Arjun Jayadev has a nice article, With Its Talk Of Extinguishing Unreturned Cash, Is The Government Defaulting On Its Obligations? for Scroll.in about what happens subsequent to the withdrawal of the legal tender character of bank notes in the denominations of ₹500 and ₹1,000 (or “demonetisation”).

The idea of the government was to cause a loss for holders of “black money” (see this Government of India white paper on definitions) and fight counterfeiting.

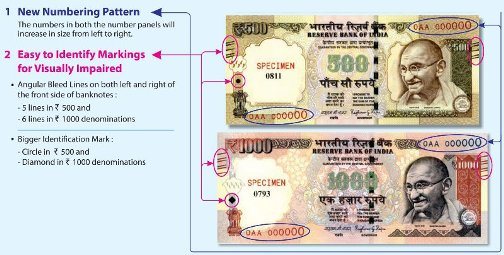

Picture from a September 2015 press release showing additional features of the old notes. The notes bear signature of Raghuram G. Rajan

There are two important separate issues here: one is the withdrawal of the legal tender character. The other is whether the RBI will exchange the notes. When the Indian PM announced the former, Indians were told that the old notes (which were about 86% of currency in existence by value) ceased to be a legal tender in four hours and that banks would exchange them for new bank notes or accept them as deposits till December end. Banks would then exchange them with the Reserve Bank. The Reserve Bank itself would exchange them directly after that till the end of March.

Soon people asked the question whether the Reserve Bank can set a last date for exchange directly at their offices (even though the notes are no longer legal tender). This is because the bank notes have a promise. The Reserve Bank’s own site says:

What is the meaning of “I promise to pay” clause?

As per Section 26 of Reserve Bank of India Act, 1934, the Bank is liable to pay the value of banknote. This is payable on demand by RBI, being the issuer. The Bank’s obligation to pay the value of banknote does not arise out of a contract but out of statutory provisions.

The promissory clause printed on the banknotes i.e., “I promise to pay the bearer the sum of Rupees …” is a statement which means that the banknote is a legal tender for the specified amount. The obligation on the part of the Bank is to exchange a banknote with bank notes of lower value or other coins which are legal tender under the Indian Coinage Act, 2011, of an equivalent amount.

So technically I could still have the old notes of denominations ₹500 and ₹1,000 and go to the Reserve Bank’s office and ask them to exchange it after December end (when banks will no longer accept them), even though the note have lost the legal tender character on November 8 itself. And the RBI seems to be allowing it till March end. The question is: what about later?

The above quote does use the phrase “legal tender”, but it’s not written in the notes. In fact, because of the promise, the Reserve Bank has to provide the bearer in legal tender (i.e., old notes of lower denomination and/or new notes).

Some have argued that because of this “demonetisation” never made sense as the notes should have continued to have the value. I don’t agree with that because that assumes certainty on these issues. If I collect the old notes from people, I have a risk that I might lose the money because I could be wrong.

Anyway, a report today from The Hindu quotes the Reserve Bank Governor:

“Actually, the withdrawal of legal tender characteristics status does not extinguish any of RBI’s balance sheet. Therefore, there is no implication on the balance sheet as of now. The question of a special dividend automatically does not arise as of now,” Mr. Patel had said.

The report is basically source based and informs us that the government is indeed going to make a law to get around the issue.