24 years back, Basil Moore wrote a book Horizontalists And Verticalists: The Macroeconomics Of Credit Money (Cambridge University Press, 1988) which begins like this:

The central message of this book is that members of the economics profession, all the way from professors to students, are currently operating with a basically incorrect paradigm of the way modern banking systems operate and of the causal connection between wages, prices, on the one hand, and monetary developments, on the other. Currently, the standard paradigm, especially among economists in the United States, treats the central bank as determining the money base and thence the money stock. The growth of the money supply is held to be the main force determining the rate of growth of money income, wages, and prices.

… This book argues that the above order of causation should be reversed. Changes in wages and employment largely determine the demand for bank loans, which in turn determine the rate of growth of the money stock. Central banks have no alternative but to accept this course of events, their only option being to vary the short-term rate of interest at which they supply liquidity to the banking system on demand. Commercial banks are now in a position to supply whatever volume of credit to the economy their borrowers demand.

The book built on his own work and that of Nicholas Kaldor and Marc Lavoie among others goes on to describe the banking system, horizontalism and endogenous money. Money is credit-led and demand-determined was his message. Economists believing in the “incorrect paradigm” are Verticalists in Moore’s terminology.

Paul Krugman whom Post Keynesian have more respect than other mainstream economists probably disappointed them when he was arguing with Steve Keen in a 3-post blog series. Arguing like a Verticalist, Krugman claims (among other Verticalist claims) in his post Banking Mysticism, Continued:

… And currency is in limited supply — with the limit set by Fed decisions. So there is in fact no automatic process by which an increase in bank loans produces a sufficient rise in deposits to back those loans, and a key limiting factor in the size of bank balance sheets is the amount of monetary base the Fed creates — even if banks hold no reserves.

The Defensive Nature Of Open Market Operations

The reason there is widespread misunderstanding of what the central bank does is because it carries out open market operations where it buys or sells government securities or does repurchase agreements. The orthodox view is that the central bank is acting the way it is to increase or decrease the amount of banks’ settlement balances and this affects the money supply – allowing banks to expand lending or leading them to contract – and thence the whole economy. The view is that the central bank has a direct control these operations and are purely volitional.

This is an incorrect view because no central bank claims to be “controlling” the money stock.

If money is truly endogenous, the question is why the central bank does these operations often. The reason is that operations of the central bank are defensive.

In his article Endogenous Money: Accomodationist, Marc Lavoie argues:

Some post-Keynesians have pointed out long ago that open market operations had little or nothing to do with monetary policy.

For instance, It is usually assumed that a change in the Fed’s holdings of government securities will lead to a change, with the same sign attached, in the reserves of the commercial banking system. It was the failure to observe this relationship empirically which led us, in constructing the monetary financial block of our model, to try to find some other way of representing the effect of the Fed’s open market operations on the banking system. (Eichner, 1986, p. 100)

That other way is that ‘the Fed’s purchases or sales of government securities are intended primarily to offset the flows into or out of the domestic monetary-financial system’ (Eichner, 1987, p. 849).

So the central bank purchases government bonds and/or does repos to neutralize the effects of transactions which change the settlement balances. One example is the flow of funds into and out of the government’s account at the central bank. Another is the demand for currency notes by banks to satisfy their customers’ needs. The central bank has no choice but to provide these notes.

Here’s a preview via Google Books:

click to view on Google Books

Also see this post Alfred Eichner And The Federal Reserve Operating Procedures.

Krugman is partly right when he says, “Banks are important, but they don’t take us into an alternative economic universe.” However he fails to see that money is endogenous and the way the banking system works show this endogeneity.

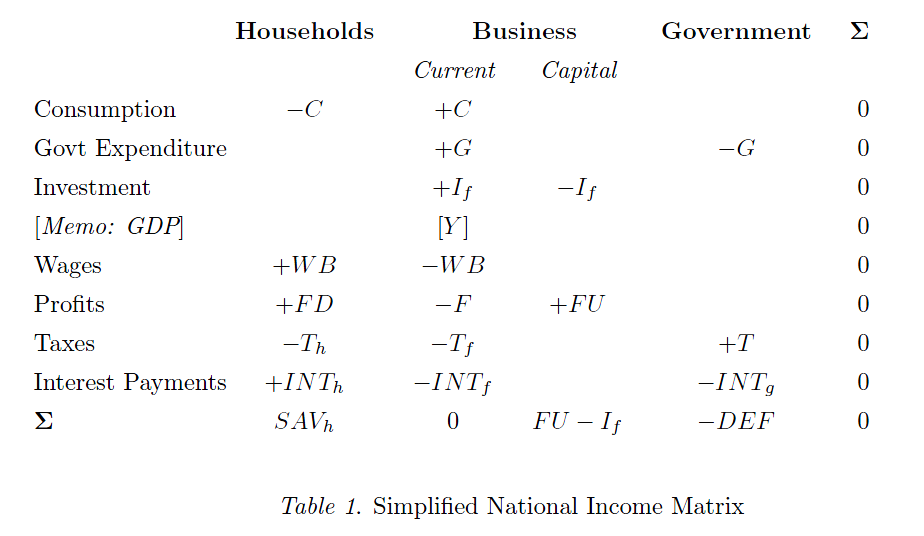

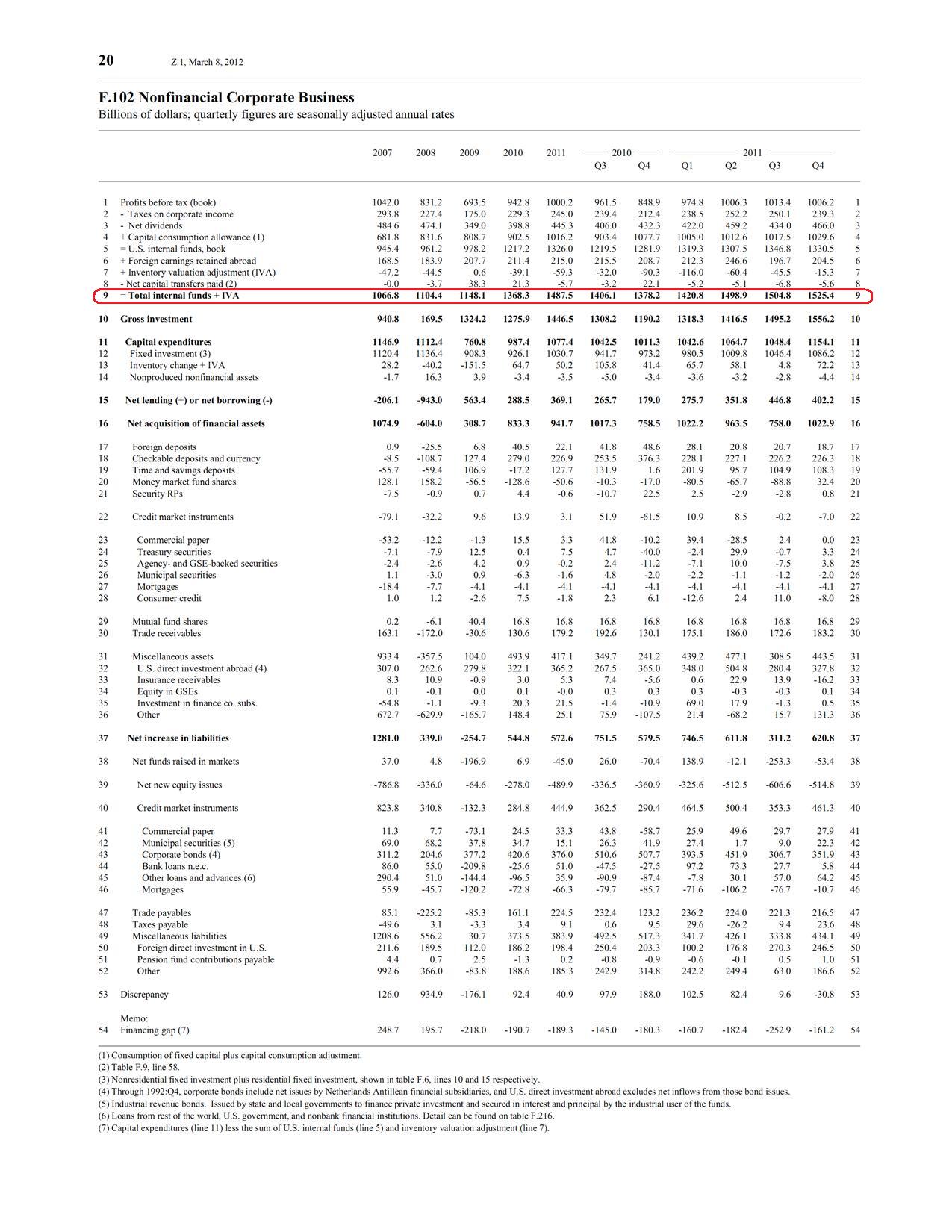

Of course, Steve Keen has issues with his models and accounting with which Krugman has troubles. Keen defines aggregate demand to be gdp plus “change in debt”. As much weird this definition is, it is double counting when investment expenditure is financed by borrowing rather than internal sources of funds. Also, if a person sells a home to another person who has financed this purchase by borrowing and the former does not make expenditure from this income, this does not increase aggregate demand – a point raised by Marc Lavoie here (h/t “Circuit” from Fictional Reserve Barking). But as per Keen’s definition it does. In his first post, Krugman seems to say the same thing as Lavoie – but in a roundabout way.

The resulting debate has however highlighted the Verticalist intuition of Krugman!