There’s one thing that slipped out of my mind in my recent post Sterling Flash Crash And The UK’s Balance Of Payments, i.e., the UK’s international investment position.

The Bank of England’s financial stability report from July has an interesting discussion on this with this chart.

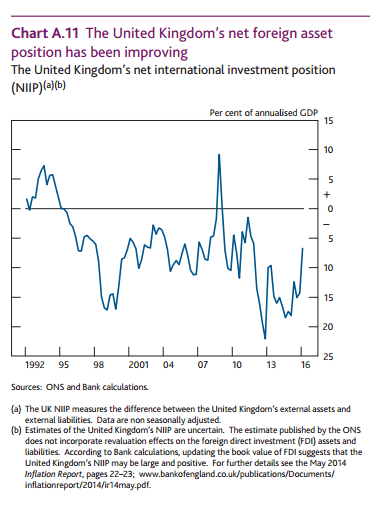

UK’s net international position. Source: BOE.

with the comment:

The currency composition of the United Kingdom’s external balance sheet does not amplify risks associated with a sterling depreciation.

Currency mismatches in a country’s external balance sheet can amplify risks associated with a large current account deficit, if a depreciation of the currency leads to a deterioration of the external balance sheet position. Although there are no official statistics on the currency composition of the United Kingdom’s external balance sheet, estimates suggest that around 60% of the stock of external liabilities is denominated in foreign currency, compared with more than 90% of the stock of external assets. This means that, other things equal, a fall in the value of sterling should increase the value of external assets relative to liabilities, improving the United Kingdom’s net foreign asset position which was -6.7% of annualised GDP in 2016 Q1 (Chart A.11).

Of course, it is important to keep in mind that while this is true, large movements in liabilities in can affect corporations and systemic risks can arise if a large corporation fails. But at the same time, assuming risks are contained, the above is beneficial to the UK. Risks associated with Brexit and the fall in the value of the Sterling aren’t as bad as presented by economists 🤡 with the opinion that the UK should remain in the EU.