International trade is central in Wynne Godley’s models and work. Wynne Godley not just foresaw the unsustainability of US private sector imbalances and the return of Keynesianism, he also proposed non-selective protectionism for the United States. Over time, he thought that more international efforts are needed, such as changing how international institutions are run.

In his article The United States And Her Creditors — Can The Symbiosis Last? written in 2005 (with coauthors), he said:

A resolution of the strategic problems now facing the U.S. and world economies can probably be achieved only via an international agreement that would change the international pattern of aggregate demand, combined with a change in relative prices. Together, these measures would ensure that trade is generally balanced at full employment.

In his last article Prospects For The United States And The World: A Crisis That Conventional Remedies Cannot Resolve (with coauthors), he said:

Need for Concerted Action

…

At the moment, the recovery plans under consideration by the United States and many other countries seem to be concentrated on the possibility of using expansionary fiscal and monetary policies.But, however well coordinated, this approach will not be sufficient.

What must come to pass, perhaps obviously, is a worldwide recovery of output, combined with sustainable balances in international trade.

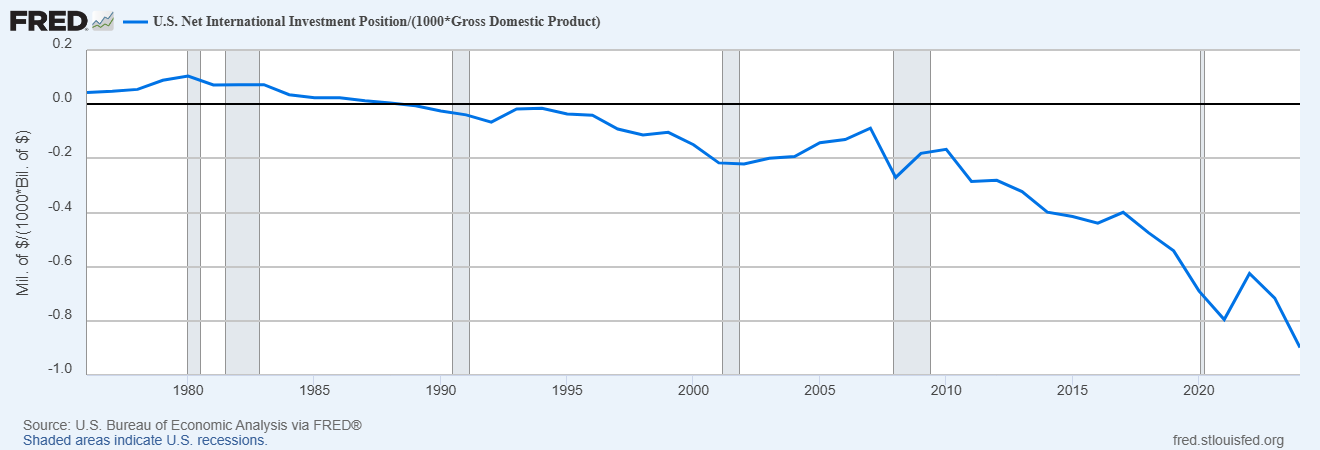

Since this series of reports began in 1999, we have emphasized that, in the United States, sustained growth with full employment would eventually require both fiscal expansion and a rapid acceleration in net export demand. Part of the needed fiscal stimulus has already occurred, and much more (it seems) is immediately in prospect. But the U.S. balance of payments languishes, and a substantial and spontaneous recovery is now highly unlikely in view of the developing severe downturn in world trade and output. Nine years ago, it seemed possible that a dollar devaluation of 25 percent would do the trick. But a significantly larger adjustment is needed now. By our reckoning (which is put forward with great diffidence), if the United States were to attempt to restore full employment by fiscal and monetary means alone, the balance of payments deficit would rise over the next, say, three to four years, to 6 percent of GDP or more—that is, to a level that could not possibly be sustained for a long period, let alone indefinitely. Yet, for trade to begin expanding sufficiently would require exports to grow faster than we are at present expecting, implying that in three to four years the level of exports would be 25 percent higher than it would have been with no adjustments.

It is inconceivable that such a large rebalancing could occur without a drastic change in the institutions responsible for running the world economy—a change that would involve placing far less than total reliance on market forces.

Francis Cripps, Alex Izurieta and Ajit Singh also talk of a different way to run the world, in their 2011 article Global Imbalances, Under-consumption And Over-Borrowing: The State Of The World Economy And Future Policies:

John Maynard Keynes repeatedly observed that the economy is a highly complex machine which we do not fully understand. This article and the Cambridge-Alphametrics-Model on which it is based represent an effort to appreciate the complexities of the world economy and its components and to seek avenues for international policy coordination. The main message that comes out of this exercise is the realization that the world economy is highly interdependent and increasingly needs far-reaching and very many specific interventions for it to achieve its full potential while pursuing a better distribution of income and employment. This in turn requires deeper knowledge of the functioning of the world economy and new institutions to achieve the required high levels of cooperation between nation states. At the moment the primary global institutions of economic coordination such as the IMF are, regrettably, more a part of the problem than its solution.