Imagine a firm F1 in the United States 🇺🇸, which sells, say, toys. The firm is solely American, insofar as the employees of this firm and factory location are concerned. But the firm also exports toys and this contributes to the United States’ exports. For simplicity, assume that raw materials aren’t imported from abroad. Let’s say sales is $120 million of which exports are $100 million.

Now, imagine the firm has offshored significant part of its production to, say, Taiwan 🇹🇼. In other words, there’s a firm F2 in Taiwan owned by significantly by F1. This gives a cost advantage to F1 and let’s say the sales are $200 million outside the U.S. and $40 million in the US.

The way the system of national accounts and balance of payments guide, i.e., the 2008 SNA and BPM6 treat these two cases are different.

Exports of the United States is $100 million in the first case but not $200 million in the second.

This is because—and I am simplifying here—the toys are manufactured by F2, which is a resident of Taiwan and the goods sold in the rest of the world (rest in relation to the United States) is between a resident unit of Taiwan and the rest of the world.

In addition, there’s a significant transfer of resources from F1 to F2 and this is captured using the concept of transfer pricing.

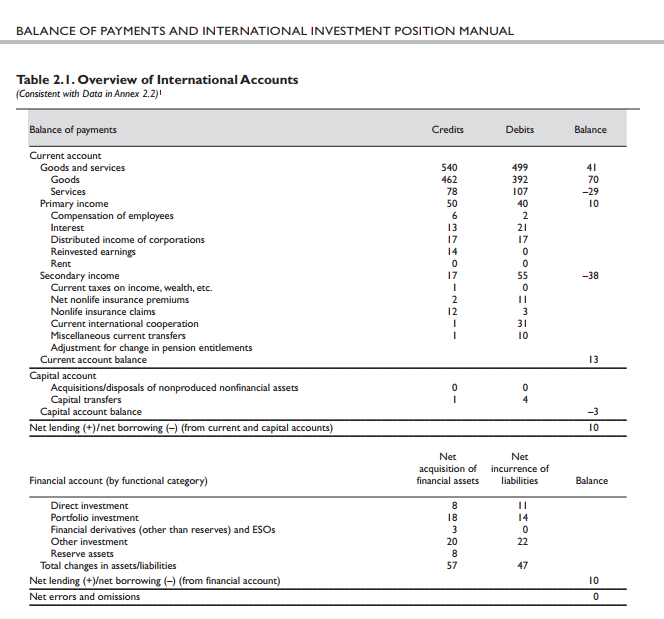

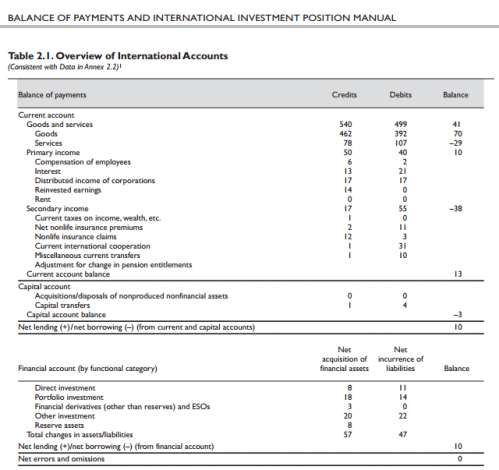

Of course, this doesn’t mean that these sales don’t affect the United States’ balance of payments. Remember how the current, capital and financial accounts look:

In the first case, only the goods line in exports is affected in the current account.

In the second case, goods and services (transfer of resources from F1 to F2), distributed income of corporations and retained earnings are all affected.

Goods, because of transfer of some goods from F1 to F2. Also because consumers inside the United States may buy the toys.

Services, because of use of intellectual property of F1 by F2.

Distributed income of corporations and retained earnings because F1 is a direct investor in F2.

So in our example, in the second case, the sale of toys to the the world affects exports, imports and primary income in the balance of payments.

So what was $100 million of exports could be $30 million of exports when production is offshored, whereas $200 million is more intuitive.

In other words, the goods and services balance (or the trade surplus, or the negative of the trade deficit) is changed.

So the change in the U.S. goods and services balance of payments is attributable to three things:

- Change in competitiveness of American firms,

- Changes in accounting treatment because of offshoring,

- Transfer pricing.

The UN 🇺🇳 guide, Guide To Measuring Global Production is a good reference for this.

It explains complications because of transfer pricing:

Transfer pricing

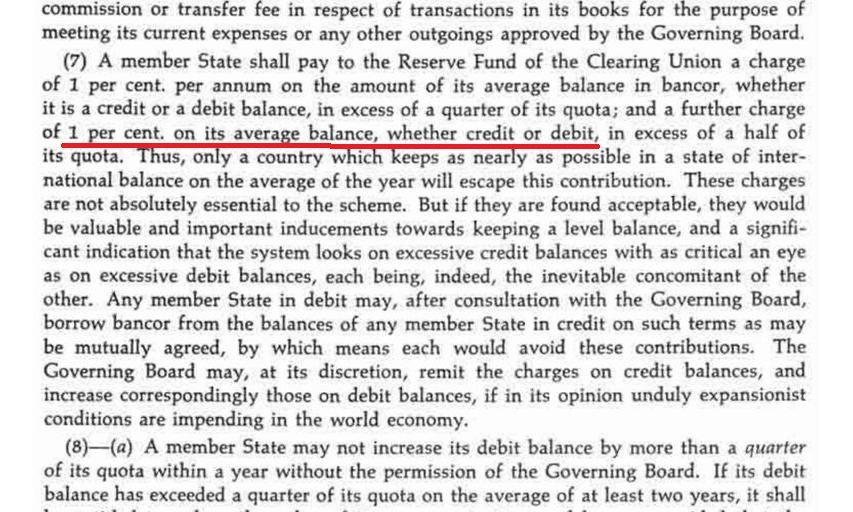

3.40 The Organisation for Economic Co-operation and Development (OECD) (2010) guidance on transfer pricing13 introduced a series of guidelines that may assist MNEs and national tax authorities in using transfer prices to value intra-firm transactions and to evaluate their appropriateness for taxation purposes. The guidelines insist that intra-firm transactions are priced, as far as possible, like arm’s length transactions between unrelated third parties. The guidelines give recommendations on how these intra-firm transactions can be analyzed to determine if they meet these requirements. These recommendations cover comparable measures of profits or comparable measures of costs to be used in assessing transactions between firms.

3.41 In this context recent developments at OECD have resulted in a series of steps to be followed by member countries to limit the impact of Base Erosion and Profit Shifting (BEPS)14. These steps will require transparency, exchange of information between taxation authorities and general cooperation to ensure the arm’s length principle is followed in transactions between entities in an MNE group.

3.42 Nevertheless, distortions in the use of the arm’s length principle are not always tax driven. The 2008 SNA (paragraph 3.133) explains that the exchange of goods between affiliated enterprises may often be one that does not occur between independent parties (for example, specialized components that are usable only when incorporated in a finished product). Similarly, the exchange of services, such as management services and technical know-how, may have no near equivalents in the types of transactions in services that usually take place between independent parties. Thus, for transactions between affiliated parties, the determination of values comparable to market values may be difficult, and compilers may have no choice other than to accept valuations based on explicit costs incurred in production or any other values assigned by the enterprise.

3.43 The 2008 SNA explains that replacing book values based on transfer pricing with market value equivalents is perhaps desirable in principle but is an exercise calling for cautious and informed judgment. One would expect such adjustments to be enforced in the first place by the tax authorities.

13 Transfer Pricing Guidelines for Multinational Enterprises and Tax Administrations: www.oecd.org/ctp/transferpricing/transfer-pricing-guidelines.htm

14 http://www.oecd.org/tax/beps.htm

The guide has 175 pages, so it’s very complicated!!

Again, distortions in transfer pricing isn’t the only thing. Even if it is captured properly, the mere act of offshoring changes the goods and services account numbers.

To summarize, there are two important issues here:

- Measurement issues for national accountants,

- Need for economists to understand the accounting behind all this.

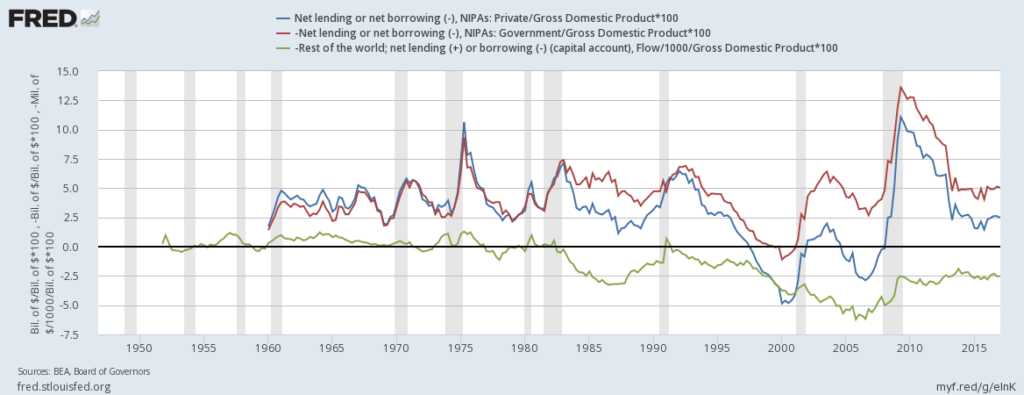

So one could say that U.S. trade balance isn’t as bad as it seems, because a lot is captured in primary income account of balance of payments instead of the goods and services account. It might also partly explain why the U.S. primary income balance is so large. It should however be noted that there’s a cancelling effect in the current account and current account balance which is equally important.

The post was motivated by a tweet by Brad Setser.