I recently heard from an online commentator that saving is the opposite of borrowing. While there is some “intuition” to this, the following exercise is show it is possible to have a positive saving and incur huge liabilities at the same time.

To complicate the matter the word “Savings” is used. Now, in national accounts, this word is used as a plural of saving and it ought to be given up as a substitute for wealth because it creates more confusions in discussions.

I had recently gone into an example of concepts such Saving, Net Acquisition Of Financial Assets, Net Investment in Nonfinancial Assets, Net Incurrence Of Liabilities and “Net Lending(+)/Net Borrowing(-)”.

The example I wrote in that post was buried in something abstract, so let me extract the most essential paragraphs here and add a few things.

Let us suppose:

A household earns $100 in a year (including interest payments and dividends), pays taxes of $20 and consumes $75.

He takes a loan of to finance a house purchase near the end of the year whose price is $500.

Assume that the Loan-To-Value (LTV) of the loan is 90% – which means he gets a loan of $450 and has to pay the remaining $50 from his pocket to buy the house. (i.e., he is financing the house mainly by borrowing and partly by sale of assets).

How does the bank lend – assuming the bank does the creditworthiness checks and decides to lend – simply by expanding it’s balance sheet (“loans make deposits”).

Ignoring, interest and principal payments (which we assume to fall in the next accounting period),

His Saving is +$100 – $20 – $75 = +$5.

His Net Investment in Nonfinancial Assets is +$500.

His Net Incurrence of Liabilities is +$450.

His Net Accumulation of Financial Assets is +$5 – $50 = – $45.

His Net Lending is = -$45 – (+$450) = -$495 which is Saving net of Investment ($5 minus $500). i.e., his Net Borrowing is +$495.

This means even though the person has a Saving of $5, he has incurred liability of $450 and due to sale of assets worth $45, he is a net borrower of $495 from other sectors (i.e., his net lending is -$495).

That can be confusing since Net Borrowing is $495 even though the person actually borrowed $450 from the bank.

As I have mentioned before, an alternative terminology exists where Net Acquisition of Financial Assets is used instead of Net Lending and Net Lending (to a sector) is used instead of Net Incurrence of Liabilities.

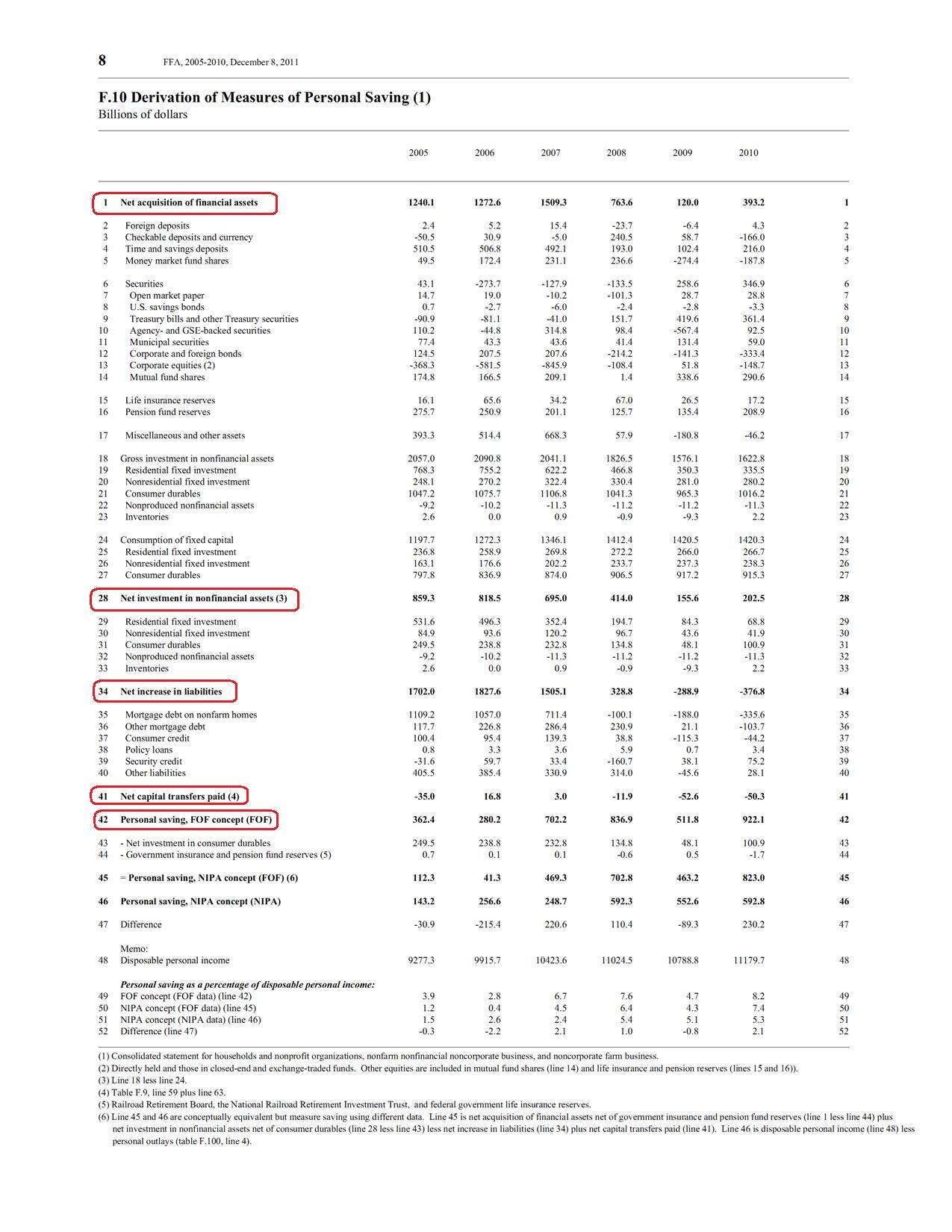

Table F.10

The Table F.10 of the Federal Reserve’s Statistical Release Z.1: Flow Of Funds Accounts Of The United States is below:

(click to expand and click again to expand)

The Flow of Funds Table F.10 may lead one to suppose that “Net Investment in Nonfinancial Assets” is Saving. Or to put it more simply one may suppose that “purchasing a house is saving”. Or worse “purchasing a house is dissaving”.

This is “Monetarist Intuition”. Here the house was purchased by incurring liabilities and sale of assets.

As we saw above – for the personal sector,

Saving = Disposable Income – Consumption.

NIPA accountants calculate it this way. But we also saw that

Saving = Net Acquisition of Financial Assets + Net Investment in Nonfinancial Assets – Net Incurrence of Liabilities

which can be verified from the table. This method is used by the Flow of Funds accountants.

As an aside, apart from definitional issues between Flow of Funds and NIPA, there can discrepancies and the following link discusses this without giving any conclusion.

click to view on Google Books