It isn’t really all that complicated.

There were some responses to my previous post on Steve Keen and his new model for QE. One commenter wrote that Keen’s “charter” entry is needed because of fundamental equations of accounting and secondly SNA – the System of National Accounts has “deep problems”. Strange claim.

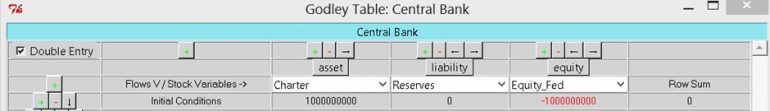

Keen’s entry “charter” appears in his “Godley Table”. (taken from his Naked Capitalism post).

Of course this has nothing to do with Wynne Godley – as he never used “charter” in central bank balance sheets. And “charter” is really not needed.

So let us get straight to the point.

Let us assume the Federal Reserve buys $10bn of Treasuries. We can have two scenarios – Scenario 1: purchase from banks and Scenario 2: purchase from non-banks. (In general a mix).

Scenario 1

Federal Reserve:

Change in Assets = +$10bn

Change in Liabilities = +$10bn

Change in Net Worth = $0

Banks:

Change in Assets = $0

(of which: change in reserves = +$10bn and change in Treasury securities = −$10bn).

Change in Liabilities = $0

Change in Net Worth = $0

Scenario 2

Federal Reserve:

Change in Assets = +$10bn

Change in Liabilities = +$10bn

Change in Net Worth = $0

Banks:

Change in Assets = +$10bn.

Change in Liabilities = +$10bn

Change in Net Worth = $0

Non-banks:

Change in Assets = $0

(of which change in deposits = +$10bn and change in Treasuries = −$10bn)

Change in Liabilities = $0

Change in Net Worth = $0

Summary:

In Scenario 1, the Federal Reserve’s assets and liabilities increase by $10bn since it has $10bn more of Treasury securities as assets and $10bn more of reserves as liabilities. The values of banks’ assets and liabilities do not change as it exchanges one asset for another and its reserves increase.

In Scenario 2, Fed’s balance sheet changes are the same as Scenario 1. Banks see a rise in reserves (assets) and a rise in deposits (liabilities). Nonbanks’ assets and liabilities do not change – just the composition of assets (they have $10bn of more deposits and $10bn less Treasury securities than before).

Of course this is at the time of the transaction and little about what happens next. However, it is important to get the above right and then proceed rather than bringing in some “charter”.

My own views of the effect of LSAP is found in a previous post: Central Bank Asset Purchases And Its Connection To Tobin’s Theory Of Asset Allocation.