Fitch Revises Hungary’s Outlook to Negative; Affirms at ‘BBB

Fitch Ratings-London-11 November 2011: Fitch Ratings has revised the Outlooks on the Republic of Hungary’s Long-term foreign and local currency Issuer Default Ratings (IDR) to Negative from Stable and affirmed the ratings at ‘BBB-‘ and ‘BBB’, respectively. The agency has also affirmed Hungary’s Short-term IDR at ‘F3’ and Country Ceiling at ‘A-‘.

“The revision in Hungary’s Outlook to Negative reflects a sharp deterioration in the external growth and financing environment facing Hungary’s small, open and relatively heavily indebted economy,” says Matteo Napolitano, Director in Fitch’s Sovereign Group. “Moreover, various fiscal policy measures and the scheme to allow the repayment of household foreign currency mortgages at below market exchange rates have dented foreign investor confidence, on which medium-term growth prospects depend.”

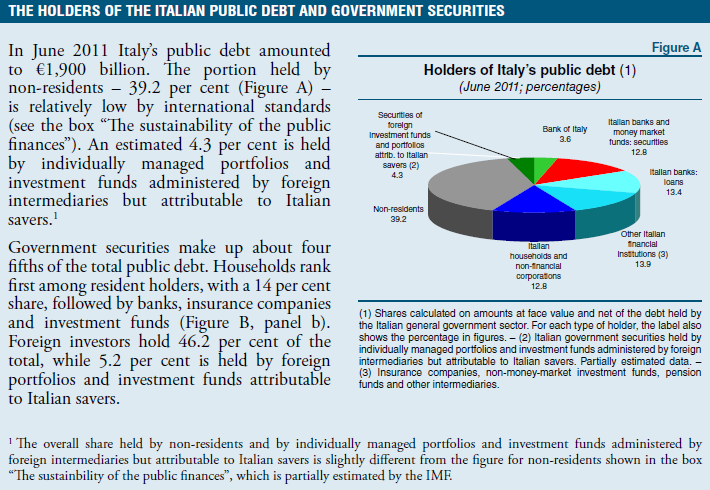

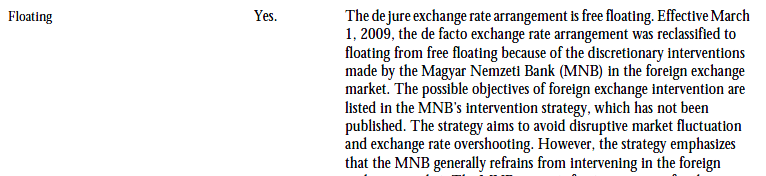

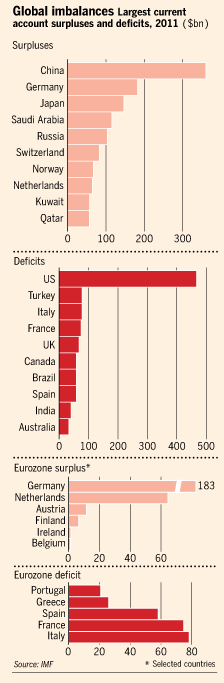

Hungary is particularly exposed to any deterioration in the economic and financial conditions in the eurozone, owing to its open economy, mainly Western European-owned banking sector, relatively high levels of public and external debt and financing ratios, sizeable stock of portfolio investment (including a 40% non-resident share of domestically issued government debt) and Swiss Franc (CHF) mortgages debt.

Heightened risk aversion has increased refinancing risks on external sovereign maturities. Hungary needs to refinance around EUR4.6bn in 2012, and EUR5bn-EUR5.6bn annually in 2013-14, of foreign exchange denominated debt. Any potential selling of HUF-denominated debt by non-resident investors could add to financing pressures. The government’s EUR1.6bn cash deposit at the central bank provides a moderate buffer against refinancing risks.

Growth prospects have weakened sharply both in Hungary and in its main Western European trading partners in recent months. In October, Fitch revised its forecast for 2012 eurozone GDP growth down to 0.8% from 1.8% previously, and to 1.6% from 1.7% previously for 2011. Against this backdrop, with domestic demand weighed down by fiscal tightening and private-sector de-leveraging, Fitch expects Hungary’s economy to grow by only 0.5% in 2012, down sharply from the agency’s projection of 3.2% in June 2011.

The government appears committed to fiscal consolidation and through the course of 2011, has set out an array of measures in the Szell Kalman plan in March, the Convergence Programme in April and the new measures announced in September. Despite some widening in the structural budget deficit in 2011, it will run a general government surplus in 2011 of around 3.5% of GDP, driven by large one-off factors such as the return of private pension assets to the public sector. Fitch forecasts that government debt will decline to around 76% of GDP at end-2011, from 80% at end-2010.

For 2012, the government intends to reduce the structural budget deficit by over 2 percentage points of GDP to bring the headline deficit to 2.5% of GDP, thus taking Hungary out of the EU’s Excessive Deficit Procedure (EDP). However, the weak growth outlook, the uncertain costing and implementation of some measures and potential reform fatigue make this challenging. Fitch forecasts a 2012 budget deficit of 3.3% of GDP.

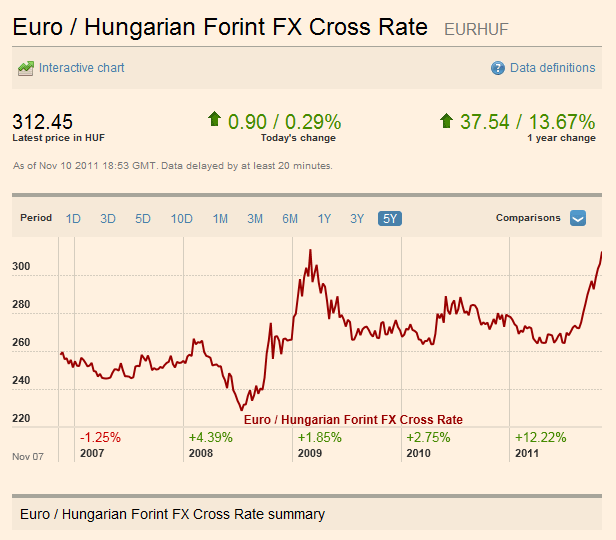

Over the course of 2011 the Hungarian forint (HUF) has depreciated by 13%-14% against both the euro and the CHF, thus increasing further heavy public- and private-sector debt repayment burdens. The government’s policies to tackle the large stock of CHF-denominated household debt (equivalent to 16% of GDP in mid-2011) may turn out to be fairly ineffective and have negative consequences. Credit constraints and a lack of sufficient savings will likely prevent the share of CHF loans that are repaid early at a preferential exchange rate from rising above 20%-25% of the total (see ‘Hungary: Risks from Swiss Franc Debt Exposure’, dated 5 October 2011 at www.fitchratings.com).

However, this will still place further pressure on the HUF and on the banking sector’s balance sheet, which is already beset by an exceptional levy, rising non-performing loans and several years of sluggish economic activity. Although the system average Tier 1 capital adequacy ratio (CAR), at 10.9% in September 2011, looks reasonable, a number of banks are already making losses and will require re-capitalisation – which is likely to be forthcoming from foreign parents. Nevertheless, foreign parent banks are likely to continue to cut their exposure to Hungary and the supply of credit is likely to continue to contract, weighing on GDP growth.

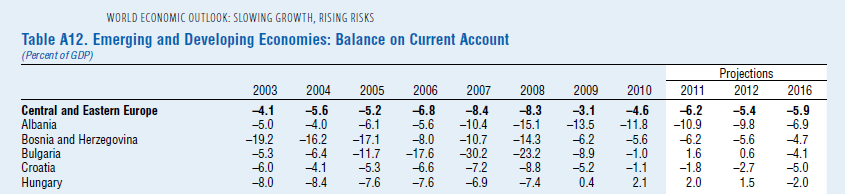

Some of Hungary’s fundamental rating strengths such as a rich and diverse economy, and underlying political stability remain in place. Moreover, it is running a large current account surplus, which Fitch forecasts at an annual average of 2.4% in 2011-12, helped by resilient export performance and weak domestic demand. It should also attract around USD2bn in non-debt financing in 2012 from EU transfers and other sources.

Foreign direct investment (FDI) registered a net outflow of EUR1bn in H111. Aside from a handful of large investments in the automotive sector, there are few significant FDI projects in the pipeline. Potential investors appear to be either delaying decisions, or investing elsewhere, as government policies have eroded Hungary’s business climate – a traditional rating strength and key part of the growth model.

When Fitch affirmed Hungary’s rating at ‘BBB-‘ and revised the Outlook to Stable on 6 June 2011, it noted that “negative pressure on the rating could also emerge from the anaemic growth, private sector capital outflows, increased problems in the banking sector or a significant shift in investor sentiment that adversely affected Hungary’s public and external financing capacity”.

Hungary is exposed to an intensification of financial instability and recession in the euro area. A significantly worse than currently anticipated slowdown, evidence of private sector capital outflows or problems in the banking sector, a rise in the risk premium or fiscal financing pressure could lead to a downgrade. A material weakening in the government’s commitment to fiscal consolidation could also lead to a downgrade.

Conversely, the government meeting its budget deficit targets and a return to healthy growth, particularly in the context of significant structural reforms and declining external debt ratios, could lead to positive rating action.

Contact:

Primary Analyst

Matteo Napolitano

Director

+44 20 3530 1189

Fitch Ratings Limited

30 North Colonnade

London, E14 5GN

Secondary Analyst

Ed Parker

Managing Director

+44 20 3530 1176

Committee Chairperson

Shelly Shetty

Senior Director

+1 212-908-0324

Media Relations: Peter Fitzpatrick, London, Tel: +44 20 3530 1103, Email: peter.fitzpatrick@fitchratings.com.

Additional information is available at www.fitchratings.com.

The ratings above were solicited by, or on behalf of, the issuer, and therefore, Fitch has been compensated for the provision of the ratings.

Applicable criteria, ‘Sovereign Rating Methodology’, dated 15 August 2011, are available at www.fitchratings.com.

Applicable Criteria and Related Research:

Sovereign Rating Methodology

ALL FITCH CREDIT RATINGS ARE SUBJECT TO CERTAIN LIMITATIONS AND DISCLAIMERS. PLEASE READ THESE LIMITATIONS AND DISCLAIMERS BY FOLLOWING THIS LINK: HTTP://FITCHRATINGS.COM/UNDERSTANDINGCREDITRATINGS. IN ADDITION, RATING DEFINITIONS AND THE TERMS OF USE OF SUCH RATINGS ARE AVAILABLE ON THE AGENCY’S PUBLIC WEBSITE ‘WWW.FITCHRATINGS.COM’. PUBLISHED RATINGS, CRITERIA AND METHODOLOGIES ARE AVAILABLE FROM THIS SITE AT ALL TIMES. FITCH’S CODE OF CONDUCT, CONFIDENTIALITY, CONFLICTS OF INTEREST, AFFILIATE FIREWALL, COMPLIANCE AND OTHER RELEVANT POLICIES AND PROCEDURES ARE ALSO AVAILABLE FROM THE ‘CODE OF CONDUCT’ SECTION OF THIS SITE.

Copyright © 2011 by Fitch, Inc., Fitch Ratings Ltd. and its subsidiaries.