There’s a discussion on Nick Rowe’s blog about the interpretation of TARGET2 balances of the NCBs in the Euro Area’s Eurosystem. How do we interpret this? My answer is the headline.

TARGET2 balances arise because of cross-border payment flows within Euro Area countries. Instead of going through how these arise, I assume the reader knows them. I have covered it many times in my blog and many others have written it.

Let’s work here in the approximation that the Euro Area is the world and there’s no economic activity outside it. Since cross-border flows within the Euro Area banking system and the Eurosystem are transactions between resident economic units and non-resident units, these flows will give rise to entries in the balance of payments of each nation within the Euro Area.

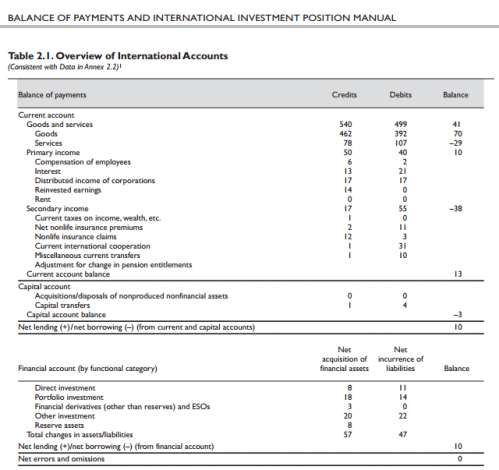

In the new balance of payments terminology, such as as in the sixth edition of the Balance Of Payments And International Investment Position Manual, (BPM6), there’s an identity:

current account balance + capital account balance = net lending (financial account balance).

For terminologies see this table from the guide:

This is an identity but suggestive of some behaviour. The question is what is the residual in this. The current account consists of things such as exports, imports, interest payments between resident and non-resident units and so on. The capital account consists of acquisitions and disposals of non-produced non-financial assets and capital transfers. The financial account consists of things such as direct investment flows, portfolio investment flows and so on. Other than that, there’s also “reserve assets” and “other investment”.

There is a nice 1991 article by the BIS Capital flows in the 1980s: a survey of major trends. The author quotes James Meade who makes this distinction between autonomous flows and accommodative flows:

[accommodative capital flows] take place only because the other items in the balance of payments are such as to leave a gap of this size to be filled … [while] autonomous payments … take place regardless of other items in the balance of payments.

Strictly, this distinction makes sense in fixed exchange rate regimes. In floating exchange rate system, the two—accommodative and autonomous—can’t be clearly be separated.

Anyway, coming back to the Euro Area, before the crisis started, the banking system was working fine. So there would be flows in both the current account and the financial account. The goods and services balance in the current account depends on domestic demand and output at home and abroad and relative competitiveness. There’s no reason for this to be zero. Economic units engaged in the financial markets would buy and sell securities and these affect the financial account of the balance of payments of the two nations involved in the transaction. There’s no reason for balance of things such direct investment, portfolio investment (and financial derivative flows) to balance or to equal the current account balance. Since flows typically are via TARGET2, this affects banks’ balances at their NCBs. So it’s possible toward the end of the day for banks in Spain 🇪🇸 as a whole to find themselves in need for reserves (or settlement balances) and banks in say Germany 🇩🇪 to be in a situation where they have excess funds. So banks in Spain will likely contact banks in Germany to borrow funds, either for one day or more. This is because they will get a cheaper interest rate. If they borrowed from their NCB, the interest rate is slightly higher.

These borrowings and lendings give rise to other investment in balance of payments of the two nations. So in Meade’s language, this is an accomodative flow. Not all other investment items are accommodative flows and similarly, not all accommodative items are other investment items.

But as the financial crisis began in 2007, the interbank system froze. Banks didn’t lend each other much. Hence the residual was balances between the NCBs. This would arise automatically. So these flows can be said to be accommodating. The counterpart of this is banks borrowing from their NCBs.

There’s a technicality: somewhere around mid-2000s, the system was changed so that the bilateral balances of NCBs were assigned to the ECB on a daily basis.

Since the TARGET2 balance of NCBs is a stock and not a flow, they can be hence thought of as the cumulative accommodative item. Since the crisis, a lot of things have happened. The European Central Bank has taken various steps, so that banks have sufficient liquidity. Banks have been given facilities to borrow huge amounts from their NCBs for collateral at cheap rates. Later the ECB also started its asset purchase program in which it bought government bonds, ABS and covered bonds. Some of these were already in existence when the interbank markets froze. So even as interbank markets opened, they didn’t feel the need to borrow funds from banks abroad.

The IMF’s guide BPM6 says in Appendix 3 that these intra-Eurosystem claims (the TARGET2 balances) are to be recorded in Other Investment:

Intra-CUNCBs and CUCB balances

A3.46 Transactions and positions corresponding to claims and liabilities among CUNCBs and the CUCB (including those arising from settlement and clearing arrangements) are to be recorded for the central bank under other investment, currency and deposits or loans (depending on the nature of the claim) in the balance of payments and IIP of member economies. If changes in these intra-CU claims and liabilities do not arise from transactions, relevant entries are to be made under the “other adjustment” column of the IIP. Remuneration of these claims and liabilities is to be recorded in the balance of payments of CU member economies as income on a gross basis under investment income, other investment.

where CUCB and CUNCB are abbreviations for currency union central bank and currency union national central bank, respectively.

There is some similarity with “reserve assets” in the financial account of the balance of payments and the international investment position when comparing all this to a fix exchange rate regime. In the latter, when autonomous flows aren’t sufficient, the central bank may sell gold or foreign reserves in the markets. It may also engage in borrowing funds in foreign currency. These are also accommodative flows. In the Euro Area case however, the inter-NCB claims (and the assignment to the ECB) happens automatically. Also “reserve assets” don’t go below zero, while TARGET2 balances can be negative in the sense that they are in liabilities of some NCBs instead of being in assets.

The conclusion of all this is that TARGET2 is a sort of a residual finance to a whole nation which arises automatically. Some have interpreted this to conclude that this is unlimited. This is however not the case. Since the counterpart to these are banks’ borrowing from their NCBs, this is limited to how much collateral banks can provide the Eurosystem, with or without the help of their government.