Discussions of the U.S. public debt and fiscal deficits curiously miss on the connection with the external sector. Even the Congressional Budget Office (CBO)’s The Budget And Economic Outlook report misses this connection when projecting the public debt over many scenarios.

Last week the President of the Federal Reserve Bank of New York, William Dudley gave a speech at a “Panel Discussion on Fiscal Challenges” and the two topic discussed by him were: the interest expense of the US government on its debt and the U.S. sectoral balances.

According to him, “we are in an unusual period in which net interest expense is temporarily depressed”. You can read about it at the FRBNY web page of the speech.

Which brings me to his discussion on sectoral balances. This is not the first time he has talked on this and the public debate on the public debt and fiscal deficit of the United States almost always miss the important connection of this with the external sector imbalance. But Dudley knows the importance of this in policy making, even though he begins his talk by saying that discussion of fiscal policy “for central bankers [is] always dangerous waters to swim in”.

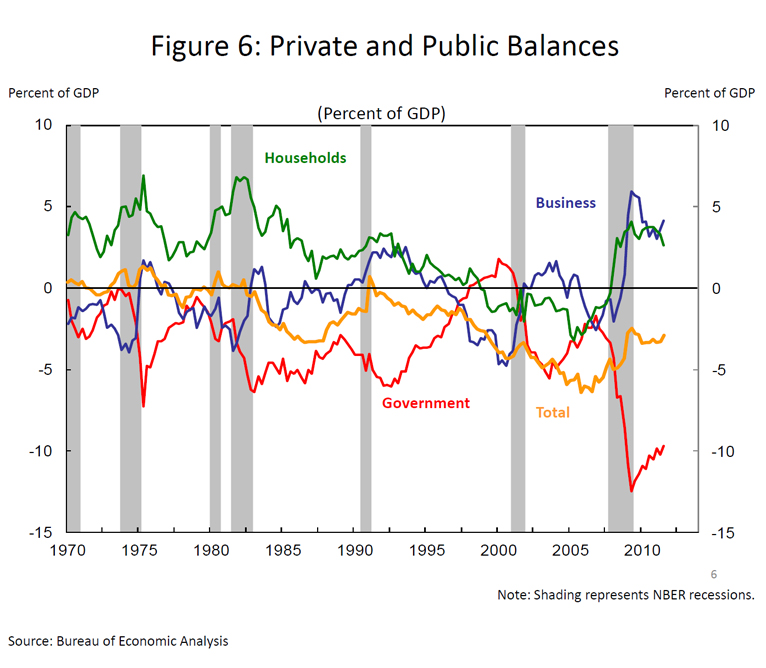

Here’s Dudley’s chart:

Let’s just say Dudley is less dogmatic about fiscal policy than his colleagues because he says:

Fiscal adjustments require offsetting changes in private-sector spending and saving behavior, and in the trade sector. Prudent economic policies and international coordination can help ensure that such adjustments take place in ways that support economic activity (and, by extension also support government revenue).

and

On one hand, the U.S. economy must be reoriented toward global demand and stronger net exports. On the other hand, there will have to be offsetting adjustments elsewhere in the world. After all, on a global basis, the current account balance—properly measured—must sum to zero. This means that countries with significant trade surpluses will need to reorient their economies over time toward increasing domestic demand and running smaller trade surpluses.