Both Angela Merkel and the German Finance Minister Wolfgang Schäuble have been quoted in the media as saying that they won’t go ahead with the “€-bills” and plans like that in their lifetime! Of course such quotes are incompletely reported and what they mean is that they won’t have a plan such as that without a common fiscal policy.

In the ongoing Summit, European leaders came up with a few plans which led to financial markets rallying. The Italian FTSE MIB Index was up 6.59% today!! There was one plan which didn’t take off and this was the plan of having a “redemption fund”. The formal proposal is here: TOWARDS A GENUINE ECONOMIC AND MONETARY UNION Report by President of the European Council Herman Van Rompuy

Of course this didn’t go through because the two German leaders wouldn’t have allowed it in their lifetimes! So what does Germany really want?

To understand this we must first understand that – as argued by Wynne Godley in 1992 – to join a monetary union nations should surrender their sovereignty with this sovereignty being taken over by a supranational authority (which was absent in the Maastricht Treaty):

I recite all this to suggest, not that sovereignty should not be given up in the noble cause of European integration, but that if all these functions are renounced by individual governments they simply have to be taken on by some other authority. The incredible lacuna in the Maastricht programme is that, while it contains a blueprint for the establishment and modus operandi of an independent central bank, there is no blueprint whatever of the analogue, in Community terms, of a central government. Yet there would simply have to be a system of institutions which fulfils all those functions at a Community level which are at present exercised by the central governments of individual member countries.

The counterpart of giving up sovereignty should be that the component nations are constituted into a federation to whom their sovereignty is entrusted. And the federal system, or government, as it had better be called, would have to exercise all those functions in relation to its members and to the outside world which I have briefly outlined above.

Merkel and Schäuble want to move ahead with the full creation of a federation – presumably headquartered in Brussels and they have the task of managing the fiscal decisions for the whole of the Euro Area. Since this institution will run deficits, it is natural that it will finance the difference between expenditure and taxation by issuing bills and bonds (which will be the real €-bonds). Hence the two leaders have qualified their statements but this has been quoted everywhere as some kind of comedy of errors!

The two leaders have the double task of convincing the German politicians and German public on the one hand and politicians from the rest of the Euro Area on the other hand. In the middle of this, they see this plan from Herman Van Rompuy, José-Manuel Barroso, Jean-Claude Juncker and Mario Draghi adding to confusions. The plan from the four EU leaders still has no supranational institution which makes financial decisions for the whole Euro Area but only a special purpose entity presumably retired after 25 years.

The important difficulty in the creation of a supranational institution which will manage the finances of the whole Euro Area (and not any “sinking fund”) is that the current setup is an incomplete one where nations’ governments still have a good amount of power in spite of them having surrendered most of their sovereignty.

While convincing the German citizens may be a hard task, Merkel and Schäuble are facing difficulties also in convincing other European leaders. Other nations do not wish to surrender whatever powers they still have but in the process do not understand what an integration means. Their leaders could have chosen to not join the Euro Area – just like what Mrs Thatcher did for the UK. Now that they have joined it and given it is difficult for any one nation to leave, it is in their best interest to go ahead with the full integration which has a supranational fiscal authority but this comes with surrendering more powers!

As Wynne Godley argued further:

If a country or region has no power to devalue, and if it is not the beneficiary of a system of fiscal equalisation, then there is nothing to stop it suffering a process of cumulative and terminal decline leading, in the end, to emigration as the only alternative to poverty or starvation. I sympathise with the position of those (like Margaret Thatcher) who, faced with the loss of sovereignty, wish to get off the EMU train altogether. I also sympathise with those who seek integration under the jurisdiction of some kind of federal constitution with a federal budget very much larger than that of the Community budget. What I find totally baffling is the position of those who are aiming for economic and monetary union without the creation of new political institutions (apart from a new central bank), and who raise their hands in horror at the words ‘federal’ or ‘federalism’. This is the position currently adopted by the Government and by most of those who take part in the public discussion.

As Jim O’ Neill of Goldman Sachs mentions in a recent interview to Bloomberg, the Germans are open to this but unfortunately, the French have objections to this route.

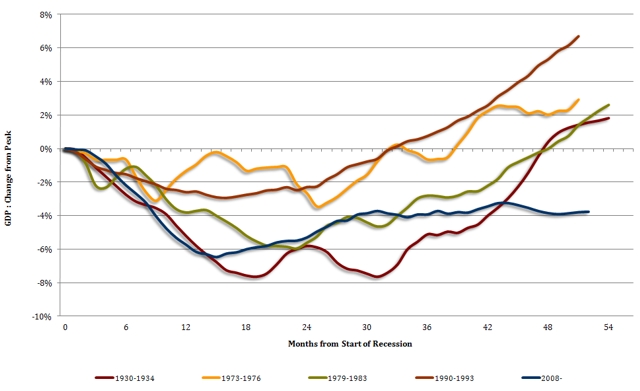

In the above video (edit: no longer available), O’ Neill (jokingly called Governor O’Neill by Tom Keene of Bloomberg because he is said to be the top man for the post of the chief of the Bank of England when Mervyn King’s term ends soon) argues the Europeans are known to leave it till the last moment – when it’s on the brink. Till then they will continue to muddle. Unfortunately for Merkel and Schäuble, solving short term issues makes the financial market conditions ease substantially, the opposite of what they want, because only when other Euro Area nations are in a lot of trouble will they be ready to accept the German solution. Of course this is a sad way to solve the problem but Schäuble has been quoted in the press saying that the EA needs a crisis to make any progress.

Unfortunately the financial markets rally!

How ironic!