Yesterday S&P put 15 of the EA17 governments on CreditWatch negative (comments and links here). It later came out with Credit FAQ: Factors Behind Our Placement Of Eurozone Governments On CreditWatch which gives the rationale for the action. According to the S&P

For countries in net external liability positions, including the eurozone’s peripheral economies, we see growing risks to the funding of their external requirements. In our view, financial institutions located in countries in net external asset positions (such as Germany) also face pressure where the quality of those assets is deteriorating.

So it seems to understand that the problem of the Euro Area is severe internal imbalances leading to high net external debt.

S&P also wrote an article titled Why Trade Imbalances For Creditors As Well As Debtors In The Eurozone Are Weighing On Growth, a few days back. Available through S&P’s Twitter update

click to view the tweet on Twitter

A wisecrack:

More fundamentally, large imbalances between the 17 member economies remain; after many years of high current account deficits in net debtor eurozone countries, these economies have built up substantial levels of net external debt. Such high levels of external leverage will weigh on economic growth prospects–in both net debtor and net creditor eurozone countries–over the next several years. How imbalances between them are unwound, and under what conditions, could determine the success or failure of policymakers in addressing the European debt crisis.

Australia

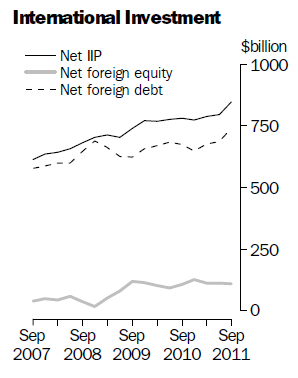

More on net indebtedness. Australia’s ABS released its Balance of Payments and International Investment Position, September 2011. It has this chart on Australia’s Net International Investment Position (with sign reversed in their convention):

Australia’s debt is both in domestic and foreign currencies and banks have hedged most of the foreign currency exposure hedged using foreign exchange derivatives. Australia’s government has almost zero liabilities in foreign currency.

Some people claim that as long as the debt to foreigners is in domestic currency, it doesn’t matter for some kind of “intuitive” reasons. My view is that while it is true that it is advantageous to incur liabilities to foreigners in domestic currency, my reasons are entirely different. A liability in domestic currency prevents revaluation losses if the exchange rate depreciates. A net indebtedness to foreigners is still a burden. A point rarely understood.