Ashwani Saith’s new book is out. It’s the history of how Post-Keynesianism was dethroned at Cambridge through power and influence of neoliberalism.

Wynne Godley is on the cover!

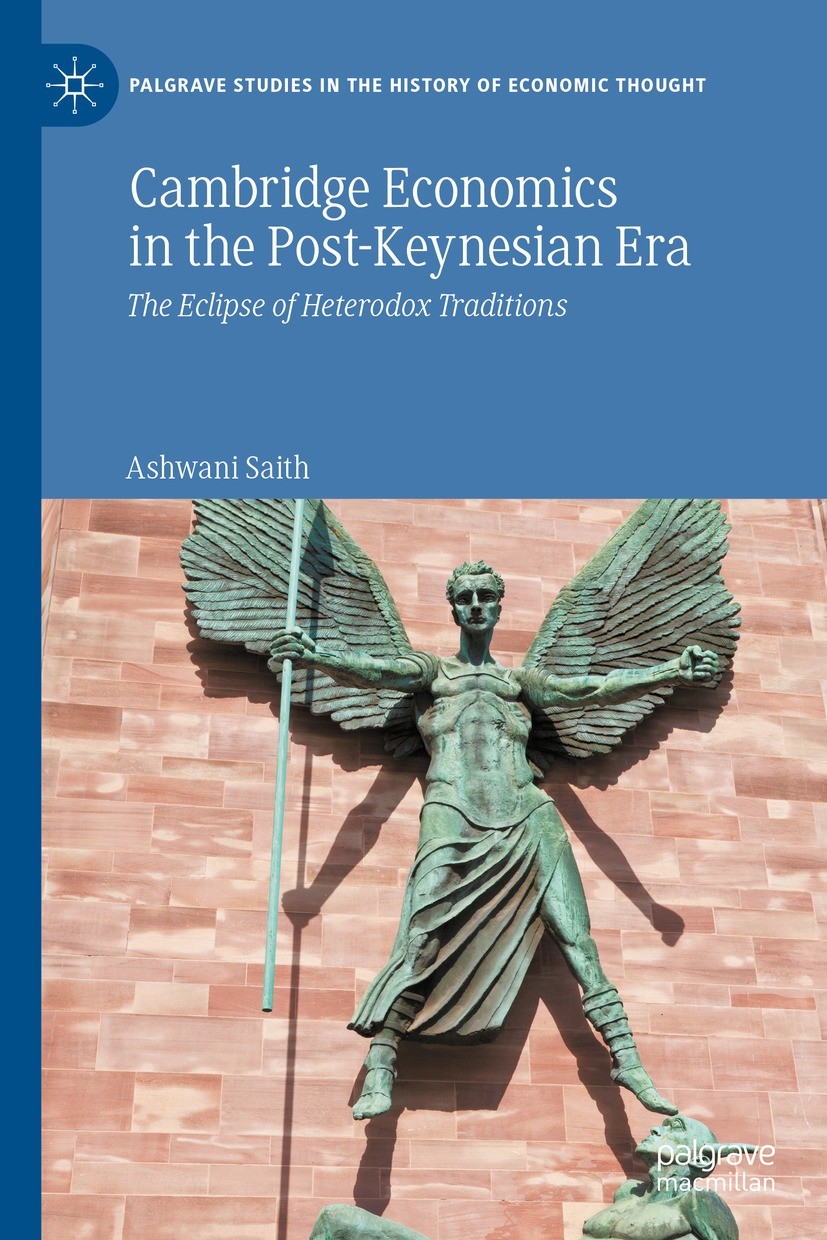

From the book’s description of the cover:

COVER

St Michael’s victory over the devil.

Jacob Epstein, Coventry CathedralOn 14–15 November 1940, “a bright moonlit cloudless night made navigation simple” for the Luftwaffe operation—fatefully code-named Moonlight Sonata—of the blanket bombing of Coventry in which “almost a third of the city was fattened” with its medieval cathedral reduced to rubble. (GCHQ 2021). Wynne Godley was married to Kitty Garman, daughter of Kathleen Garman and the famous sculptor Jacob Epstein, one of whose creations lives on the wall of the cathedral in Coventry evoking the unbroken spirit of the city, with Benjamin Britten composing his War Requiem for the consecration of the reconstructed cathedral in 1962. It depicts St Michael—representing the good—slaying the devil. Epstein used a model of his “impossibly handsome” son-in-law, Wynne, to sculpt the head of St Michael. Though Wynne and his research team, along with other celebrated heterodox lineages, lost out proverbially to “the devil” in the Cambridge war of economics, there has subsequently been a defiant phoenix-like revival of the reputation and work of the famous Godley-Cripps Cambridge Economic Policy Group of the 1970s, as well as of other renowned radical traditions nurtured since the 1920s in Cambridge, the crucible of heterodox economics. The allegorical symbolism of Sir Jacob Epstein’s sculpture resonates with the leitmotif of the book.

Here’s Marc Lavoie’s review:

Ashwani Saith’s book is monumental, enthralling, beautifully written with its occasional satirical tone, but as we are being warned, depressing. It explains how the Faculty of Economics of the University of Cambridge—the world centre of post-Keynesian economics—was gradually and entirely taken over by neoclassical economics and why the Department of Applied Economics, also at the heart of heterodox economics, eventually came to be dismantled. This was so far an untold story, except for a chapter on ‘Faculty wars’ in Saith’s previous book, the intellectual biography of Ajit Singh. The current book provides 14 chapters of a meticulous detective story, relying mostly on Cambridge archives, but also on testimonies, interviews, emails, and previous articles of participants to these events. The book makes clear that, besides possible strategical mistakes by the incumbent heterodox economists, there were inexorable and ineluctable outside forces that led to this dismal state of affairs, through the Americanization of the economics profession and through the changing political winds that blew out heterodox and left-wing economics nearly everywhere in the world. The last chapter shows that all is not lost, both in Cambridge and elsewhere in the world.

…

REFERENCES

…

GCHQ. (2021, April 19). The bombing of Coventry in WWII. Retrieved December 19, 2021, from https://www.gchq.gov.uk/information/the-bombing-of-coventry-in-wwii

…

The book is 1217 pages long.

Word count of “Kaldor” and “Godley”: 428 and 512 respectively.