Always start macroeconomics with balance of payments 🙂

Moody’s Investors Service has today downgraded the domestic- and foreign-currency government bond ratings of the United Kingdom by one notch to Aa1 from Aaa.

It also downgraded the Bank of England:

In a related rating action, Moody’s has today also downgraded the ratings of the Bank of England to Aa1 from Aaa.

This has seen a lot of reactions – such as quoted here in an FT Alphaville blog post ‘This downgrade is nonsense!’

So let us get straight to scenarios which lead to defaults – in addition to ones purely voluntary.

Scenario 1.

The easiest is to think of a scenario where the Euro Area forms a political union and the UK is invited to join it and it joins it – such as in 2027. The UK government then gives up the power to make drafts on its central bank and becomes a state level government. UK government bonds will be redenominated in Euro and hence a possibility of default exists – including on debts in existence in 2013.

Scenario 2.

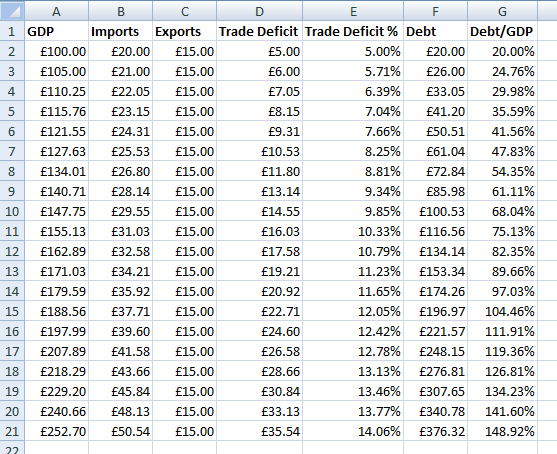

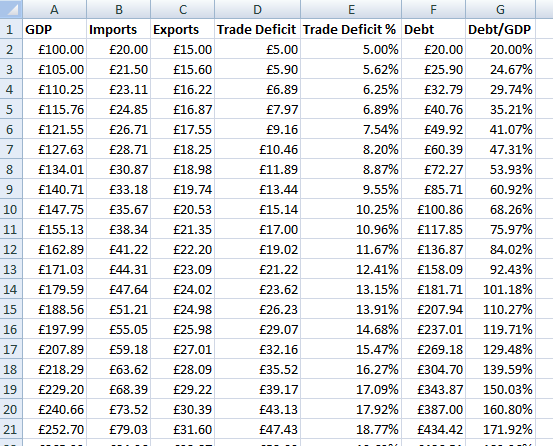

Suppose the UK pegs GBP to some currency such as the Euro or the dollar in 2024. Then surely the government and the central bank can default on debts in existence in 2013 and denominated in GBP in say 2037 isn’t it (like Russia in 1998)?

Now you may complain that it was the government’s mistake to have pegged its exchange rate – but whatever said, an investor holding a bond in 2013 would have been hurt in 2037.

Scenario 3.

Suppose the UK has a balance of payments crisis in 2030. It needs foreign exchanges and needs an international lender such as the IMF. Now suppose the IMF insists that the UK government and the Bank of England default on foreigners holding GBP denominated bonds including those in existence in 2013. Voluntary default?

Conclusion

Moody’s can be criticized for playing political games but a good critique cannot be that default is not possible.

You can come up qualifiers but won’t prove Moody’s rating change wrong.

Don’t get me wrong. I am trying to convince to come up with stronger arguments for critiquing the rating agencies instead of simple ridiculing. Usually the rating actions are defended by people arguing for fiscal contraction. Paradoxically the recovery of the world economy cannot come about easily with without at least a worldwide fiscal expansion.