But this long run is a misleading guide to current affairs. In the long run we are all dead. Economists set themselves too easy, too useless a task, if in tempestuous seasons they can only tell us, that when the storm is long past, the ocean is flat again.

– John Maynard Keynes, A Tract on Monetary Reform (1923), Ch. 3, p. 80.

As you might know, the Indian government cancelled the legal tender nature of majority of bank notes in circulation, earlier this month and asked Indians to deposit them at banks or exchange them for new. The aim according to the government was to curb counterfeiting and what’s called black money here. This is damaging as a large amount of transaction is in bank notes and the implementation has been a failure. People have been standing in queues for the whole day and some even reach banks at 2 am to get a good position in the queue. For many, standing in queues means that the day’s labour is lost. For others, there are delays in wage payments since their employers have problems getting hold of new bank notes. More than 50 people have died. Even 11 bank managers have died due to stress and work overload.

Despite this we keep hearing from the government and the ruling political party’s defenders that the benefits will be long term.

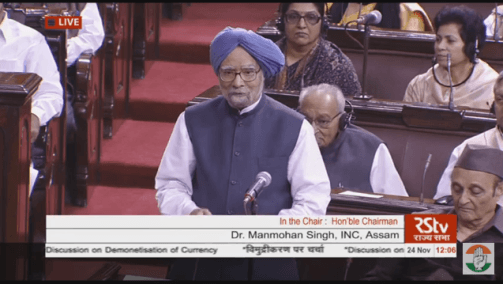

The previous Indian Prime Minister (who was the nation’s leader during mid 2004-mid 2014), Manmohan Singh gave a scathing speech in the Indian Parliament yesterday in which he quotes Keynes on the long run. Manmohan Singh was a student at Cambridge and his heroes are Nicholas Kaldor and Joan Robinson and presumably John Maynard Keynes as well. In this era where politicians are promoting neoliberal ideas, it’s good to see the master being quoted in a Parliament.

The seven-minute video is linked below.

click the picture to see the video on YouTube.

This question about the long-term reminds me of super-hysteresis which was referred by Marc Lavoie recently in an article for INET. It’s closely related to the Kaldor-Verdoorn law in which demand affects supply. The damage done to the demand side because of slowdown in production caused by the Indian government’s poor implementation of its decision to replace majority of bank notes by value affects the supply side as well. Almost nobody who talks about the long-term benefits talks about this issue.