Cyprus has recently received the attention of academicians and financial professionals in recent weeks. Need I say that?

So national bankruptcy is to be resolved by winding down a bank, moving guaranteed deposits (i.e., upto €100,000) to another and as per the latest Reuters article on this, big numbers (anywhere ranging from 20 to 40 per cent loss on deposits on amounts over €100,000) are quoted.

Martin Wolf has a good summary:

The current plan is closer to what one would wish to see in an orderly bank resolution. Laiki Bank is to be split into good and bad banks. Deposits of less than €100,000 in the bank and assets worth €9bn – the sum owed to the central bank as part of its liquidity support – will be transferred to Bank of Cyprus. The remainder will be wound down. Those with claims to deposits in excess of €100,000 will obtain whatever the value of the bad bank’s assets turns out to be.

Meanwhile, savers at the Bank of Cyprus with deposits of more than €100,000 will have their accounts frozen and suffer a “haircut” of still unknown size. That reduction in value is likely to be large: perhaps 40 per cent. Finally, temporary exchange controls are to be imposed.

Why are the reasons for such huge numbers?

The reason is that the nation has accumulated huge net indebtedness to foreigners over years and this has been financed by banks raising deposits from foreigners, so that if debt traps are to be avoided, foreigners are to be required to take losses.

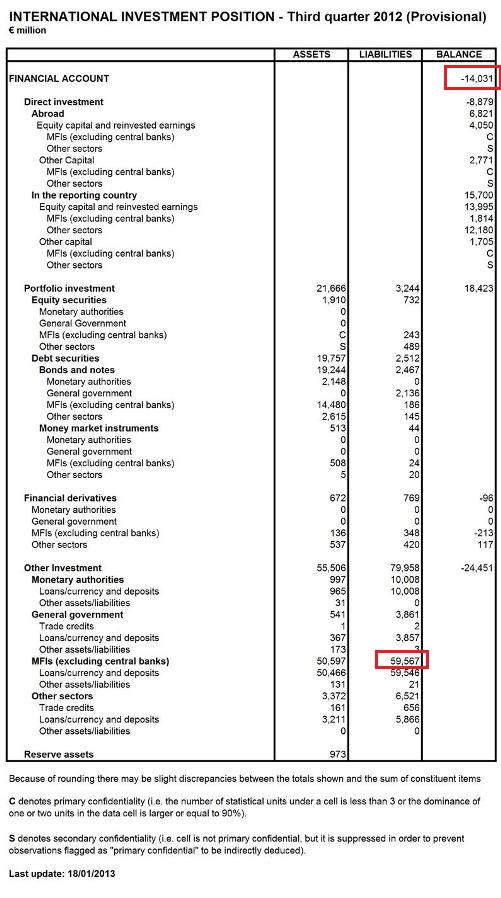

The following is the international investment position of Cyprus at the end of Q3 2012 (source: Central Bank of Cyprus)

In the balance of payments literature, banks’ position is referred as Other Investment. Also, the above refers to a Financial Account but it really means net IIP. Ideally it would have been better if this data had been updated but the above information is useful nonetheless.

In the balance of payments literature, banks’ position is referred as Other Investment. Also, the above refers to a Financial Account but it really means net IIP. Ideally it would have been better if this data had been updated but the above information is useful nonetheless.

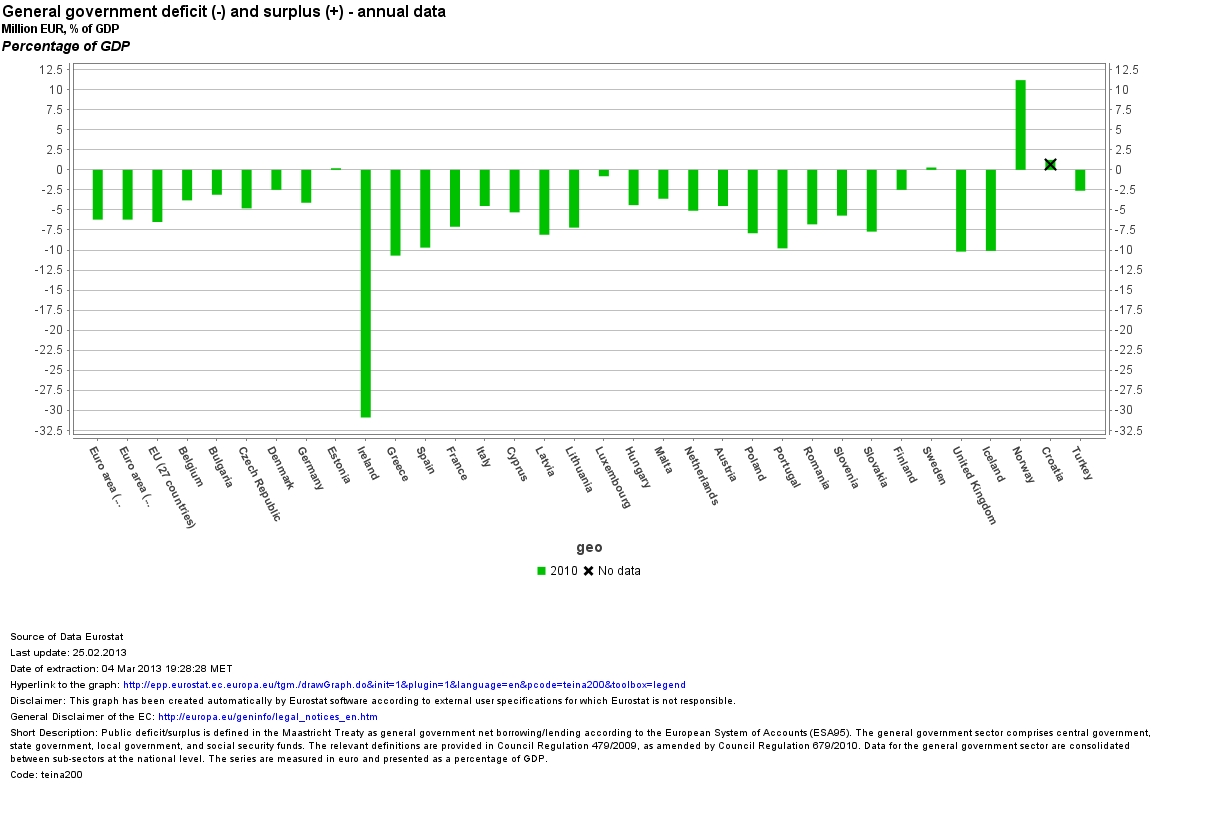

As a percent of gdp, the net IIP position (with the opposite convention to standard usage) was 81.1% (Source: Eurostat) which is big in itself but very much lower than the now famous banks’ liabilities to foreigners/Russians! (the second red box above).

If a nation wants to resolve bankruptcy, it is better to do it by imposing losses on foreigners – especially if an international lender of last resort is available! And if this is to done it in the optimal way, best to do it once – rather than keep doing it. The ratio of two red boxes in the table – i.e., net liability as a proportion of gross bank liabilities to foreigners is 24.56%.

So Cyprus needs to wipe out about this amount as a percent of deposits roughly. It is not necessary to reach a position of zero indebtedness but something low such as 10% of gdp is ideal. Some buffer is needed because there will be leakages in spite of capital controls – requiring fire sale of foreign assets (and subsequent losses) by banks or borrowing from the ECB which may want to ensure that banks have good collateral for the ELA. Foreign deposits below €100,000 shouldn’t be hit. So “net-net”, as a percentage, this may be higher than 24.56%. All this depends on the latest situation and the distribution of foreign deposits and also the distribution between residents and foreigners but 24.56% of deposits is a good starting point – it gives a rough estimate of the order of magnitude of the problem.

At any rate, losses imposed on foreigners have to be big for the ECB and Euro Area governments to stand behind.