I was very happy to have found a small mention in a recent Wired article on the “one trillion coin” – till the idea was killed by the U.S. Treasury and the Federal Reserve.

You may have certainly heard of the proposed $1T platinum coin even if you are not from the United States.

The United States government has hit the debt-ceiling, and will soon run out of other financial resources (asset-sales) to finance its expenditure and this may result in a default on its debt or almost complete freeze on expenditure (except interest payments on debt being financed out of taxes). Of course the simplest solution is to increase the ceiling or to completely do away with this. But it is not so easy.

Here’s Krugman aptly describing the situation in his New York Times Op-Ed piece Coins Against Crazies:

… Republicans go wild at this analogy, but it’s unavoidable. This is exactly like someone walking into a crowded room, announcing that he has a bomb strapped to his chest, and threatening to set that bomb off unless his demands are met.

So there’s an idea originally from Carlos Mucha, a lawyer from Georgia which became viral. The idea is for the U.S. Treasury to mint a $1T platinum coin and deposit it at the Federal Reserve. This sidesteps the debt ceiling because the coin doesn’t count in public debt!

Here is an article from the magazine Wired on him: Meet the Genius Behind the Trillion-Dollar Coin and the Plot to Breach the Debt Ceiling. The article mentions my name as the first to have understood Carlos’ idea and spread it 🙂 🙂

Ezra Klein of the Washington Post first reported two days back that the coin idea was killed by the US Treasury and the Federal Reserve.

What is it that gives the Treasury Secretary the power to mint a platinum coin of $1T?

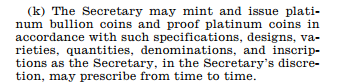

According to § 5112 (k) of Chapter 51 of Title 31, Subtitle IV of the U.S. Code:

Now this alone was strong to make it go viral – thanks to the initiative of Joe Weisenthel of Business Insider who picked up the idea from Cullen Roche of Pragmatic Capitalism and Monetary Realism. Also Neochartalist bloggers were spreading the idea.

The trick was that the coin – although a liability of the government – doesn’t count in what the U.S. government calls the “public debt”.

Now there are several things. Since there are other laws to prevent the Federal Reserve from directly lending to the US Treasury, this raises the question of whether the Federal Reserve can accept the coin. Also, the U.S. Mint which is a part of the U.S. Treasury (as opposed to the Bureau of Engraving and Printing – which prints currency notes for the Federal Reserve) sells “circulating” coins directly to the Federal Reserve – depending on the demand for it from households, businesses and foreigners. There are however some types of coins such as numismatic coins (which coin collectors love) which are directly marketed by the Mint without the Federal Reserve entering the picture. So there are legalities around whether the Fed can directly buy the $1T coin from the U.S. Treasury. To avoid this, some people have proposed that the U.S. Treasury directly sell platinum coins of smaller denominations to the public to get funds in its account in order to make payments.

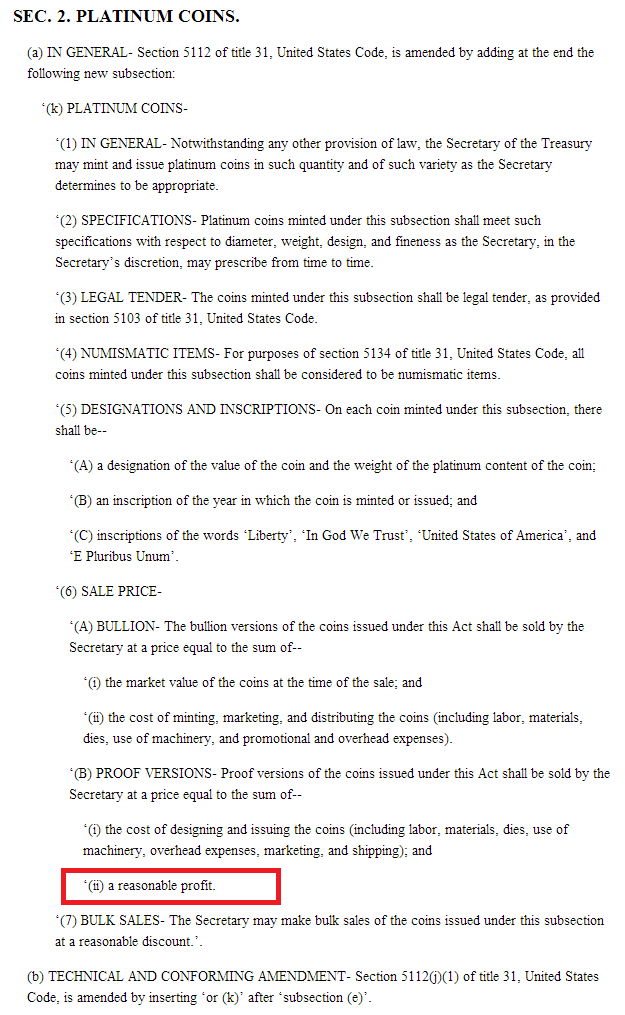

Another obstacle is that the U.S. Code isn’t straightforward on the “price theory” of the coin. For other coins there are some codes in the U.S. Code but apparently not for the platinum coin.

The coin was introduced in a bill H.R. 2018 (104th): United States Platinum and Gold Bullion Coin Act of 1995 which has the price theory (below) for the coin but the whole thing didn’t make it to the final law.

I think this may have had a role in the Federal Reserve and the U.S. Treasury refusing it.

But it is a genie out of the bottle and won’t go back so easily!

Finally the ultimate authority on the platinum coin:

(click to go to the New York Times’ Room For Debate)