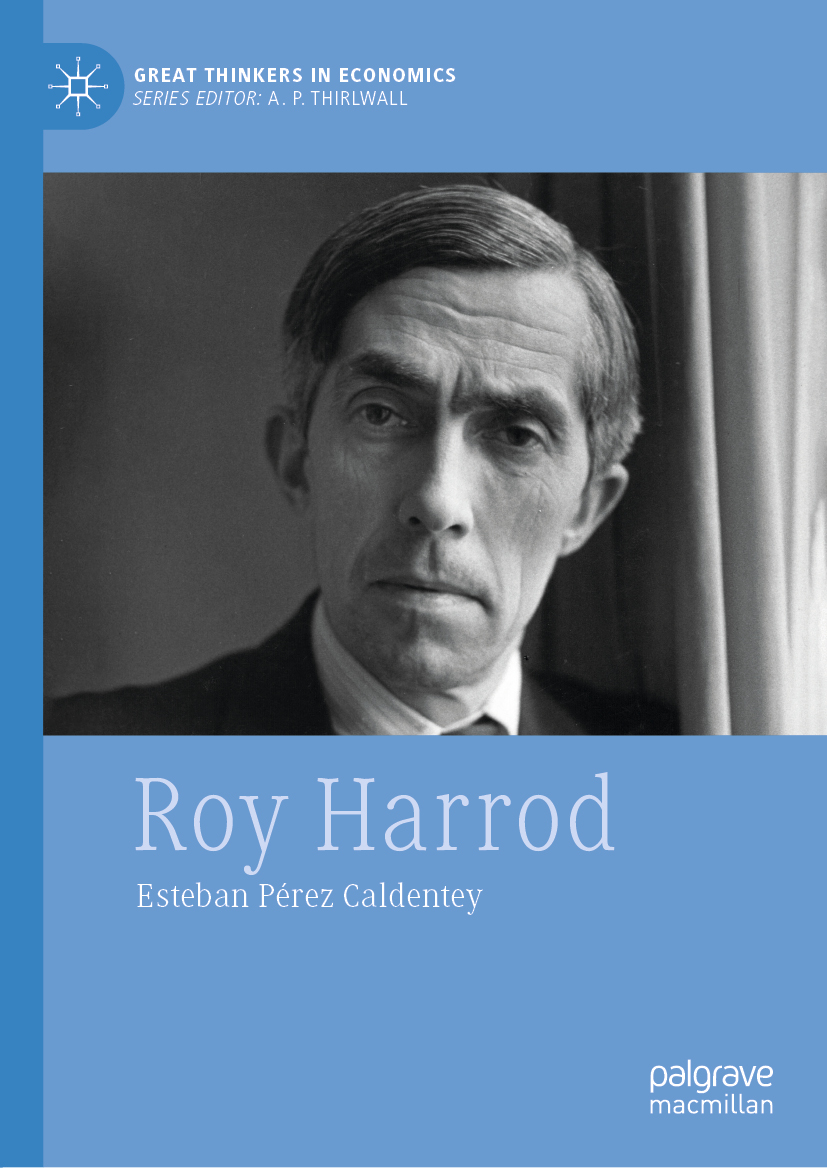

Kahn, R. 1976. The historical origins of the IMF, in Keynes and International Monetary Relations, ed. H. P. Thirlwall, London, Macmillan

…

Keynes, J. M. 1946. The balance of payments of the United States, Economic Journal, vol. 56

Keynes, J. M. 1972. The economic consequences of Mr Winston Churchill, in Collected Writings of John Maynard Keynes, vol. 9, Essays in Persuasion, London, Macmillan

…