The OECD released its Economic Outlook recently. The preview is available here but download is for subscribers. Else if you are an FT subscriber, you can get it from FT Alphaville’s Long Room.

A few interesting charts (at least for me):

(click to enlarge)

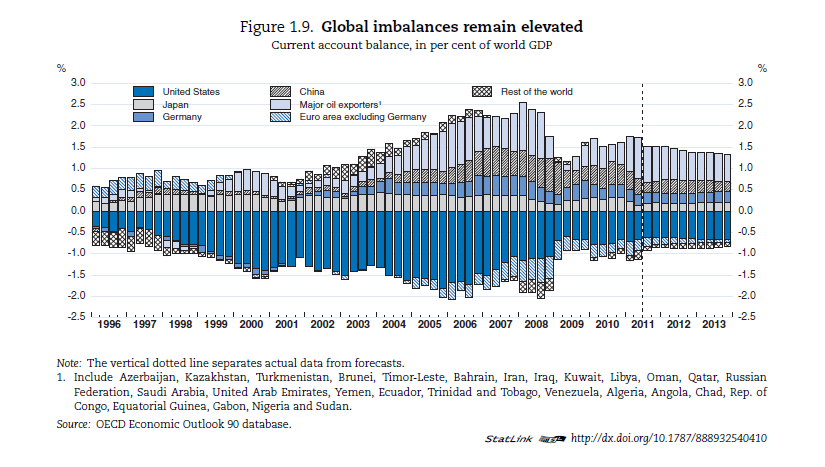

Most Economists (except a few good ones), following the work of Mundell, Fleming and Friedman believed that in floating exchange rate regimes, the invisible hand will work to remove imbalances. Unfortunately, this has not happened and it has taken the crisis for them (most of them actually!) to realize that there is no mechanism and it is still unclear if they understand this.

There are some dissenters among Post Keynesians, such as Randall Wray, who do not consider current account deficits as an imbalance. See this blog post. Also see Reserve Bank of Australia’s Guy Dibelle’s speech In Defense of Current Account Deficits from July 2011.

An intuition I see often displayed in blogs is that these numbers are small and hence not problematic! My view is that these imbalances are kept low by keeping demand low. More importantly, these imbalances (deficits) add to the stock of external debt (because a deficit in the current account increases net indebtedness to foreigners) and this gets out of control sometimes leading to deflation of demand and/or seeking help from the IMF. So “low” imbalances accumulate to a huge net indebtedness.

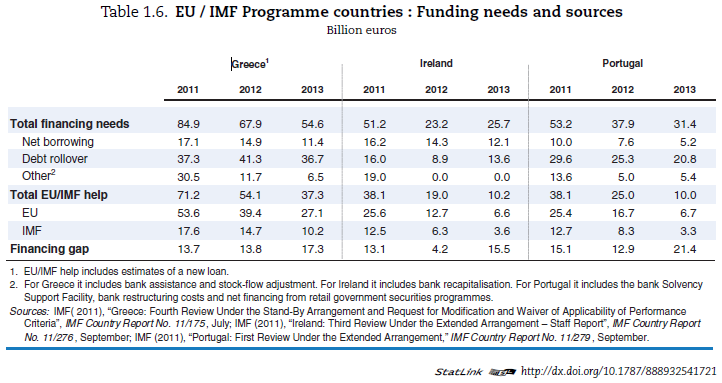

There is an informative graph on the financing needs of Greece, Ireland and Portugal:

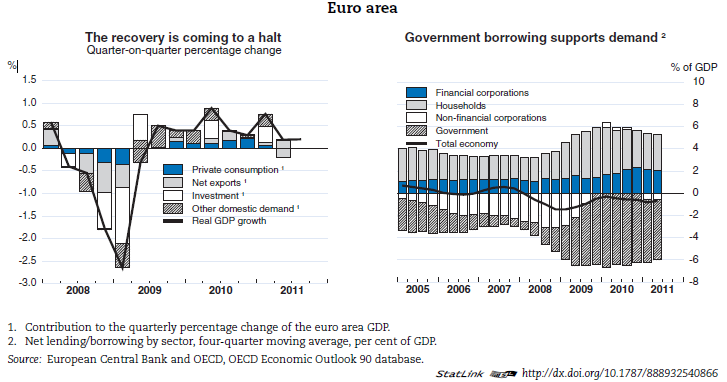

The report also charts sectoral balances for the Euro Area!

(click to enlarge)

The Euro Area as a whole seems healthy, and it is imbalances within that are causing the troubles.

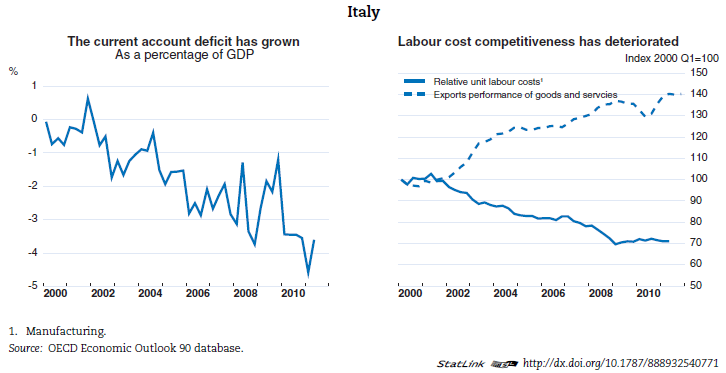

It seems Italy’s current account is worsening:

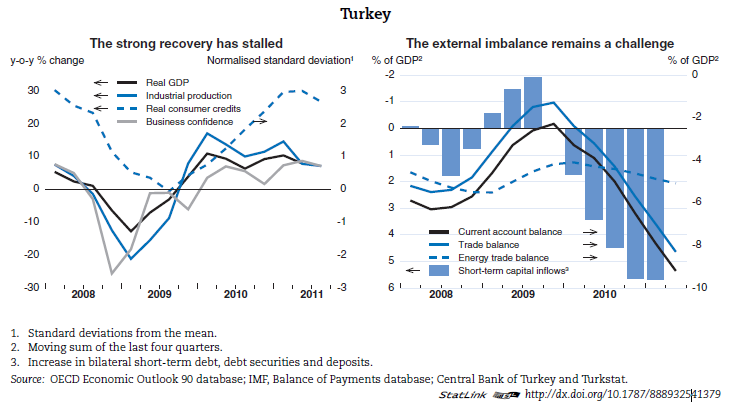

Turkey’s current account attracts a lot of attention and challenges look like this:

Turkey’s currency Lira has depreciated a lot recently

In Post Keynesian theory, the exchange rate is determined in a beauty contest in addition to demand and supply for financial assets. Sudden movements can be very painful and hence nations face a balance of payments constraint – success of nations depends on how producers do in international markets. In words of Wynne Godley,

For growth to be sustainable, it is essential that the management of domestic demand be complemented by the management of foreign trade (by whatever policies) in such a way that the net balance of exports less imports contributes in parallel to the expansion of demand for home production.

At the global level, since not everyone can be net exporting, the problem of global imbalances affects everyone, and new changes are required on how the global economy is run.