Worker: I am losing my job because of globalization.

Economist: No, you are losing it because of automation.

[Plus calling them ‘losers’, such as by saying, “losers of globalization should be compensated”]

This is not just unhelpful but wrong too! Actually, saying it is wrong is underplaying it. It’s okay to be wrong sometimes—everyone is wrong sometimes—but how bad can getting it precisely the opposite every time? Anyone throwing darts at the dartboard can hit the bulls eye by fluke but what is it like throwing darts in the opposite direction?

Economists should be more modest and remind themselves of what Keynes said about workers in The General Theory:

… workers, though unconsciously, are instinctively more reasonable economists than the classical school

There is some irony to all this. Economists have played down the notion of technological unemployment. If production is constant and productivity rises, there’s a fall in employment because less labour is required to produce the same output. So output has to rise to keep employment from falling because of “automation”. In Post-Keynesian economics, the principle of effective demand matters both in the short run and the long run. So technological unemployment is a real possibility. New Consensus economists concede that John Maynard Keynes rules in the short run but assume that Jean-Baptiste Say rules in the long run. The irony hence is that New Consensus economists seem to show worry about automation these days.

In my opinion, this is because the sacred tenet of free trade must be defended by economists at all costs. So they make a concession about loss of employment to robots. Unfortunately that’s not right either. Globalization—both because of competition by international producers and offshoring of jobs via global supply chains—has led to the loss of livelihood for many in the Western world.

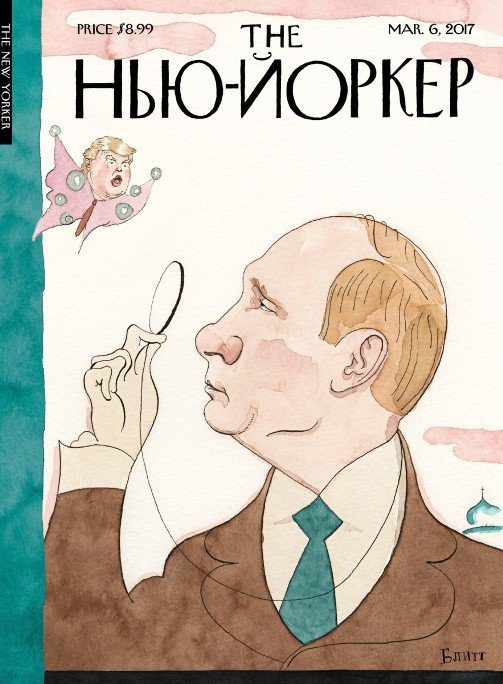

Political parties with fascistic tendencies have noticed this huge error at the heart of the New Consensus economics and the liberal political parties to whom these economists advise. They have understood that by pointing out that globalization—under the current rules of the game—can destroy jobs. They have seen support from people. It’s true that the political movement is not likely to deliver much but at the same time, liberal leaning political parties should try to understand this to regain lost ground.

Instead, we see writing such as The Productivity Paradox by Ryan Avent of The Economist. It’s only a paradox if you view it using the lens of the New Consensus Economics. He himself seems to appreciate others’ claims that:

the robot threat is totally overblown: the fantasy, perhaps, of a bubble-mad Silicon Valley — or an effort to distract from workers’ real problems, trade and excessive corporate power.

Not sure why the Silicon Valley gets the blame, and not economists themselves, but anyway, that is some conceding.

Remember the concept of technological unemployment is a race condition.

If productivity rises a lot and demand not much, we have unemployment. If the latter rises fast, we have more employment.

In fact productivity rises in the Western world has been quite low recently and we should embrace robots. This is because measured productivity is likely to rise if output rises. Productivity rise (as per the Kaldor-Verdoon Law) is due to two things: an exogenous component and an endogenous component which depends on the rise in output. Also, remember Keynes talked of autonomous and induced expenditures as component of effective demand, which drives output. So if governments around the world design policy in which demand rises fast, then “automation” can not just be welcomed, it will be a cause of it, i.e., higher production leading to more automation because of learning-by-doing. But economists will continue to get it backward!