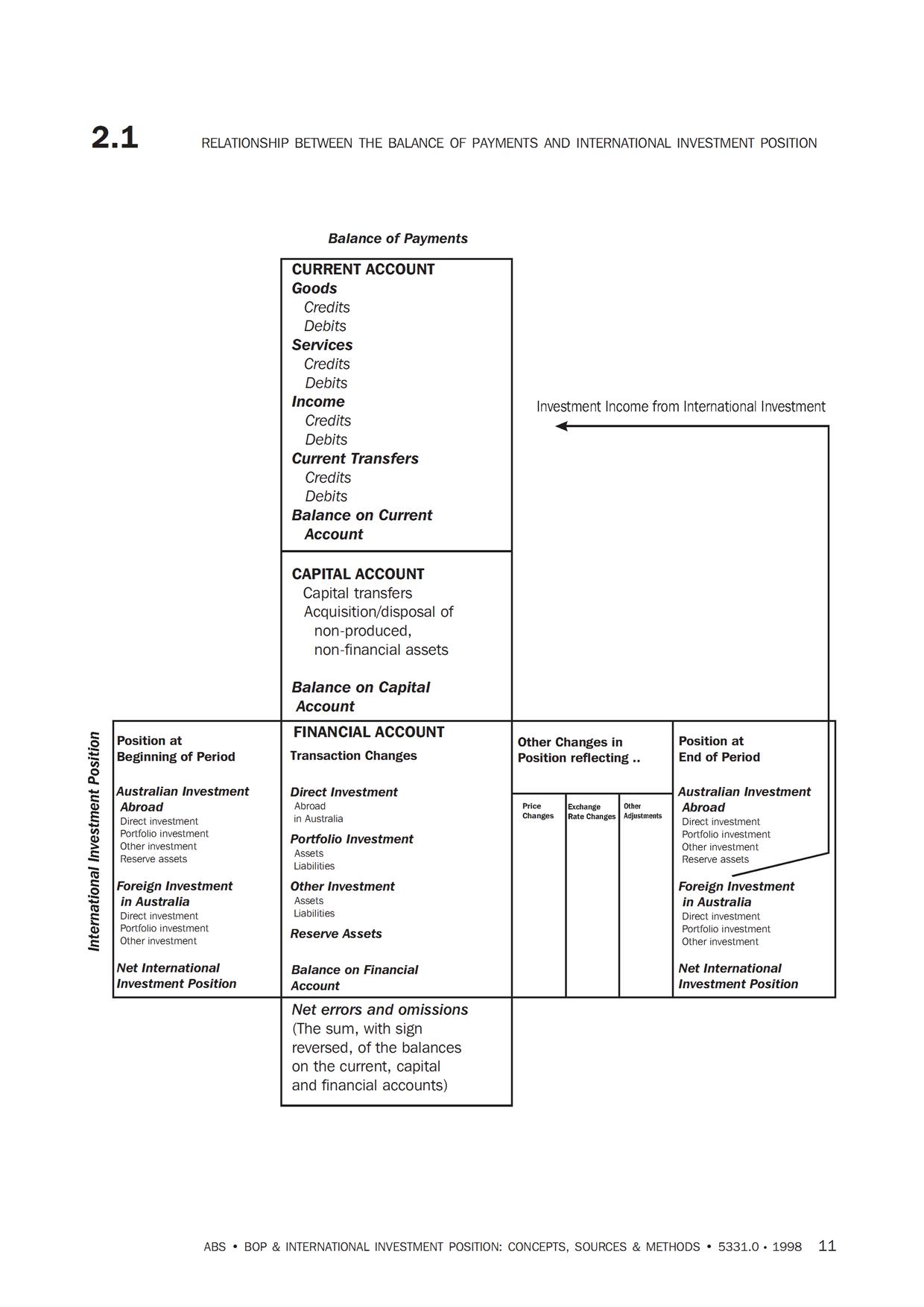

Some time back I had started with the first part of a series of posts on this topic: see Balance Of Payments: Part 1. From the same post, here’s from the Australian Bureau of Statistics’ manual Balance of Payments and International Investment Position, Australia, Concepts, Sources and Methods, 1998

(click to enlarge)

So we have the current account, the financial and the international investment position at the beginning and end of each accounting period. In addition we have, revaluations on assets and liabilities. These arise due to change in the value of assets (such as rise in stock markets) and due to movement of the exchange rate or both.

Also, textbooks use a slightly different language than official statistics and manuals. Textbooks simply use the phrase capital account when they mean the financial account.

I aim to go into each of this and the behaviour of institutions who are involved in the whole process and how it leads to changes in assets and liabilities of all sectors and the consequences. We will see how endemic current account deficits act as a hemorrhage in the circular flow of national income as Wynne Godley would put it and decides the fate of nations as Anthony Thirlwall may have it.

To really appreciate, one needs to have a strong methodology for studying this. One way is to use G&L’s transactions flow matrix but it can get complicated in case of two nations. Needless to say, from a modeling perspective, it is more useful than the usual way of studying balance of payments. However, for appreciating G&L methodology one needs to first understand the usual way of studying this.

Double Entry Versus Quadruple Entry Bookkeeping

In contrast to national accounts, Balance of Payments is based on double entry bookkeeping. Here’s from the IMF’s Balance of Payments And International Investment Position Manual (BPM6), pg 9:

The balance of payments is a statistical statement that summarizes transactions between residents and nonresidents during a period. It consists of the goods and services account, the primary income account, the secondary income account, the capital account, and the financial account. Under the double-entry accounting system that underlies the balance of payments, each transaction is recorded as consisting of two entries and the sum of the credit entries and the sum of the debit entries is the same.

In contrast, national accounts as per SNA2008 or G&L’s way of doing it uses quadruple entry bookkeeping who point out in their book Monetary Economics that:

… Copeland pointed out that, ‘because moneyflows transactions involve two transactors, the social accounting approach to moneyflows rests not on a double-entry system but on a quadruple-entry system’. Knowing that each of the columns and each of the rows must sum to zero at all times, it follows that any alteration in one cell of the matrix must imply a modification to at least three other cells. The transactions matrix used here provides us with an exhibit which allows to report each financial flow both as an inflow to a given sector and as an outflow to the other sector involved in the transaction.

G&L point out that even Hyman Minsky was aware of this. Here’s from the article The Essential Characteristics of Post-Keynesian Economics (page 20):

The structure of an economic model that is relevant for a capitalist economy needs to include the interrelated balance sheets and income statements of the units of the economy. The principle of double entry book keeping, where financial assets are liabilities on another balance sheet and where every entry on balance sheet has a dual in another entry on the same balance sheet, means that every transaction in assets requires four entries.

The System of National Accounts 2008 (2008 SNA) says (page 21):

In principle, the recording of the consequences of an action as it affects all units and all sectors is based on a principle of quadruple entry accounting, because most transactions involve two institutional units. Each transaction of this type must be recorded twice by each of the two transactors involved. For example, a social benefit in cash paid by a government unit to a household is recorded in the accounts of government as a use under the relevant type of transfers and a negative acquisition of assets under currency and deposits; in the accounts of the household sector, it is recorded as a resource under transfers and an acquisition of assets under currency and deposits. The principle of quadruple entry accounting applies even when the detailed from-whom-to-whom relations between sectors are not shown in the accounts. Correctly recording the four transactions involved ensures full consistency in the accounts.

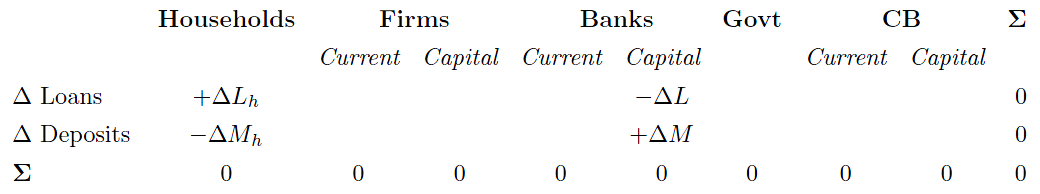

Simple example: your and my favourite: loans make deposits. The following is a transaction where a household has borrowed some funds from the banking sector:

Introduction To Current Transactions

I mentioned that in recording transactions between residents and nonresidents and presenting it as balance of payments, national accountants use double entry bookkeeping (as opposed to quadruple), so any transaction in the current account necessarily involves another entry in the financial account (ignoring barter and accidental cancellations). However, the opposite is not the case: a transaction on the financial account will lead to another entry in the financial account and not directly in the current account. A purchase of US equities by a UK resident cannot be said to cause or increase the US current account deficit.

One example: if you are are US citizen travelling to the UK and have pay for coffee at the London airport by paying in Federal Reserve notes, it will give rise to an entry in the current account (credit from the perspective of the UK balance of payments) and a debit (increase in assets of UK residents: change in currency notes). This is just transaction among thousands and the question is how is all this to be recorded and more importantly (later) what does it tell us.

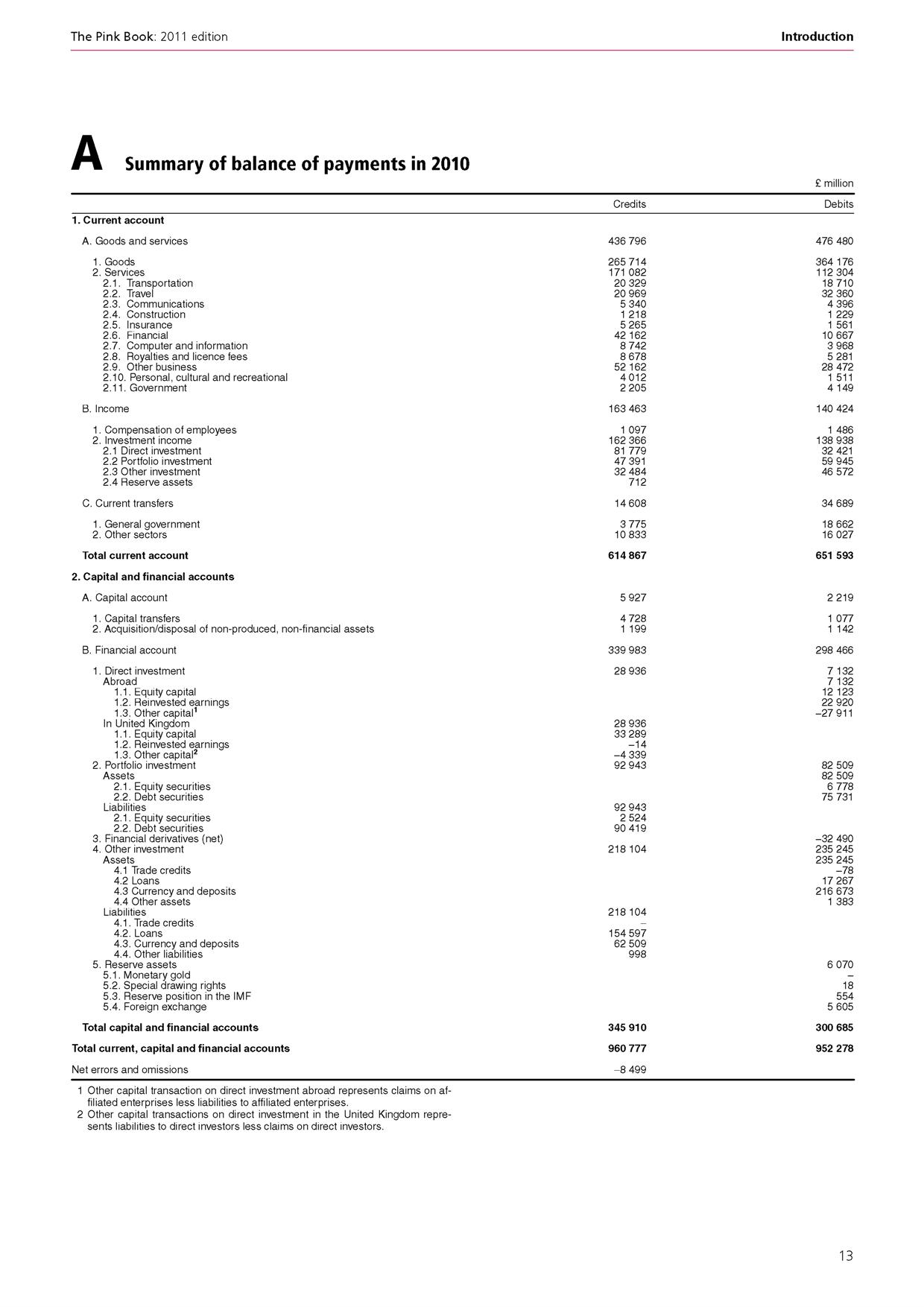

Here’s how a standard balance of payments table looks like (note: this does not include international investment position)

(source: UK Pink Book 2011; click to enlarge)

We will go over details in the next post in this series. For now let us see how this looks for the example presented earlier: A US traveller pays $10 for coffee at the London Heathrow airport with Federal Reserve currency notes. Assuming the current exchange rate, the following (double) entries need to be included in the UK balance of payments:

| £ | Credits | Debits | |

| Current Account | |||

| Goods and Services | 6.328 | ||

| Financial Account | |||

| Bank Deposits, Foreign Currency Assets | 6.328 |

This is a simple example – hardly needing so much background and information but in the next post in this series, we will look at complicated examples where intuitions can easily go wrong. If the above were the only transaction between UK and US residents in the accounting period (quarter/year), this will also change the US indebtedness to the UK by £6.328 or $10 and this will be shown in the international investment positions of the UK and the US. If the exchange rate had moved from the start of the period, revaluations would need to be done to record the closing stocks of assets and liabilities.