In the previous post in this series The Eurosystem: Part 2, I discussed cross-border flows within the Euro Area. With exceptions, most of these flows are current balance of payments and balance of payments financing flows. Of course there are other flows with the world outside the EA17 and these flows flow via the correspondent banking arrangements banks have put in place and not the topic of discussion in this series.

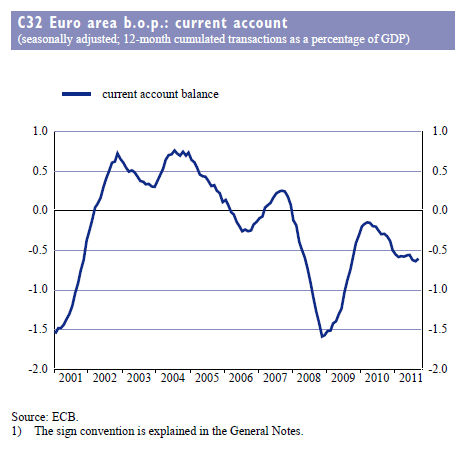

The cross-border flows are important for the Euro Area since as a whole, the Euro Area’s balance of payments is almost in balance.

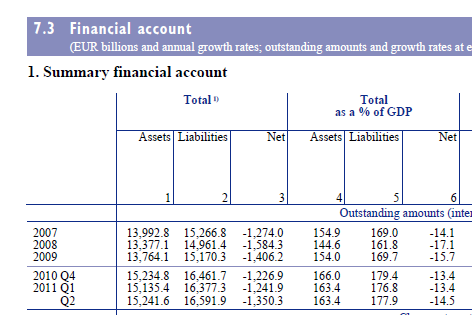

So the Euro Area current account was in a deficit of €11.7bn in 2011Q3 and a net indebtedness of €1.35tn to the rest of the world at the end of Q3, or 14.5% of GDP. So most of external imbalances of the EA17 nations are within the Euro Area.

Back to TARGET2 flows: there was a debate among some economists on various matters related to these flows. Some even went on to suggest that these flow affect credit in Germany because the nation was financing the current account of the other nations. From an exogenous money viewpoint, this reduces banks’ ability to provide loans to their customers! (which is incorrect because money is not exogenous). The replies tried to disprove it by using the argument that attempted to prove that the NCBs were not financing the current account. Sorry no links.

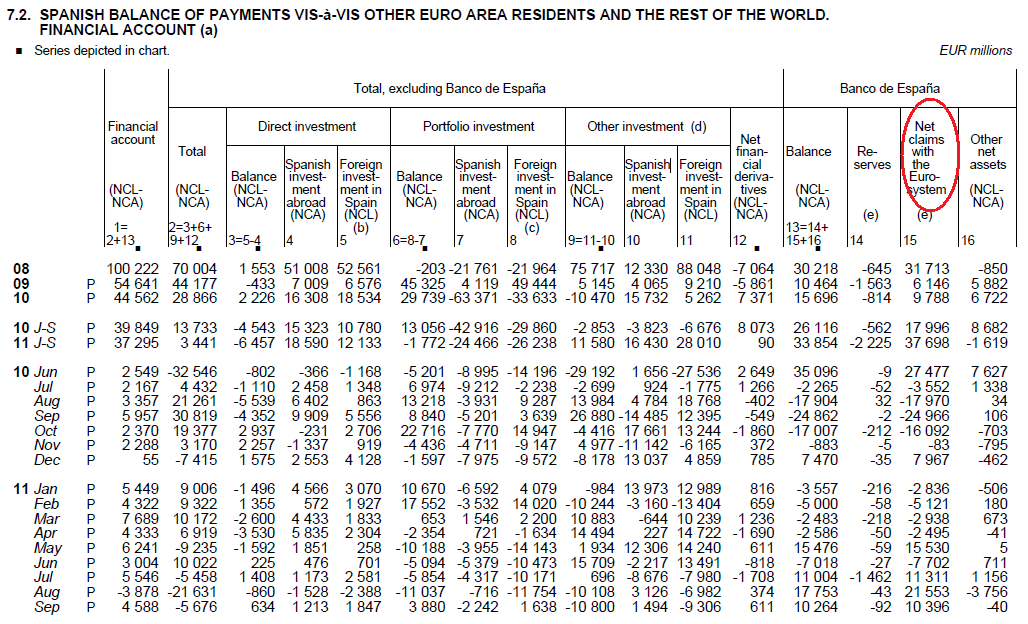

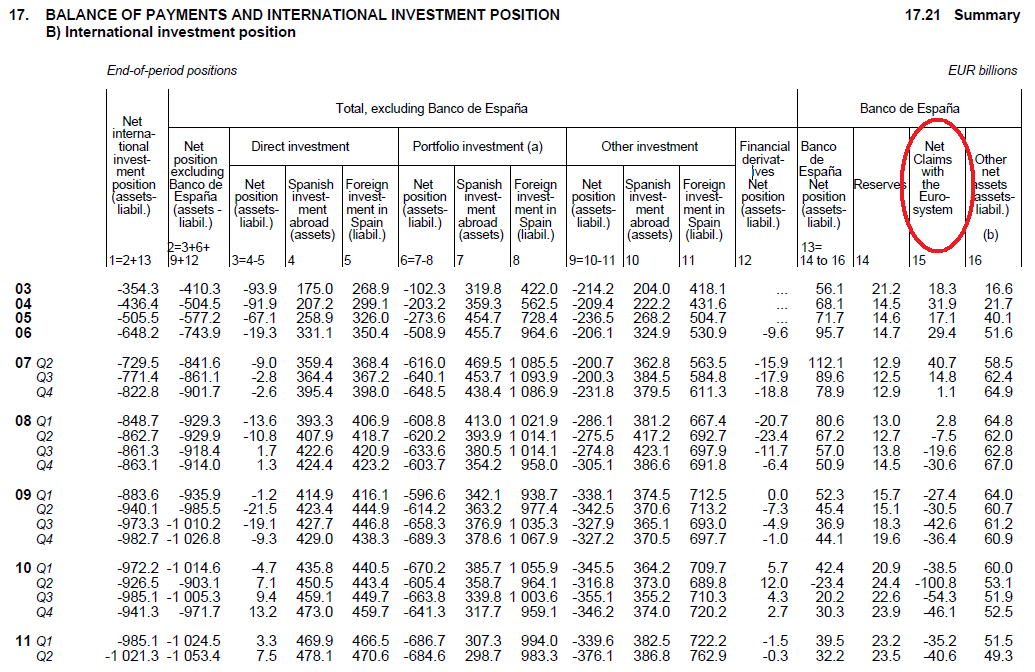

This is a small post and my point is to show that since TARGET2 is designed to automatically change the balance sheets of the NCBs, the debate whether the NCBs finance the flows or not is a bit counterproductive. Of course having said this, I wish to highlight the fact that the item “Claims within the Eurosystem” (in either assets or liabilities) is definitely recorded in the balance of payments and the international investment position as can be seen below for the case of Spain.

(Click to enlarge, Source)

(click to enlarge, Source)

Of course, the “Claims Within the Eurosystem” is just one item in the financial account and the international investment position, so not the whole of the current account deficit is financed this way. One minor advantage is that this part of the gross indebtedness of a whole deficit nation is at the ECB’s main refinancing rate, which is much lower than the effective interest rate deficit EA nations are paying on their gross liabilities to foreigners. This is not worthy of further attention, though.

How long can these flows continue? As long as the banks have sufficient collateral to provide to their home NCB. When banks run out of collateral (eligible for borrowing from the Eurosystem), emergency measures have to be taken and a future post in this series will discuss the Emergency Loan Assistance Program (ELA) used by NCBs.

[I welcome your comments. I have a “Zero Comments Policy” as opposed to a “No Comments Policy”. I like being notified of a comment.]