On 8 Dec, the European Central Bank announced that it will conduct two Longer-Term Refinancing Operations (LTRO) with a maturity of 36 months – one each in December and February. According to the initial press release,

The operations will be conducted as fixed rate tender procedures with full allotment. The rate in these operations will be fixed at the average rate of the main refinancing operations over the life of the respective operation. Interest will be paid when the respective operation matures.

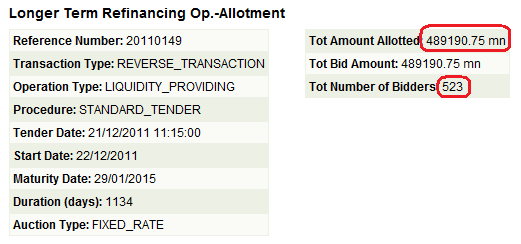

The allotment was made today and banks borrowed around €489bn.

The ECB had also given banks an option to shift previous funding:

Counterparties are permitted to shift all of the outstanding amounts received in the 12-month LTRO allotted in October 2011 into the first 3-year LTRO allotted on 21 December 2011.

And according to today’s press release,

The allotment amount of EUR 489,190.75 million includes EUR 45,721.45 million that were moved from the 12-month LTRO allotted in October 2011. A total of 123 counterparties made use of the possibility to shift, whereas 58 banks decided to keep their borrowing in the 12-month LTRO, which has now a remaining outstanding amount of EUR 11,213.00 million.

Another feature of today’s allotment was that Italian banks issued bonds backed by their sovereign and retained the issuance to place them as collateral with their Banca d’Italia – their home NCB for their bids. According to FT Alphaville,

According to Reuters, 14 Italian banks have listed €38.4bn worth of state-guaranteed bonds ahead of the LTRO.

More information:

RTRS-ITALIAN BANKS TAPPED ECB’S NEW 3-YR LOANS FOR MORE THAN 110 BLN EUROS – ITALIAN BANKING SOURCE

RTRS: 14 Italian banks win clearance for state-backed bond issues worth EUR 57-58bln, figure includes EUR 38.4bln already listed – sources

Another reason the auction received so much attention was due to the huge speculation that banks will borrow from the Eurosystem and use it to purchase the debt of their sovereigns and even other Euro Area governments. To me, this is nothing more than speculation because it fails to understand how banks work – the LTRO was to help banks meet their funding needs. It is true that some banks (and only a few) may have done this “carry trade” but it is highly risky and as Megan Greene of Roubini Global Economics put it,

This sort of carry-trade could be extremely dangerous, because it not only fails to break the banking/sovereign feedback loop, it actually strengthens it.

Gavyn Davies of FT had this to say in his blog (which is a fine explanation).

The French government was very explicit that the liquidity injection could be used by banks to buy sovereign debt with a large positive carry. This will almost certainly prove too optimistic, since the banks need the money to redeem their own bonds, not to buy risky debt from sovereigns. Nevertheless, the ECB is certainly preventing banks from selling sovereign debt that they otherwise would have sold, and it is doing this by expanding its own balance sheet. …