In a post last week – The Eurosystem: Part 1, I went into the Euro Area payment system TARGET2 and touched upon domestic payments and implementation of monetary policy in the Euro Area. This post takes off from their to discuss cross-border flows. There are two reasons for looking into this is:

- to understand the flow-of-funds in the Euro Area – in particular current balance of payments and balance of payments financing flows;

- to understand how the Eurosystem – the ECB and the 17 National Central Banks (NCBs) work together.

Suppose a Firm F (F for France) banking at BNP Paribas wants to send a payment of €1m to a Firm G (G for Germany) banking at Deutsche Bank. How do the funds flow? In Part 1, I discussed how funds flow for domestic payments, but here two nations are involved and hence is likely to be more complicated. The various institutions involved in this transaction are

- Firm F

- BNP Paribas

- Banque de France, France’s NCB

- Deutsche Bundesbank, Germany’s NCB

- Deutsche Bank

- Firm G

- European Central Bank (ECB)

To work out how the funds flow and what effects it has on the balance sheets of these institutions, it is again useful to get into the Eurosystem legal framework as we did in Part 1.

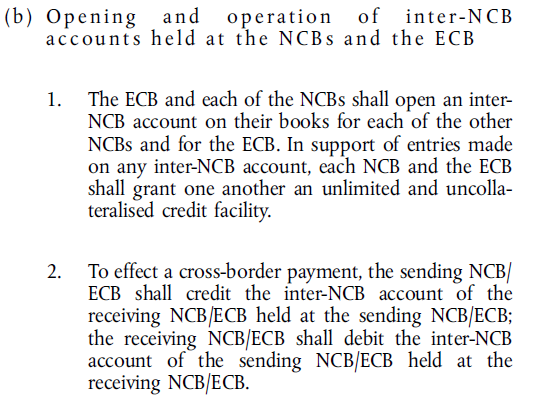

According to the Guideline of European Central Bank of 30 December 2005 on a Trans-European Automated Real-time Gross settlement Express Transfer system (TARGET) (ECB/2005/16) Article 4(b)1&2 (link):

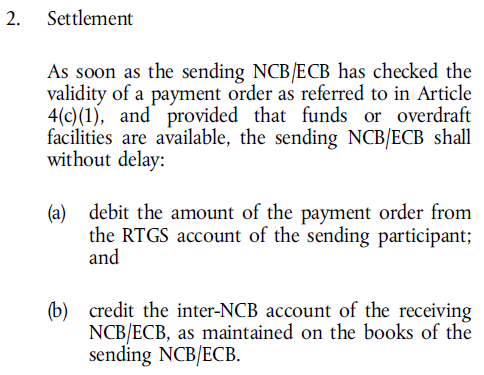

and according to Article 4(c)2:

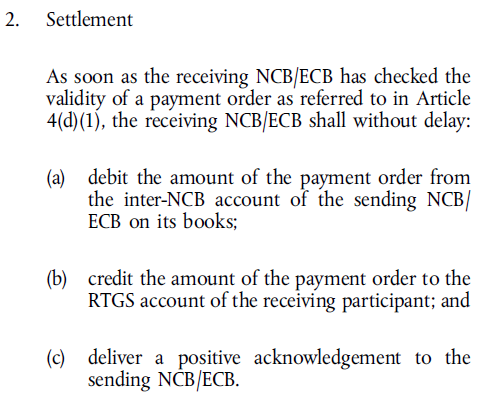

Further, according to Article 4(d)2:

So the NCBs and the ECB have accounts at each other and grant each other unlimited and uncollateralized credit! i.e., they allow all funds to go through. This was shocking when I first discovered this from the same document but later realized it makes sense. There is one more rule that is still missing – how the NCBs settle with each other.

According to the European Central Bank Annual Report 2010, Accounting Policies, Page 219:

INTRA-ESCB BALANCES/INTRA-EUROSYSTEM BALANCES

Intra-ESCB transactions are cross-border transactions that occur between two EU central banks. Intra-ESCB transactions in euro are primarily processed via TARGET2 – the Trans-European Automated Real-time Gross settlement Express Transfer system (see Chapter 2 of the Annual Report) – and give rise to bilateral balances in accounts held between those EU central banks connected to TARGET2. These bilateral balances are then assigned to the ECB on a daily basis, leaving each NCB with a single net bilateral position vis-à-vis the ECB only. This position in the books of the ECB represents the net claim or liability of each NCB against the rest of the ESCB. Intra-Eurosystem balances of euro area NCBs vis-à-vis the ECB arising from TARGET2, as well as other intra-Eurosystem balances denominated in euro (e.g. interim profit distributions to NCBs), are presented on the Balance Sheet of the ECB as a single net asset or liability position and disclosed under “Other claims within the Eurosystem (net)” or “Other liabilities within the Eurosystem (net)”. Intra-ESCB balances of non-euro area NCBs vis-à-vis the ECB, arising from their participation in TARGET2, are disclosed under “Liabilities to non-euro area residents denominated in euro”.

Using these rules and procedures, we can work out the example presented at the beginning of this post.

At the initiation of the payment of €1m by Firm F, BNP Paribas will debit Firm F’s account €1m, Banque de France will debit BNP Paribas’ account €1m, Deutsche Bundesbank will credit Deutsche Bank’s account €1m and Deutsche Bank will credit Firm G’s account €1m. There remains the settlement between Banque de France and Deutsche Bundesbank and intraday, they settle bilaterally and then settle at the ECB at the end of the day. An important point however is that when NCBs settle with the ECB, they do not need to provide collateral. Also, in principle the overdraft facility provided by the ECB is unlimited.

Some clarifications. How did NCB provide intraday credit to BNP Paribas? The answer is quite simple: Ex Nihilo, at the stroke of a pen, rather automatically via the system’s computers! The same with Deutsche Bundesbank – it provided Deutsche Bank with settlement balances in the same manner, and so did Deutsche Bank provide €1m of extra deposits to its customer Firm G. And finally at the end of the day, the ECB does the settlement between the NCBs on its books.

However, this is not the end of the story. During the day, there are payments in all directions but let us ignore that. So BNP Paribas finds itself with a positive intraday credit of €1m from Banque de France. Intraday overdrafts were discussed in Part 1 and I repeat the relevant part here. Toward the end of the day, banks may want to instead borrow from the rest of the financial system, instead of relying on central bank credit because the latter is free of interest only intraday and is charged an interest rate equal to that of the marginal lending facility overnight. Typically, this poses no problem because some banks may have excess reserves which they may want to lend out because keeping it deposited at the central bank will pay an interest equal to that of the deposit facility which is lower. So typically, banks would retire intraday credit toward the end of the day and borrow funds from the rest of the financial system.

In this case, BNP Paribas would have to borrow abroad because other banks do not have excess reserves in the example. Deutsche Bank will be looking to lend the funds at a higher rate than depositing it at Bundesbank which pays lower interest and we have a situation in which BNP Paribas will borrows funds from Deutsche Bank. The interest rate on this lending/borrowing will likely be the near the ECB main refinancing rate – else, the ECB will intervene to bring the EONIA to the main refinancing rate – its target. It is important to remember that this causes the reversal of the balance sheet changes of the ECB and the NCBs – changes which happened when funds flowed from Firm F to Firm G.

All this is when there is no stress in the markets. During periods of crisis, banks in some affected regions may see deposits flowing out due to worries about credit risk. Banks which are losing funds are unable to borrow funds from abroad and this leaves banks indebted to their home NCBs and the NCBs have a large Other liabilities within the Eurosystem (net).

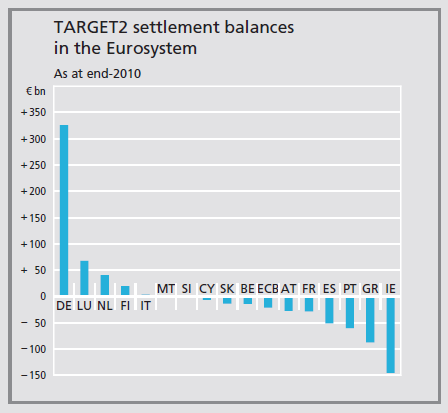

The Bundesbank Monthly Report March 2011 has a special topic The dynamics of the Bundesbank’s TARGET2 balance on Page 34 and has a good discussion. It has two nice charts, one of them is settlement balances of each NCB in the Eurosystem

This was at the end of 2010 and would have worsened in recent times and shows the amount of stress in the banking system.

In Part 3, I hope to discuss the implementation of monetary policy – i.e., the ECB procedures on setting the interest rate and the differences and similarities with the American system.

Hopefully there is a Part 4 which goes into the “sovereign debt” crisis – which really is a balance of payments crisis worsened by the fact that Euro Area national governments do not have a lender of the last resort.