In Krugman’s blog post which is dismissive of Wynne Godley’s work (referred in my previous post) he (Krugman) makes the following claim:

First involved consumption spending. Conventional Keynesian consumption functions suggested that the savings rate would rise as incomes rose — and this wasn’t just the Keynesian interpreters, Keynes himself made the same claim.

which shows that Krugman has less clue about what he talks. Funny, the profession is ruled by clowns like him.

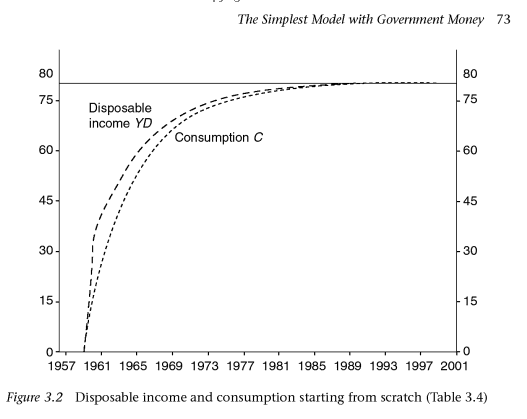

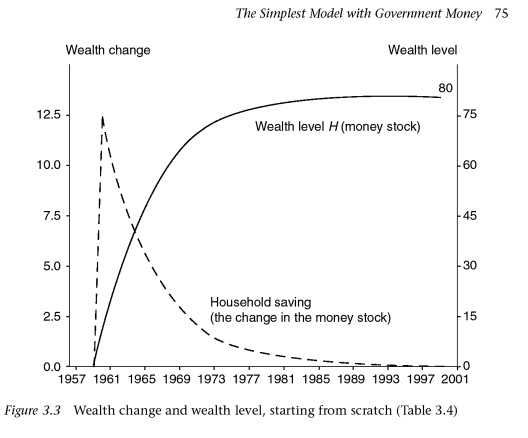

In Wynne Godley’s models, there is a propensity to consume out of income and out of wealth – represented in his models by the parameters α1 and α2 and the rate of saving in any period is given by the model. So in the simplest model – for example in Godley’s book with Marc Lavoie Monetary Economics, the rate of saving can has the following dynamic:

(image screenshot via amazon.com “Look Inside”)

(Note: In the above model, money is the only asset). This is starting from scratch but similar behaviour can be seen if one starts with some initial self-consistent configuration.

This is contrary to what Paul Krugman claims of Keynesian models. The above shows how the rate of saving first rises and then starts to fall and this whole adjustment will happen with a time lag given by a “stock-flow norm” and can be fast.

The reason it happens is simple. It is clear Krugman doesn’t realize the underlying stock-flow dynamics. As households’ saving and income rises because of a rise in government expenditure, they are also accumulating wealth. So a scenario where saving rises forever is meaningless because they would start consuming from their wealth as well.

Krugman continues:

This, in turn, led to predictions of rising savings rates after World War II, and hence a persistent shortage of demand — hence the secular stagnation theory briefly prominent. (There was even an early Heinlein novel built in part around the secular stagnation theory. As I recall, it was pretty bad.)

which is quite wrong – as stock-flow consistent dynamics suggests otherwise.

I’ll hold it to make any generic statements but it is clear that Krugman doesn’t know a thing or two about Keynesian Macroeconomics 🙂

*Many times standard textbooks use a Keynesian consumption function of the form

C = α0 + α1·YD

where C is the consumption, and YD is the disposable income.

It is then easy to see that C/YD decreases with YD and this is what Krugman is talking of.

However only slight improved modification where the consumption function depends on wealth as well leads to a different behaviour as highlighted in the main text. So it is strange Krugman dismisses consumption functions and instead talks of “failures that it seemed could have been avoided by thinking more in maximizing terms” !

*I thank Nick Edmonds in pointing this out.