Since the publications of Keynes’ GT, economists have been trying to overthrow the true interpretation of Keynes. To complicate the matter, Keynes himself committed a lot of errors in the book despite having a great colleague in Joan Robinson who truly was beyond the errors. Keynes also underestimated the power of vested interests:

… But apart from this contemporary mood, the ideas of economists and political philosophers, both when they are right and when they are wrong, are more powerful than is commonly understood. Indeed the world is ruled by little else. Practical men, who believe themselves to be quite exempt from any intellectual influences, are usually the slaves of some defunct economist. Madmen in authority, who hear voices in the air, are distilling their frenzy from some academic scribbler of a few years back. I am sure that the power of vested interests is vastly exaggerated compared with the gradual encroachment of ideas. Not, indeed, immediately, but after a certain interval; for in the field of economic and political philosophy there are not many who are influenced by new theories after they are twenty-five or thirty years of age, so that the ideas which civil servants and politicians and even agitators apply to current events are not likely to be the newest. But, soon or late, it is ideas, not vested interests, which are dangerous for good or evil.

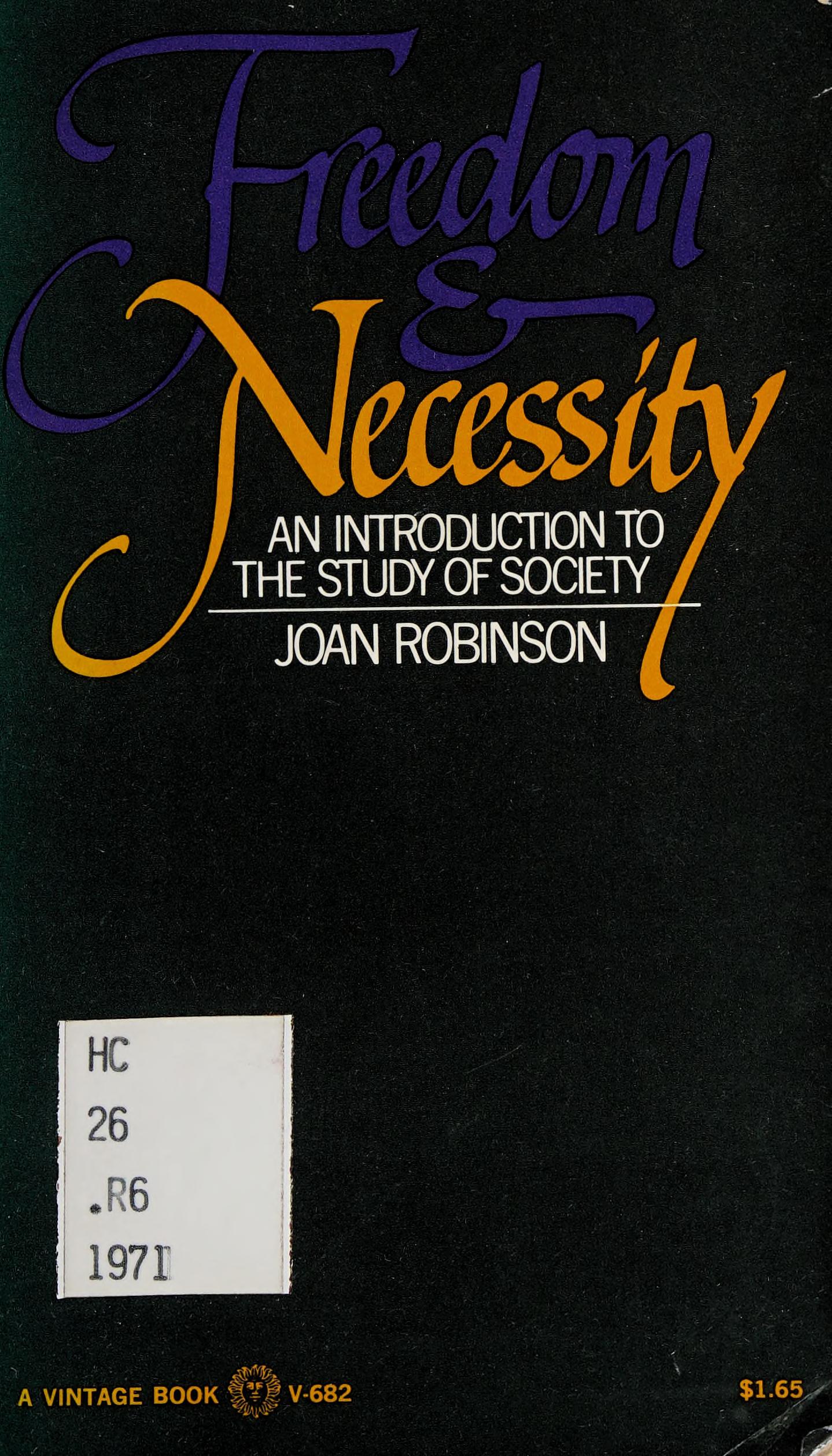

Marjorie Turner in Joan Robinson And The Americans explains Robinson’s views:

Robinson had no doubt about where the bastard Keynesian doctrine came from: it “evolved in the United States, invaded the economics faculties of the world, floating on the wings of the almighty dollar. (It established itself even amongst intellectuals in the so-called developing countries, who have reason enough to know better.)” She thought the worst part was that while “Keynes was diagnosing a defect inherent in capitalism … the bastard Keynesians turned the argument back into being a defense of laisser-faire, provided that just the one blemish of excessive saving was going to be removed.” Robinson condemned Samuelson’s alleged role in spreading bastard Keynesianism. The Samuelson textbook Economics in the 1970 edition committed this offense, she said, but by his 1976 edition, “Samuelson’s faith in macroeconomic policies (but not in the verities of microeconomics) had been badly shaken.” Regarding the alleged affection of the bastard Keynesians for laissez-faire and microeconomics as received, she admitted feeling “helpless.”

[Title borrowed from a paper of Marjorie Turner]