[For previous discussions, see my posts Limits To Growth? and The Full Employment Assumption]

Brian Romanchuk has written a post as a response to my post Limits To Growth? referred above. In that his tone seems to be that the U.S. does not face an external constraint fundamentally, and that trade acts as a drag only because politicians have an impression that there exists a constraint.

To hold that claim Brian should to able to defend the dynamics which is likely if that were the case: the U.S. public debt and the net international investment positions deteriorate without limit (relative to gdp). Not sure at the moment if he thinks that debt/gdp ratios can grow without any limit.

That is the financial aspect of his argument. From the trade perspective, Brian says:

In any event, the U.S. could get away with strong GDP growth without causing external difficulties right now. There is plenty of spare global manufacturing capacity, so rapid U.S. growth would be accommodated by exporters. After awhile, there would be a self-reinforcing global growth spurt, which will reduce the pressure on the U.S. trade balance.

There are two things. One is capacity constraint and the other competitiveness. Both I and Brian agree there is no need to worry about the former. (Unlike neoclassical economists who are worried about the former!). It is about the latter where the debate is. This is in addition to the financial aspect mentioned in the previous paragraph.

The U.S. having plenty of spare manufacturing capacity has little impact on competitiveness. At a micro level, one can think of a firm with lots of idle resources but the sales team not being able to win projects for the firm. So two things—capacity and competitiveness—need to be studied separately. If the rest of the world does not expand, there is not much U.S. firms can do. If they produce more stuff, it will just be left as additional inventories forcing a clearing sale in domestic markets at the year end. So presence of spare capacity cannot make U.S. exports grow if domestic demand rises, either due to rise in private expenditure or via fiscal policy. In addition, there’s no self-reinforcing global growth because exports won’t take off to begin with.

To be more technical, there is one way in which U.S. exports may rise. If production rises, then via the Kaldor-Verdoorn process, U.S. productivity will also rise and this affects pricing of products and U.S. exporters may get some price advantage.

So rise in production can lead to a rise in competitiveness.

But this effect is quite negligible in the short run because competitiveness is both about non-price competitiveness and price competitiveness.

There is an additional effect. U.S. production rising means rise in national income and rise in imports. This implies a rise in global output and demand and helping U.S. exports. Again, this effect is small and doesn’t prevent a deterioration of balance of payments and international investment position. So U.S. production rising helps exporters a bit but not much.

What the world needs is a coordinated policy to raise output by fiscal policy and putting limits on balance of payments imbalances.

Whoever becomes President of the United States has to not only take care of domestic policies but also act as a leader in world wide policy.

All this is about the future. But it’s not that the U.S. balance of payments hasn’t mattered in the past. Because of imbalances in trade, the U.S. fiscal policy could not save the U.S. i.e., could not bring the economy back into full employment quickly. It has taken about 9 years and there is still not full employment. So much has been lost. The critical imbalance in U.S. trade is the numero uno reason for the lack of a quick recovery. It could be said that the U.S. could have expanded fiscal policy and that is quite true but it would have put the U.S. debts on unsustainable path.

Digression

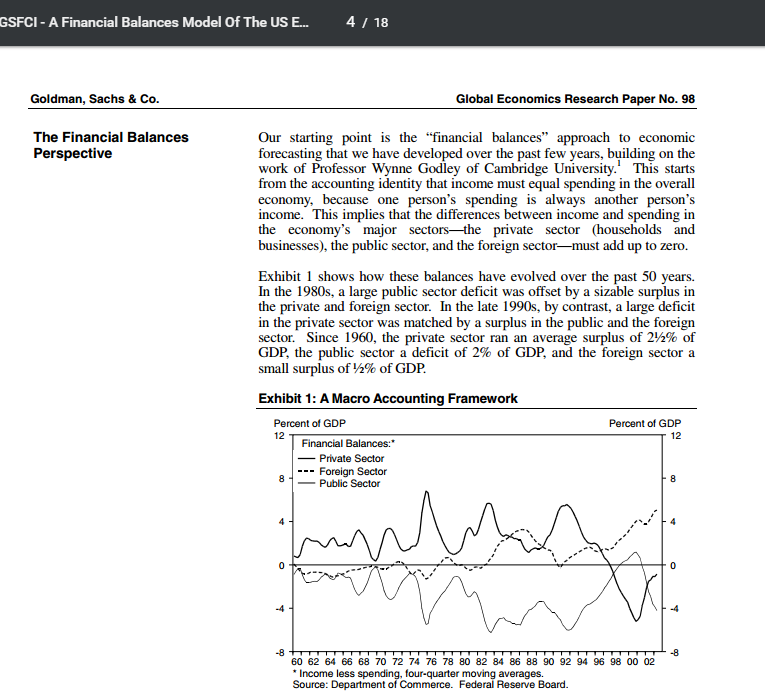

It is sometimes said, such as by a commenter in Brian’s blog that “balances balance”, so there is no need to worry about them. There is no imbalance as per an economist. This is a dubious argument. Surely the private sector can be in deficit for long and it is matched by items in the financial account of the system of national accounts. But surely private sector deficits for long is unsustainable as agreed by everyone around here. So “balances balance” is no argument.