Simon Wren-Lewis has a post on his blog, The NAIRU: A Response To Critics. In that he refers to a blog post from me where I refer to the book Monetary Economics by Wynne Godley and Marc Lavoie. He perhaps doesn’t like me just citing the textbook and needs an explanation. How is that for an argument! Suppose I write a paper on gravitation. Do I always have to derive Einstein’s equations? Can’t I just refer it to the reader?

In other words, how is telling somone that, “SFC models have no NAIRU” not a good argument? Easy to check.

Anyway, an explanation: In stock-flow coherent models, the wage dynamics is given by equations such as these (page 302) :

ωT= (W/p)T = Ω0 + Ω1·pr + Ω2·(N/Nfe)

W = W–1·(1 + Ω3·(ωT−1 – W-1/p-1))

Here,

p is the price level, W is the nominal wage rate, ωT is the target real wage rate, pr is the labour productivity, N is the level of employment, Nfe is the full employment level and the three Ωs are parameters.

Wages change only discretely. Workers have a target wage rate which depends on productivity and the employment level. The actual wage rate is the outcome of bargaining of employees of firms with management. So workers try to catch up to what they consider fair. And their target depends on the level of employment. If unemployment is high, negotiation is more difficult and if unemployment is low, it’s easier as jobs can be switched. So there’s a Phillips curve.

Another important point is that there is no inflation expectations here.

The parameters Ωs used by the authors Godley-Lavoie and Gennaro Zezza are: –0.4, 1, 1.2 and 0.3.

Simulations of such models do not produce a runaway inflation, only higher inflation at full employment.

It’s not difficult to see why. How does the wage dynamics equations imply a runaway inflation? Can you inspect them conclude in a straightforward manner that there’s NAIRU? Anyway, simulations confirm.

That doesn’t mean there can’t be a wage-price spiral. This might happen—as the authors Godley and Lavoie explain—if the parameters Ωs change fast with time or if wage settlement happen more frequently. But as I have mentioned, it’s not necessarily so.

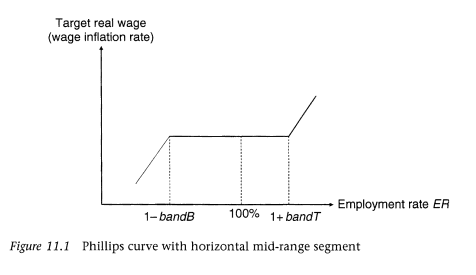

More realistic models have a flatter segment like this (Figure 11.1, page 387 from Monetary Economics, Ed. 1):

snipping via amazon.com

In this model (the “growth model prototype”) with behavioural equations for the government, central bank, firms, banks and households, the wage dynamics are similar to the equations above except that they have a flat segment. Again no accelerating prices!

In the discussion above (with no flat segment), I mention that there’s no NAIRU, but just to confirm I asked Marc Lavoie if this is crucial and he said no. Quoting his email with his permission:

The (unique) NAIRU has to be associated with a relationship that says that any negative discrepancy between the actual rate of unemployment and the NAIRU will lead to an acceleration of the rate of inflation. In terms of the rate of employment, it implies that any positive discrepancy between the actual rate of employment and the NAIRU will lead to an acceleration of the rate of inflation. This means that we can draw an upward-sloping curve relating the rate of employment to the change in the rate of inflation, where the change is zero when the economy is at the NAIRU.

In the case of Godley and Lavoie (2007), whether it is chapter 9 or 11, the equations that define the real wage target are such that they do not lead to such a curve. What we get is an upward-sloping curve that relates the rate of employment to the rate of inflation, and not to its change. When we are in the flat area of Figure 11.1, this means that the rate of inflation remains constant even if the rate of employment is higher. Besides the flat area, we have a kind of old Phillips curve: to a higher rate of employment is associated a higher rate of inflation, but that is all. There is no acceleration. Another way to put it is to say that there is an infinite number of NAIRU or a multiplicity of NAIRU (of rates of employment with steady inflation).

So with explanations about wage dynamics which has a Phillips curve (with or without a flat segment), I show that SFC models have no NAIRU.