… but not fun for the Spanish people.

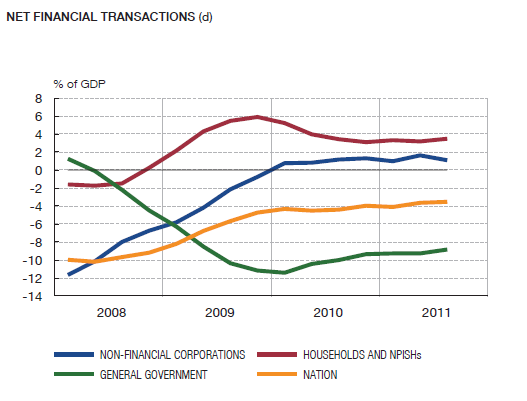

In yesterday’s post Spain’s Sectoral Balances, I briefly discussed the sectoral balances of Spain and its connection with demand, income and output. Here’s the original graph from the Banco de España again with my viewpoints in the previous post.

I learned some GIMP from a friend some time ago and thought I’ll use it for some fun.

I consider two scenarios:

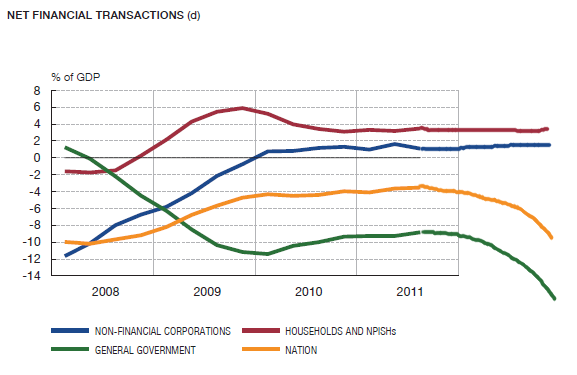

Suppose the Spanish government relaxes its fiscal policy (independent of other Euro Area governments’ policies) or does not tighten it. How do the sectoral balances look? Here’s a likely scenario:

(may not sum to zero because of drawing discrepancies)

The “projection” – not to scale since I had limited availability for space – implies the government deficit keeps rising and this is the result of the rising current account deficit. A higher fiscal stance leads to a slightly higher income and employment but the flip side of this is a rising indebtedness to the rest of the world caused due to the current account deficits. The public sector is incurring almost all the change in net indebtedness – i.e., its contribution to net borrowing from the rest of the world is the highest.

Of course, this process cannot go on forever as a rising indebtedness implies foreigners have to be attracted by hook or crook and interest rate paid on government debt and consequently all private sector debts will also keep rising leading to a deflationary bust at some stage.

Also note, the causality here is a bit opposite of what was described in the previous post! The causalities between the balances of the “three sectors” is complex and not so straightforward. Here a higher fiscal stance leads to a higher income and expenditure and a widening of the current account deficit which in turn widens the budget deficit.

To prevent such possible instabilities – at least their smell of such instabilities – the European leaders have imposed the “fiscal compact” on nations.

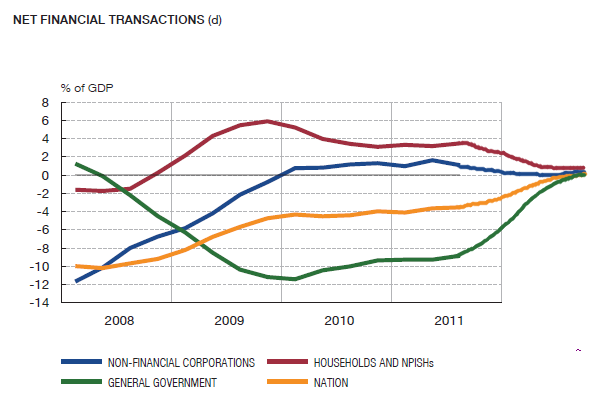

What do they aim to achieve? The following “projection” is a possible answer:

The above describes the possible outcome of a tight fiscal stance of the Spanish government. A tight fiscal policy leads to lower income and hence a lower current account deficit – because of lower expenditure on foreign products – but it is achieved via lower output and employment.

The above projections are not based on a specific model for the Spanish economy but some analysis based on familiarity with SFC modelling.

Macroeconomics is not so easy – there are so many constraints – and governments have to strive to achieve the best optimal outcome. “Market forces” do not do that.

The second scenario can also be achieved by a coordinated fiscal expansion by the Euro Area nations. The sectoral balances may behave similar to the second scenario but in the expansionary scenario, output and hence employment is higher. Unfortunately there is no mechanism or institutional means by which fiscal policies are coordinated within the Euro Area (the exception is the recent “fiscal compact” which unfortunately misses the point). Even if there is an agreement on fiscal expansion, there is nothing to make sure that there is a constant management of the whole process – i.e., there are chances of failure.

There are various ideas one sees on proposing a solution to end the Euro crisis but almost none appreciate the real problems. In my opinion, there is no alternative to moving ahead with a European integration and granting more fiscal powers to the European powers – making it a central government – which is involved in fiscal transfers and a mandate to achieve full employment.