In my previous post Sources And Uses Of Funds, I used the term “net worth”, and the reader would have noted the the strange dissimilarity with business accounting.

It’s best first to verify that national accountants (with the exception of the Federal Reserve’s Z.1 flow of funds accounts of the United States) do it the way described in the previous post.

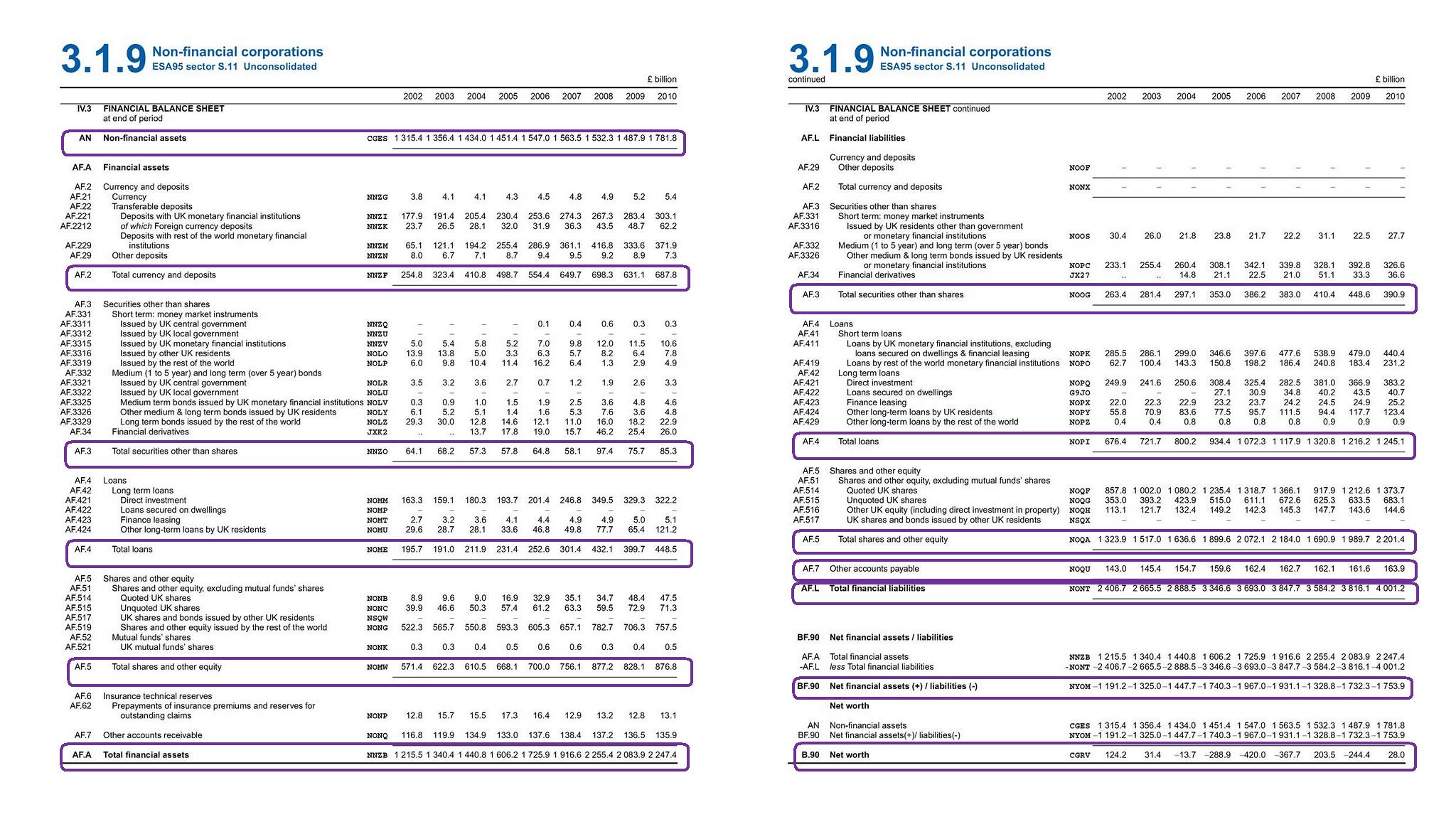

The UK Blue Book 2011 has the following description of Non-financial corporations’ balance sheet at the end of 2010:

| Assets Nonfinancial Assets Liabilities and Net Worth Currency and Deposits | £, billion 4,029.2 1,781.8 4,029.2 – |

The relevant tables are below:

So “Shares and Other Equity” is treated as a liability of the corporation even though dividends are not compulsory. In a sense, equities are treated as being equivalent to debt securities. How does one calculate this? Assuming the relevant information is available, one simply needs to calculate the market value of equities issued by corporations.

The tendency to treat equities issued by corporations as not liabilities is misleading. This is all the more important if foreigners hold a large amount of equities and this may underestimate the indebtedness to foreigners. Indeed statistical agencies of many nations release data for the loosely defined term “external debt” and do not count equities held by foreigners in this. This “intuition” can easily be dismissed – foreigners can liquidate equities.

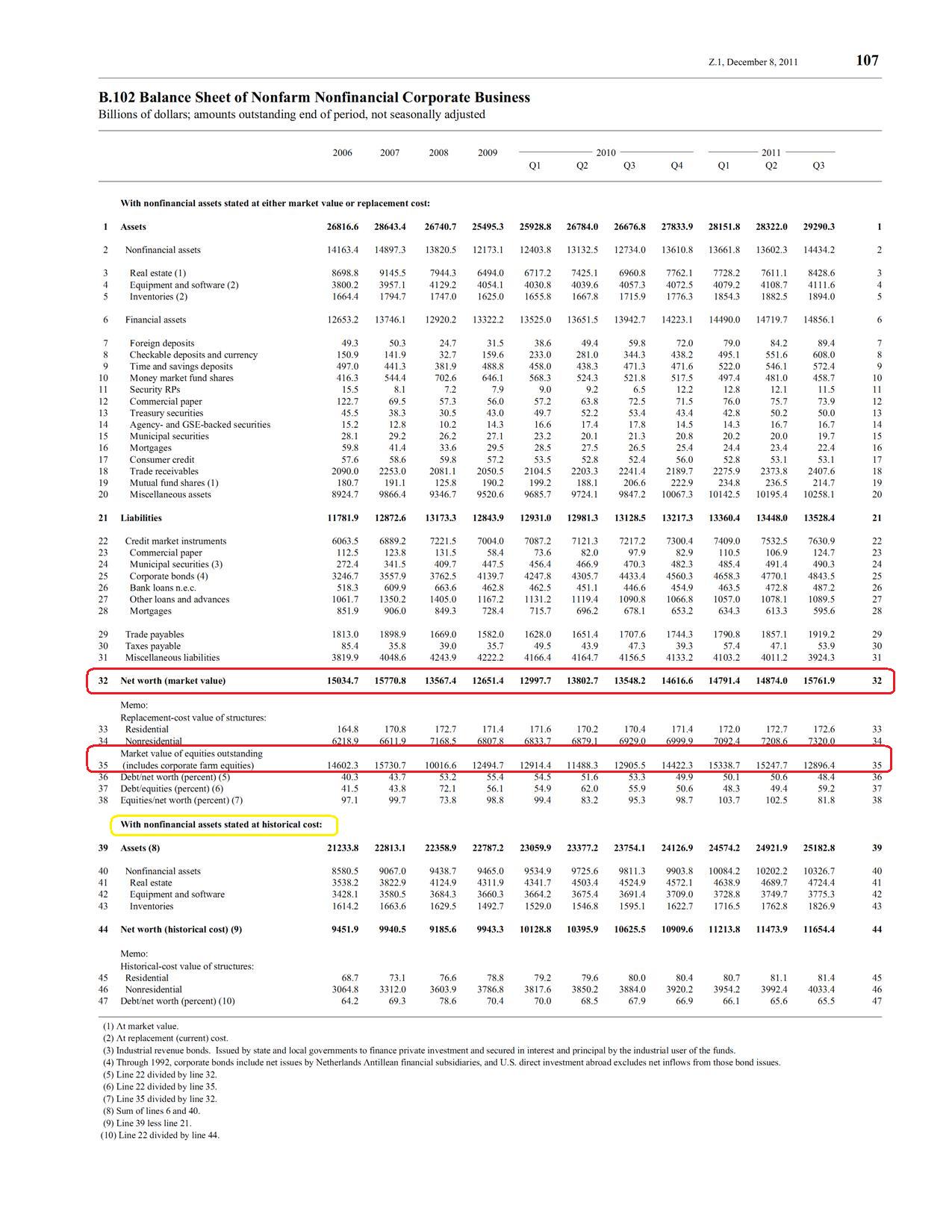

For comparison, below is the similar Z.1 statistic of Nonfarm Nonfinancial Corporate Businesses of the United States

The Federal Reserve by excluding the market value of equities issued in liabilities, exaggerates the net worth of corporations.

SNA Description of Differences

The System of National Accounts describes the differences in Section 1.64

Business accounts commonly (but not invariably) record costs on an historic basis, partly to ensure that they are completely objective. Historic cost accounting requires goods or assets used in production to be valued by the expenditures actually incurred to acquire those goods or assets, however far back in the past those expenditures took place. In the SNA, however, the concept of opportunity cost as defined in economics is employed. In other words, the cost of using, or using up, some existing asset or good in one particular process of production is measured by the amount of the benefits that could have been secured by using the asset or good in alternative ways. Opportunity cost is calculated with reference to the opportunities foregone at the time the asset or resource is used, as distinct from the costs incurred at some time in the past to acquire the asset. The best practical approximation to opportunity cost accounting is current cost accounting, whereby assets and goods used in production are valued at their actual or estimated current market prices at the time the production takes place. Current cost accounting is sometimes described as replacement cost accounting, although there may be no intention of actually replacing the asset in question after it has been used.

So current cost accounting or replacement cost accounting is used. We saw in the last post that financial assets and liabilities are to be valued at their market values. In addition, real estate will be evaluated at the market price. Capital goods are to be valued at their replacement cost. Inventories should be valued at the current cost of production, not at the price the producers expect to it to sell.

Moreover, according to the SNA:

Current cost accounting has ramifications that permeate the entire SNA. It affects all the accounts and balance sheets and their balancing items. A fundamental principle underlying the measurement of gross value added, and hence GDP, is that output and intermediate consumption must be valued at the prices current at the time the production takes place. This implies that goods withdrawn from inventories must be valued at the prices prevailing at the times the goods are withdrawn and not at the prices at which they entered inventories. This method of recording changes in inventories is not commonly used in business accounting, however, and may sometimes give very different results, especially when inventory levels fluctuate while prices are rising. Similarly, consumption of fixed capital in the SNA is calculated on the basis of the estimated opportunity costs of using the assets at the time they are used, as distinct from the prices at which the assets were acquired. Even when the fixed assets used up are not actually replaced, the amount of consumption of fixed capital charged as a cost of production should be sufficient to enable the assets to be replaced, if desired. When there is persistent inflation, the value of consumption of fixed capital is liable to be much greater than depreciation at historic costs, even if the same assumptions are made in the SNA and in business accounts about the service lives of the assets and their rates of wear and tear and obsolescence. To avoid confusion, the term “consumption of fixed capital” is used in the SNA to distinguish it from “depreciation” as typically measured in business accounts.

Back to Net Worth

The SNA has this description of net worth:

Net worth is the difference between the value of all financial and non-financial assets and all liabilities at a particular point in time. For this calculation, each asset and each liability is to be identified and valued separately. As the balancing item, net worth is calculated for institutional units and sectors and for the total economy.

For government, households and NPISHs [Non-profit institutions serving households], the value of net worth is clearly the worth of the unit to its owners. In the case of quasi-corporations, net worth is zero, because the value of the owners’ equity is assumed to be equal to its assets less its liabilities. For other corporations, the situation is less clear-cut.

In the SNA, net worth of corporations is calculated in exactly the same way as for other sectors, as the sum of all assets less the sum of all liabilities. In doing so, the value of shares and other equity, which are liabilities of corporations, are included in the value of liabilities. Shares are included at their market price on the balance sheet date. Thus, even though a corporation is wholly owned by its shareholders collectively, it is seen to have a net worth (which could be positive or negative) in addition to the value of the shareholders’ equity.

Update: Corrected the values in the table at the beginning of the post.