In a recent blog post Revisiting The Euro Crisis, J. W. Mason argues that the current account imbalances in balance of payments isn’t a/the cause of the Euro Area crisis.

This is completely wrong!

Current account deficits have an effect on the government budget balance and a higher current account deficit would lead to a higher budget deficit than otherwise. This is not just a matter of accounting but true behaviourally. The large current account deficits ultimately caused a large public debt and investors in government debt became nervous and there was a crisis in the government bond markets of the Euro Area. Since lot of government debt is held by foreigners, as it is difficult for residents to hold all that debt (when there’s large net international indebtedness), the sale and the movement of funds abroad after the sale also resulted in a banking crisis, as banks went heavily overdraft at their NCBs and didn’t have sufficient collateral.

The crisis in banking and government bond markets caused more crisis in private debt markets and fiscal retrenchment, fall in GDP and that leading to more crisis!

As simple as that!

One of Mason’s arguments is that since lending by foreigners needn’t arise out of prior saving, the result liabilities owed to foreigners isn’t really debt. But how does it follow that one thing implies the other? If foreigners transfer a large amount of funds to accounts in their home countries, there would be a banking crisis as banks would find it difficult to post collateral to their NCB (National Central Bank). The government would have to rescue banks adding to public debt and making investors nervous.

Greek banks endogenously creating money doesn’t mean that a purchase of a German product by Greek residents doesn’t reduce Greek’s net asset position or increase its net indebtedness to Germany.

Mason says:

Many people with a Keynesian background talk about endogenous money, but fail to apply it consistently

Perhaps he is the one failing?

Take a simpler example: loans make deposits. But it’s also true that deposits are funding banks. The fact that banks created funds doesn’t imply that the created deposit isn’t a liability or debt.

Mason also discusses how the TARGET2 system works with the ECB/NCBs. The NCBs have unlimited and uncollateralised overdrafts with each other and unlike the arrangements prior the formation of the Euro Area, there isn’t an equivalent worry about central banks running out of reserves. But unlimited overdrafts for the NCBs does not imply unlimited overdrafts for the whole country! It’s just that the crisis is seen elsewhere, like in banking and the government bonds markets.

Mason also takes issue with phrases such as “capital flight”. But investors can sell assets and move funds to another country and that can put pressure on banks. How is the phrase not helpful in describing what is going on?

The problem with the Euro Area is that with exchange rates fixed irrevocably and with governments prevented from making overdrafts at their NCBs, governments cannot devalue their currency or take independent fiscal action than allowed by markets. Fixed or floating, the problem is there, and the Euro Area setup makes it worse. Doesn’t remove the problem altogether!

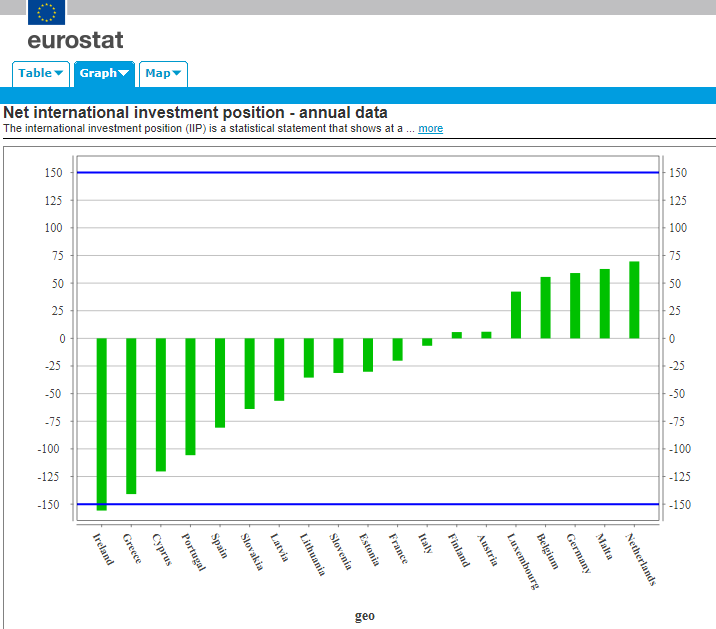

You can see from the data from Eurostat that Euro Area countries with the worst net international investment position were the ones seeing the worst crisis. The net international investment position is accumulated current account balance plus revaluations/holding gains/”capital gains”.

Of course, the solution of the crisis isn’t wage deflation (sometimes referred to as internal devaluation), but the formation of a central government. With the central government, there are fiscal transfers with some Euro Area countries receiving more from the government than what they send in taxes. This would improve the current account balance of those countries, keeping imbalances in check. A central government would both be able to take independent action and keep imbalances in check.